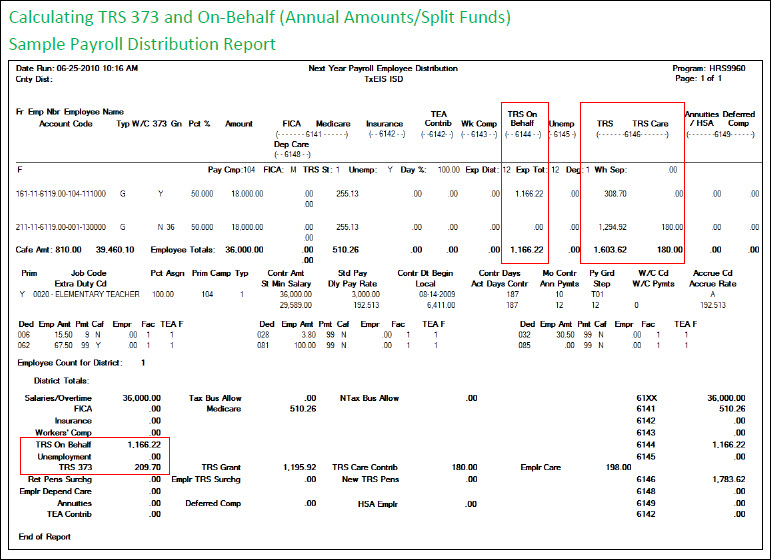

Calculating TRS 373 and On-Behalf (Annual Amounts/Split Funds)

The following calculations are based on annual amounts and split-fund (general/federal funds with a grant code) distributions. These calculations should be used to verify the TRS 373* and On-Behalf** amounts on the Next Year Interface Budget Reports. These reports are created through the Interface NY Payroll to NY Budget Extract Reports. TRS 373 and TRS On-Behalf should not calculate for federally funded employees with a grant code. However, the TRS 373 amount for the federal fund is calculated and used for the TRS On-Behalf calculation of the general fund.

Adjusted State Minimum Calculation

A. State Minimum Salary (as recorded on the Job Info tab) x Fund Percentage = State Minimum Salary by Fund

B. State Minimum Salary by Fund x District CEI Rate = Adjusted State Minimum Salary

| (A) State Minimum Salary | (A) x Fund Percentage | (A) and (B) equals State Minimum Salary by Fund | (B) multiplied by District CEI | (B) Adjusted State Minimum Salary |

| $29,589.00 | 161/50% | = $14,794.50 | x 1.11 | = $16,421.90 |

| 211/50% | = $14,794.50 | x 1.11 | = $16,421.90 | |

| = $32,843.79 |

Adjusted TRS Salary above Adjusted State Minimum Calculation

A. Eligible TRS Salary x Fund Percentage = Annual Eligible TRS Salary by Fund

B. Annual Eligible TRS Salary by Fund - Adjusted State Minimum = Adjusted TRS Salary above Adjusted State Minimum

| (A) Eligible TRS Salary | (A) x Fund Percentage | (A) and (B) equals Annual Eligible TRS Salary by Fund | (B) minus Adjusted State Minimum | (B) Adjusted TRS Salary above Adjusted State Minimum |

| $36,000.00 | 161/50% | = $18,000.00 | - $16,421.90 | = $1,578.11 |

| 211/50% | = $18,000.00 | - $16,421.90 | = $1,578.11 | |

| = $3,156.21 |

TRS 373 District Contribution Calculation

Adjusted TRS Salary above Adjusted State Minimum x TRS 373 District Contribution Percentage (6.644%) = TRS 373 District Contribution

| Adjusted TRS Salary above Adjusted State Minimum | multiplied by TRS 373 District Contribution Percentage(6.644%) | TRS 373 District Contribution |

| $1,578.11 (Fund 161) | x .06644 | = $104.85 (1) |

| $1,578.11 (Fund 211) | x .06644 | = $104.85 (2) |

| = $209.70 |

State Matching Calculation

A. Eligible TRS Salary x Fund Percentage = Annual Eligible TRS Salary by Fund

B. Annual Eligible TRS Salary by Fund x TRS Rates (District 6.644% + TRS-Care 1%) = State Matching

Note: State Matching is not calculated on any fund with a grant code.

| (A) Eligible TRS Salary | (A) x Fund Percentage | (A) and (B) equals Annual Eligible TRS Salary by Fund | (B) multiplied by TRS Rates (District 6.644% + TRS-Care 1%) | (B) State Matching (Fund 161) |

| $36,000.00 | 161/50% | $18,000.00 | x .07644 | = $1,375.92 |

TRS Federal Grant and Care Amount Calculation

A. Eligible TRS Salary x Fund Percentage = Annual Eligible TRS Salary by Fund

B. Annual Eligible TRS Salary by Fund x TRS Rates (Federal 6.644% + TRS-Care 1%) = TRS Federal Grant and Care Amount

| (A) Eligible TRS Salary | (A) x Fund Percentage | (A) and (B) equals Annual Eligible TRS Salary by Fund | (B) multiplied by Federal (6.644%) + TRS-Care (1%) | (B) TRS Federal Grant and Care Amount |

| $36,000.00 | 211/50% | $18,000.00 | x .07644 | = $1,375.92 |

TRS On-Behalf Calculation

State Matching (Fund 161) - TRS 373 District Contribution for General Fund (161) = TRS On-Behalf

| State Matching (Fund 161) | minus TRS 373 District Contribution for General Fund (161) | TRS On-Behalf (Fund 161) |

| $1,375.92 | - $104.85 (1) | = $1,271.07 |

TRS On-Behalf (Fund 161) - TRS 373 District Contribution for the Federal Fund with Grant Code (211) = TRS On-Behalf

| TRS On-Behalf (Fund 161) | minus TRS 373 District Contribution for the Federal Fund with Grant Code (211) | TRS On-Behalf |

| $1,271.07 | - $104.85 (2) | = $1,166.22 |

For additional information regarding TRS 373, go to the TRS website at: www.trs.state.tx.us/employers.jsp?submenu=traqs&page_id=/traqs/payroll_reporting_manual_main.

For additional information regarding TRS On-Behalf, go to the TEA website at: www.tea.state.tx.us/school.finance/audit/resguide12/far/far-91.html#P4151_336554.