Calculating Payroll Accruals

What does "accrue" mean?

Accrue means “to accumulate.” Relative to payroll, it means “to accumulate expenses actually incurred and owed, but not paid.”

Why do we accrue?

1. From the TEA Accounting Guide: “Expenditures should be recorded and reported in the period in which they are incurred. Therefore, unpaid salaries and related benefits that have been earned but not yet paid should be recorded as accrued expenditures.”

2. The amount to accrue is calculated as follows:

(Employee’s Daily Rate x Number of Days Worked for the Month) - Amount Paid for the Month = Amount to Accrue for the Month

3. The process of accruing salaries enables a school district to accurately reflect expenses after each payday.

4. Enables the district to maintain earned but unpaid salary amounts in school YTD for each employee.

5. Accruals are cleared completely when each employee processes through payoff correctly.

Note: If an employee leaves during the year, the contract balance and accruals clear if the payoff date on the Job Info tab in Staff Job/Pay Data is the same as the pay date used for any particular payroll. If the payoff date is not the same as the pay date, the accruals remain in 216X and must be cleared by using the Zero School YTD Accruals utility.

6. All businesses and city and state governments accrue pay earned in one fiscal year and not paid until the next fiscal year.

How does it work?

1. By paying employees over 12 months what they have earned in 10 months (these employees are considered standard), districts accrue (accumulate) money in saving accounts for employees.

2. Accruals (saving accounts) make it possible to account for an employee receiving a check for the same amount for 12 months even though the employee does not work 12 standard calendar months.

3. The earned or expensed amount debits (decreases) the associated appropriation amount so the district’s expenditures reflect what was actually owed for salaries and benefits during the various pay periods. The credits are placed in an accrued salary and/or benefits liability account and remains within the expensed fund until such time as the accrual is needed to meet payroll requirements. At any given time, the district should be able to balance the accrued liability amount in Finance for each fund with the YTD Accrual Payroll Account Distribution Journal accrued amount for that particular fund.

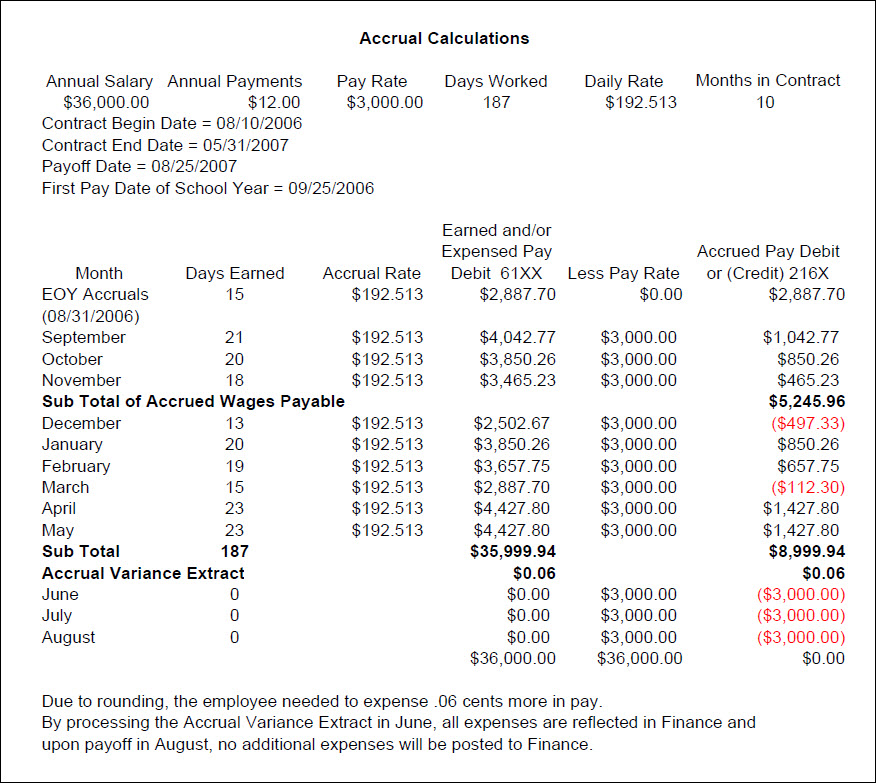

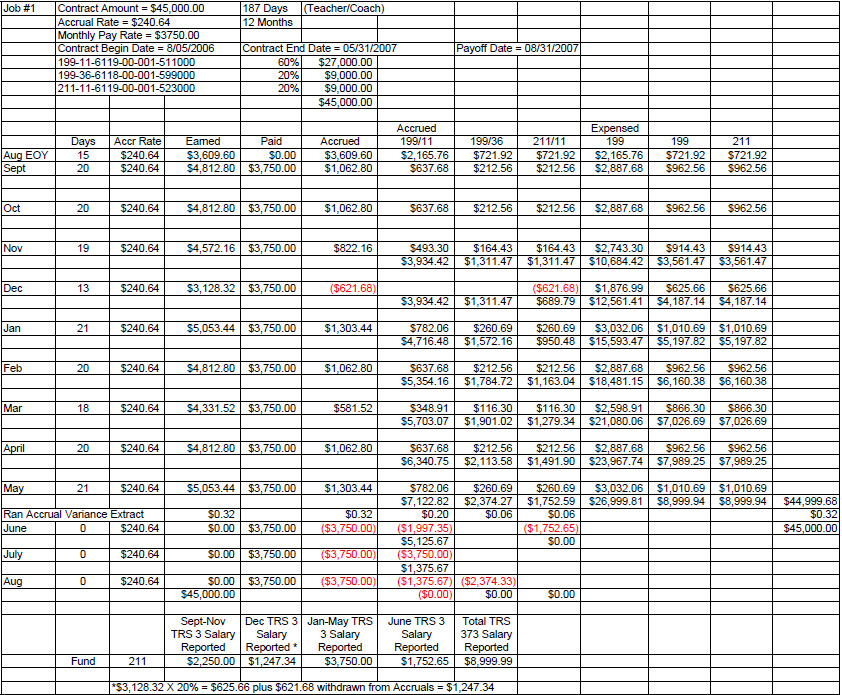

Accrual Calculations

When EOY Payroll Accruals (August accruals) are posted to the employees’ master record, the system creates a new school YTD, and the accrual days and amounts are displayed. Accruals are maintained in the pay distribution history record and represent the difference between what was earned and what was paid during the course of the school year.

Nonstandard Employee Accruals

If the employee has TRS Year selected on the Job Info tab (is a nonstandard employee) and is accruing, when accruals are calculated and posted for July and/or August payrolls, the system creates a school YTD for the new school year, the accrual amounts are displayed, and the actual pay amounts remain in the current school YTD. The program determines whether a new school YTD record for the accruals should be created based on the employee’s contract begin date and pay date. If the TRS Year is selected and the year of the contract begin date is equal to the pay date year, the calculated accruals for the payroll are recorded in the next school year.

How Accruals are Withdrawn

Below are examples of the order in which accruals are withdrawn.

- If only one distribution code has existed in the master distribution record for the entire year, regardless of the fund, accruals are withdrawn from that fund when there are no days earned in the Accrual table for the accrual code selected on the Job Info tab.

- If there has been more than one distribution code in the master distribution record or distribution codes were changed during the course of the year, accruals with federal grant codes are withdrawn first based on fund order.

3. If there are no account codes associated with a grant, or the accruals for a federal fund with a grant code has been exhausted, accruals are withdrawn based on fund order.

4. If the pay distribution history has federal fund amounts that are not associated with a grant code but that same federal fund now has a grant code in the master distribution record, it is treated as though it always had a grant code. If there is insufficient grant and care amounts accrued for the salary amount that is being withdrawn, the needed amounts are expensed.

5. If the pay distribution history has federal fund amounts that are not associated with a grant code and that same federal fund does not have a grant code in the master distribution record, it is treated as any other fund. Withdrawal takes place after all federal funds with grant codes and then in fund order. No grant and care amounts are calculated, no salary is reported on the TRS 3 and TRS 489 reports, and the TRS 373 salary is not reduced by the federal grant salary.

Below are examples of how accrual amounts are withdrawn. If a federal fund account exists in the pay distribution history and it has a grant code, that account is always exhausted first in the order indicated above. It is important to know that once the amounts have been accrued, the system does not withdraw based on the percentages in the master distribution record. Rather, the system withdraws amounts based on the guidelines as outlined above and below.

1. If only one distribution code has existed in the master distribution record for the entire year, regardless of the fund, accruals are withdrawn from that fund when there are insufficient days earned in the Accrual table for the accrual code selected on the Job Info tab.

2. If the pay distribution history has multiple accounts and there is a federal fund account with a grant code, 100% of the needed accrual withdrawal is made from that account, not to exceed the available accrual amount.

Example: Need a total of $400.00 from accruals and the grant fund has $500.00. Then, $400.00 is withdrawn, and the remaining $100.00 is available for the next accrual withdrawal. In this example, no other accounts in the pay distribution history have amounts withdrawn from accruals.

3. Withdrawal from accruals can exceed the normal gross amount for an account. If the accrual amounts withdrawn are associated with a federal fund that has a grant code, the federal grant and care amounts are based on 100% of the accrued amount withdrawn. The total amount withdrawn is displayed on the TRS 3 and TRS 489 reports and is reflected in the TRS 373 report also (if applicable).

Example: Withdrew $400.00 from the federal fund with grant code, so the grant amount is $24.00, care is $4.00, and the reported salary is $400.00.

4. If a federal fund without a grant code exists in the pay distribution history and that same fund exists in the master distribution record and has a grant code, when grant and care amounts are calculated, it ultimately results in insufficient accrual amounts in the grant and care accrual fields. This is because accrual amounts were not originally calculated for the grant and care. When the accrual amounts for the grant and care are exhausted before the accrued salary, an expense to the associated benefit account occurs.

5. If there are accrual balances at the time of payoff and the payoff date on the Job Info tab matches the pay date, remaining accrual amounts are credited back to the accounts in which they were originally expensed.

6. If there are no accrual balances remaining at the time payroll is processed, needed amounts are expensed based on the existing master distribution accounts and percentages.

7. If the account that is being withdrawn no longer exists in the master distribution record, the gross pay is zero, and it shows the amount of accrued pay being withdrawn.

Example: Fund 224 does not exist in the master distribution record. When accruals from that fund are withdrawn from the pay distribution history, fund 224 does not display a gross pay amount, but does display $4,572.25 withdrawn from accruals.

By adopting this tactic, the accrual amounts for federal funds with grant codes are exhausted first in an effort to ensure the final federal fund report does not have to be amended. Regardless of the fund, if there are multiple accounts, the amount withdrawn from accrual for an account can exceed the amount that would normally be associated with the gross amount for that account, but never exceeds the pay rate for that pay period.

The Account Distribution Journal continues to display the gross pay based on the master distribution record even though accrual withdrawals may not have affected that account.

Example: Fund 161 has a gross pay amount but no accrual withdrawal. If 100% of the employee’s pay rate is withdrawn from fund 224, fund 161 for this employee is not affected by this payroll, and no regular payroll transactions are displayed on the general journal for fund 161 for that employee. If an employee is normally on the TRS 3 and TRS 489 reports, but no amounts were withdrawn from accruals or expenditures, the employee is not displayed on these reports.

Benefit amounts are calculated based on the gross pay on the Payroll Account Distribution Journal, and the needed amounts are either withdrawn from accruals or expensed. If there is gross pay for a federal fund and no accruals are withdrawn or amounts expensed for that account, no federal grant and care are calculated, and no grant and care amounts are displayed on this report. The associated employee is not displayed on the TRS 3 and TRS 489 reports.

Example: If a federal fund grant accrual was exhausted in June, and in July 100% of the needed pay rate was withdrawn from a nonfederal fund, the employee is not displayed on the TRS 3 or TRS 489 reports. Since no pay amounts are associated with the federal fund, no amounts need to display. If there are accrual amounts in grant and care that exceeded the accrued salary amount, those amounts are credited back to the appropriate account at the time of payoff if the pay date matches the payoff date on the Job Info page.