Calculating TRS 373 and On-Behalf (Monthly Payroll/General Fund)

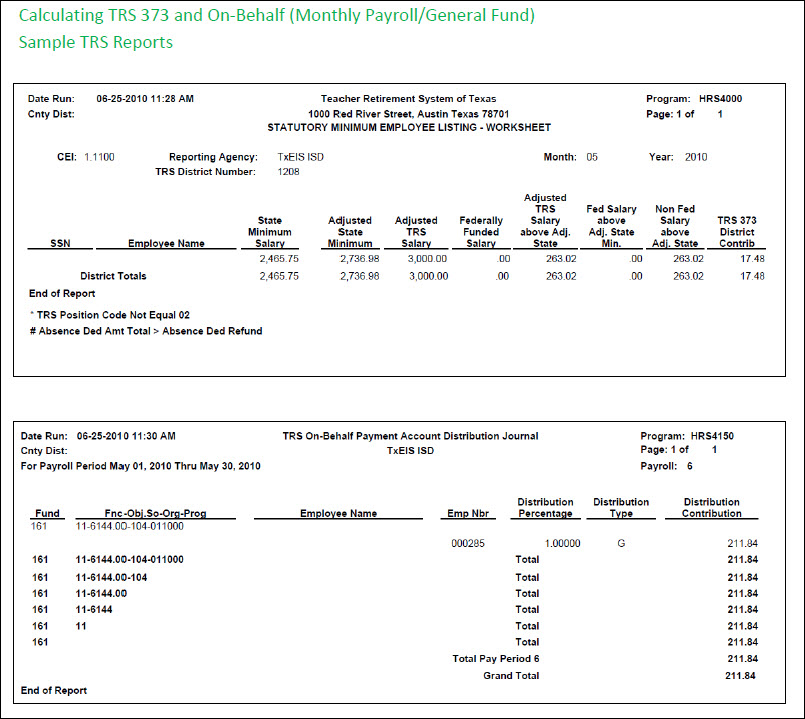

The following calculations are based on monthly payroll and general fund distributions. These calculations should be used to verify the TRS 373 and On-Behalf amounts on HRS4000 - Statutory Minimum Report #373 and HRS4150 - TRS On-Behalf Payment Journal.

Reminder: Interface the TRS 373 amounts before verifying the TRS On-Behalf amounts since On-Behalf is reduced by the TRS 373 amount. These amounts should be verified monthly.

Adjusted Statutory Minimum Calculation

A. State Minimum Salary (as recorded on the Job Info tab)/Number of Annual Payments = State Minimum Salary by Payroll

B. State Minimum Salary by Payroll x District CEI Rate = Adjusted State Minimum Salary

| (A) State Minimum Salary | (A) divided by Number of Annual Payments | (A) and (B) equals State Minimum Salary by Payroll | (B) multiplied by District CEI | (B) Adjusted State Minimum Salary |

| $29,589.00 | / 12 | = $2,465.75 | x 1.11 | = $2,736.98 |

Adjusted TRS Salary above Adjusted State Minimum Calculation

A. Eligible TRS Salary/Number of Annual Payments = Eligible TRS Salary by Payroll

B. Eligible TRS Salary by Payroll - Adjusted State Minimum = Adjusted TRS Salary above Adjusted State Minimum

| (A) Eligible TRS Salary | (A) divided by Number of Annual Payments | (A) and (B) equals Eligible TRS Salary by Payroll | (B) minus Adjusted State Minimum | (B) Adjusted TRS Salary above Adjusted State Minimum |

| $36,000.00 | / 12 | = $3,000.00 | - $2,736.98 | = $263.02 |

TRS 373 District Contribution Calculation

Adjusted TRS Salary above Adjusted State Minimum x TRS 373 District Contribution Percentage (8.25%) = TRS 373 District Contribution

| Adjusted TRS Salary above Adjusted State Minimum | multiplied by TRS 373 District Contribution Percentage (8.25%) | TRS 373 District Contribution |

| $263.02 | x .0825 | = $21.70 |

State Matching Calculation

Eligible TRS Salary x TRS Rates (District 8.25% + TRS-Care 1.25%) = State Matching

| Eligible TRS Salary by payroll | multiplied by TRS Rates (District 8.25% + TRS-Care 1.25%) | State Matching |

| $3,000.00 | x .09500 | = $285.00 |

TRS On-Behalf Calculation

State Matching - TRS 373 District Contribution = TRS On-Behalf

| State Matching | minus TRS 373 District Contribution | TRS On-Behalf |

| $285.00 | - $21.70 | = $263.30 |

For additional information regarding TRS 373, go to the TRS website at: www.trs.state.tx.us/employers.jsp?submenu=traqs&page_id=/traqs/payroll_reporting_manual_main/traqs/payroll_reporting_manual_main.

For additional information regarding TRS On-Behalf, go to the TEA website at: http://tea.texas.gov/Finance_and_Grants/Financial_Accountability/Financial__Accountability_System_Resource_Guide/.