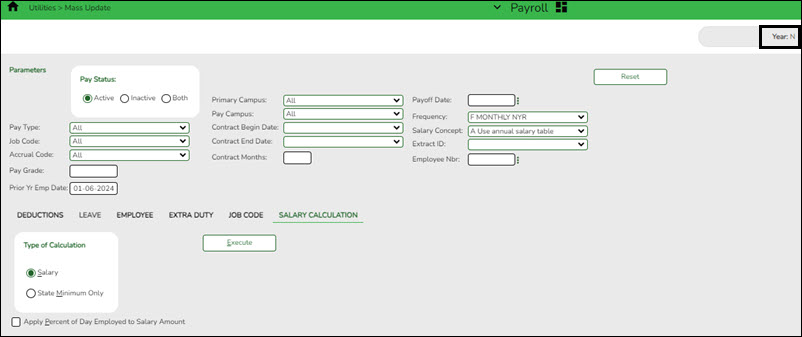

Mass update salary calculations

Payroll > Utilities > Mass Update > Salary Calculation

Perform salary calculations if you are using salary tables. This tab is used to automatically calculate salaries for active employees (pay status 1) that are linked to the salary tables. You can quickly calculate salaries and automatically update important fields in the employee record.

TIP: Salary calculations should not be done multiple times for an employee using the midpoint table.

A report provides a listing of errors prior to completing the process. Clear all errors and perform the calculations as often as necessary. All errors should be cleared before continuing. If employee errors are encountered, the listed employees are not updated. If the employee has multiple jobs and one of those jobs does not have all or part of the salary table information selected on the Job Info tab, errors are displayed and updates are not processed. When calculations are performed on one concept and the employee has multiple concepts, errors are displayed if any of the other concepts are incomplete and updates are not processed.

The system automatically uses the new contract amount and distributes it among the employees' master distribution records based on the existing percentage. The new amount displays regardless of the option selected in the Distributions Built by Amt % field on the Payroll or Personnel > Tables > District HR Options. Manual modifications may be necessary to employees' salary distribution codes, amounts, and/or percentages after performing salary calculations.

❏ The following fields must be completed on the Job Info tab for pay type 1, 2, and 3 employees:

- Pay Grade

- Step

- Max Days - If the Max Days field is not populated, salary calculations will only process if the field is not linked to the Annual Salary Concept. If the field is linked to the Annual Salary Concept, this field must be populated to run salary calculations.

- Begin Date

- End Date

- The OVTM Rate field and the # of Days Employed field are calculated when the OVTM flag and Calendar Code fields are populated on the Job Info tab.

- If the State Step field is populated on the Job Info tab, the amount from the state minimum salary table is entered in the State Min Salary field.

CAUTION: The State Min Salary field is calculated by multiplying either the State Min Days or the # of Days Employed by the appropriate daily rate from the state minimum salary table for all pay types that have state min. The % Assigned field in the State Info section on the Job Info tab is also considered in this calculation. The State Min Salary field should be checked closely and manually updated, if necessary, after performing salary calculations.

- If an employee has an extra duty account type G on the Pay Info tab, it is added to the Total field for the contract on the primary job.

- If an employee has a business allowance account type T or B amount with remaining payments and/or an extra duty account type S amount with remaining payments and distribution codes totaling 100% exists in the master distribution record for the account type, the appropriate distribution records are updated.

- If the # of Annual Payments and Contract Total fields are greater than zero, the Pay Rate field is calculated by dividing the Contract Total by the # of Annual Payments. If the # of Annual Payments and/or Contract Total are not populated, the Pay Rate is not calculated.

- If the # of Days Empld and Contract Total fields are greater than zero, the Daily Rate of Pay field is calculated by dividing the Contract Total by the # of Days Employed. If the # of Days Employed and/or Contract Total are not populated, the Daily Rate of Pay is not calculated.

- Other fields that are updated on the Job Info tab are:

- Accrual Rate - If the accrual code exists and the # of Days Empld and Contract Total fields are greater than zero, the Accrual Rate field is calculated by dividing the Contract Total by the # of Days Employed. The amount is rounded to three decimal places.

- Contract Total and Balance

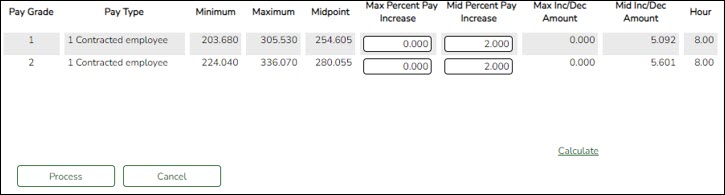

- Pay type 3 employee salaries are calculated based on the hourly/daily or midpoint salary table information. If the local annual table is used, errors are displayed when performing mass salary calculations.

- When using the hourly/daily salary schedule, calculations are based on the Hrs Per Day field x the Amount field from the salary table x the # of Days Employed field from the Job Info tab. The resulting amount populates the Contract Total and Balance fields on the Job Info tab.

- When using the midpoint salary schedule, calculations are based on the Midpoint field x the Amount field from the salary table x the # of Days Employed field from the Job Info tab. The resulting amount populates the Contract Total and Balance fields on the Job Info tab.

- If the # of Days Employed field is not populated, the Contract Total and Balance fields are not calculated.

- If not performing mass salary calculations for hourly employees, manually update the Contract Total on the Job Info tab and distribution information. This salary information is extracted to Budget and used for PEIMS reporting.

- On the Job Info tab, there is a Calculate button, salary calculations can be done for an individual rather than doing salary calculations in Mass Update for groups of employees. The Calculate button on the Job Info tab will render the same results as doing the Mass Update salary calculations.

- The Automatically Compute fields on the District HR Options page assist in manually updating employees. By using this feature, the pay rate, daily rate, dock rate, accrual rate, and overtime rate can all be automatically calculated when the annual contract and days employed are entered on the Job Info tab.