(Optional) Update accrual calendars

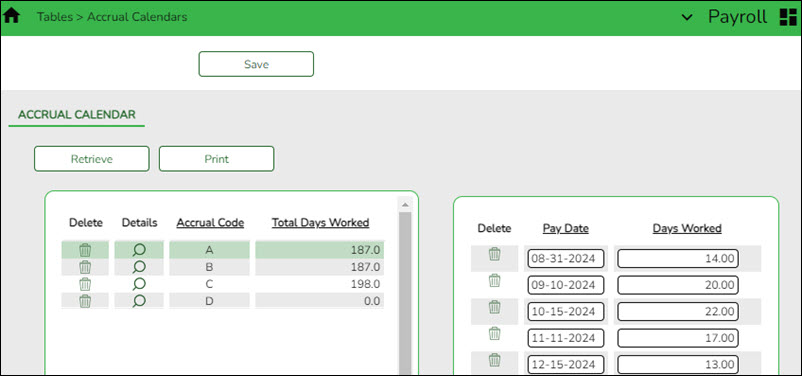

Payroll > Tables > Accrual Calendars > Accrual Calendar

This step is for LEAs that perform monthly accruals.

Create accrual calendars to accommodate the varied number of days employees work at the LEA. The calendar is used on the Payroll > Maintenance > Staff Job/Pay Data > Job Info tab to calculate the Accrual Rate when the calendar code is entered in the Accrual Info section.

Verify that the calendar code reflects the actual number of days the employee will work for the new school year; otherwise, the salary amount that should accrue over the school year will be incorrect.

- You can use the school calendar created in the previous step to get the actual workdays by month.

- If you have not set up the budget for the 2026-2027 school year, you can only enter pay dates through the 2026 calendar year. If the budget is set up for the 2026-2027 school year, you can enter 2027 pay dates in these fields.

Notes:

- This table can be updated after the move to current. All pay dates should be entered even if zero days are accrued (e.g., summer months).

- Most districts only accrue 10-month employees. If that is true for you, each code should begin with August 31 and show the number of days that group of employees will work in August. Add 12 more lines and enter the true/regular Pay Dates. Enter the days employees work in the month associated with each pay date.

- Typically, July and August (and sometimes June) will show the pay date and zero days, but they still must be included.

- Dates used (with the exception of August 31) must match the Pay Dates that will be built in the Pay Date Table.