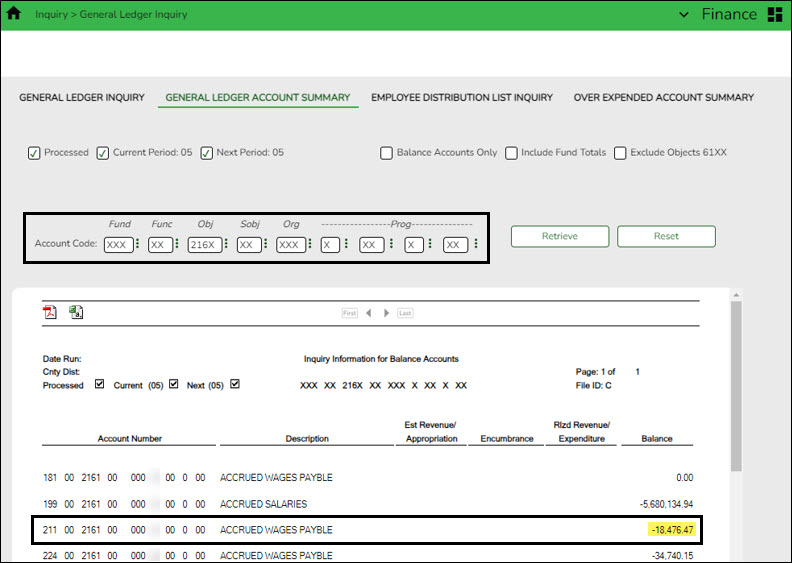

Run a general ledger inquiry

Finance > Inquiry > General Ledger Inquiry > General Ledger Account Summary

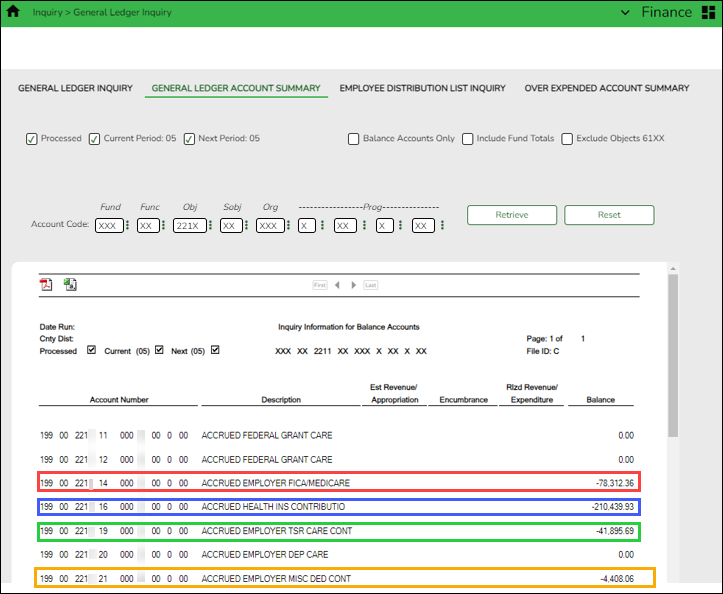

When considering potential journal entries to be made later in this step, use the following chart for reference.

| General Ledger Inquiry Report | School YTD Report | Expenditure Object Code |

| 216X | Accrued Wages | 6119 or 6129 |

| 221X.11 | Accrued Federal Grant Deposit | 6146 |

| 221X.12 | Accrued Federal Grant Care | 6146 |

| 221X.14 | Accrued Employer FICA/Medicare | 6141 |

| 221X.15 | Accrued Employer Unemployment Tax | 6145 |

| 221X.16 | Accrued Health Insurance Contribution (Emplr Health Insurance Accrued + TEA Health Ins Accrued) | 6142 |

| 221X.17 | Accrued Employer 457 Contribution | 6149 |

| 221X.18 | Accrued Employer Annuity Contribution | 6149 |

| 221X.19 | Accrued Employer TRS Care Contribution | 6146 |

| 221X.20 | Accrued Employer Dependent Care | 6149 |

| 221X.21 | Accrued Employer Miscellaneous Deduction Contribution | 6149 |

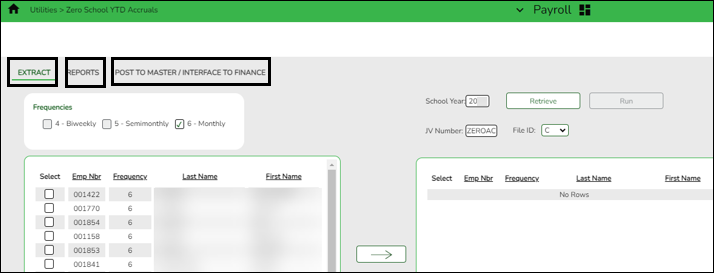

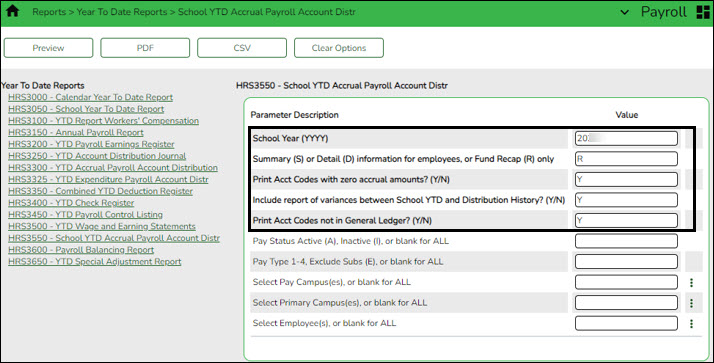

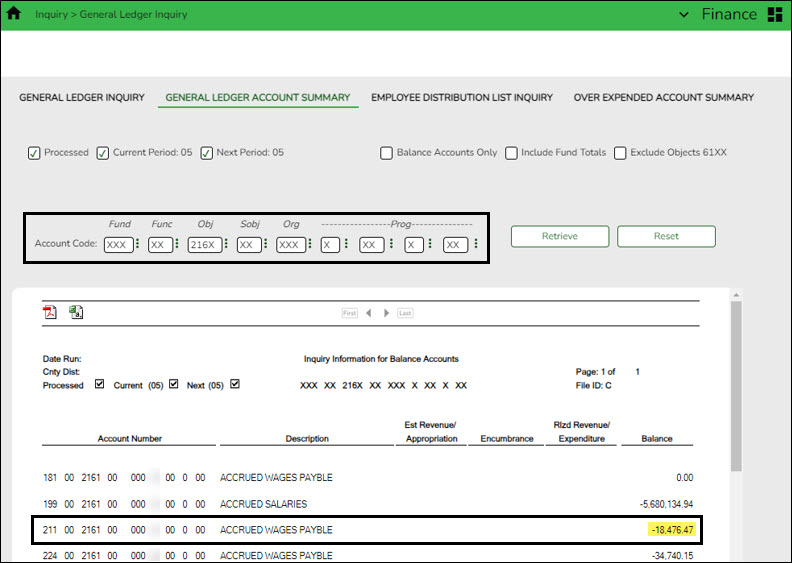

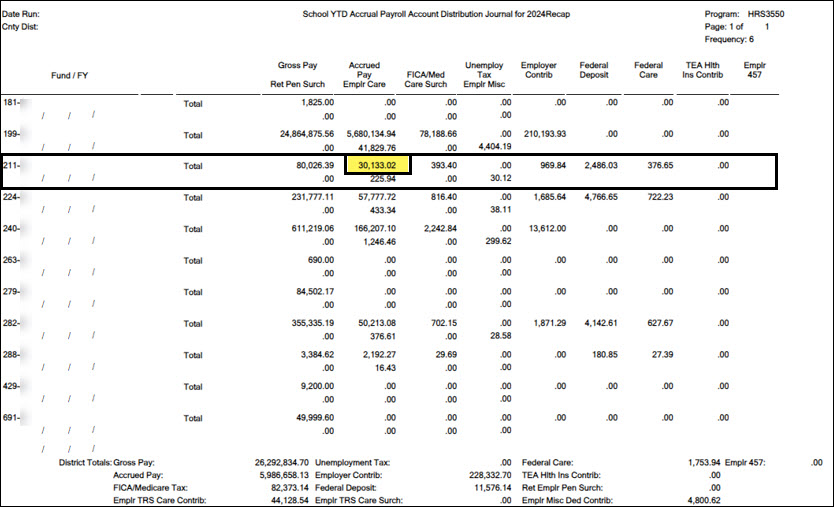

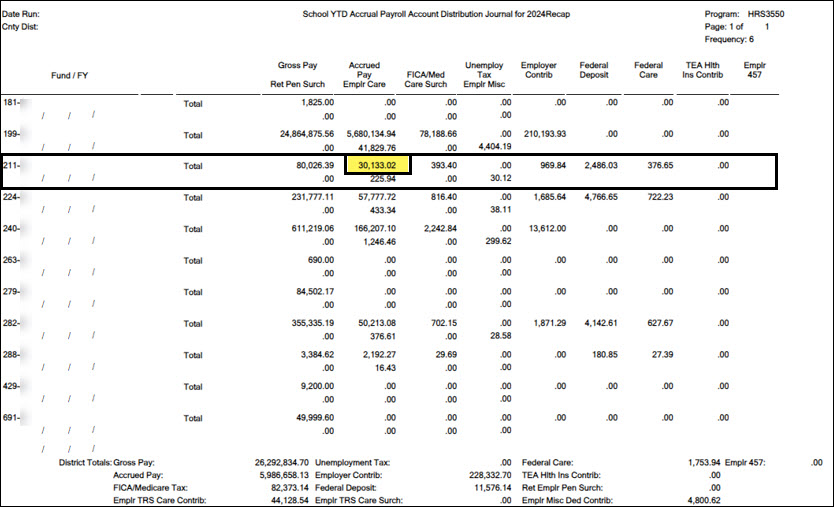

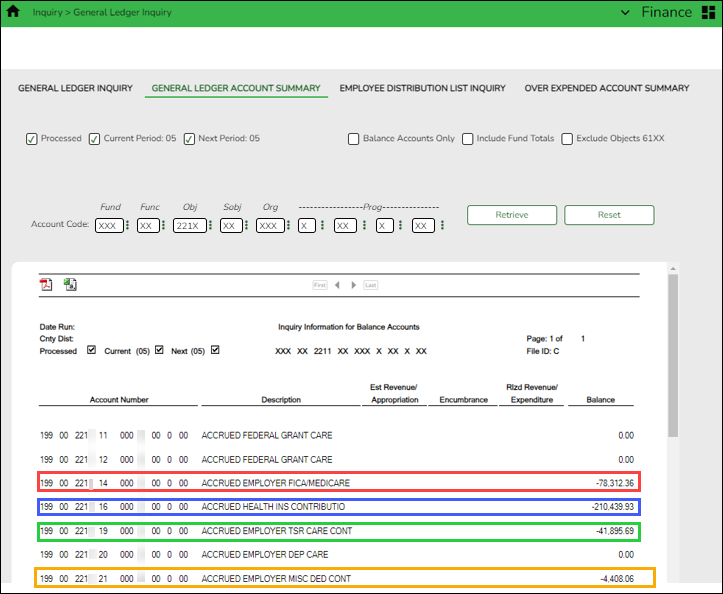

Run an inquiry on the 216X and 221X accounts from Finance and compare the balances to the Payroll > Reports > Year To Date Reports > HRS3550 - School YTD Accrual Payroll Account Distribution Journal.

This inquiry can also be run in Purchasing.

If there is a difference in any of the funds, a journal entry needs to be made to balance the general ledger to the HRS3550 - School YTD Accrual Payroll Account Distribution Journal.

Compare the HRS3550 report totals to the General Ledger Inquiry reports.

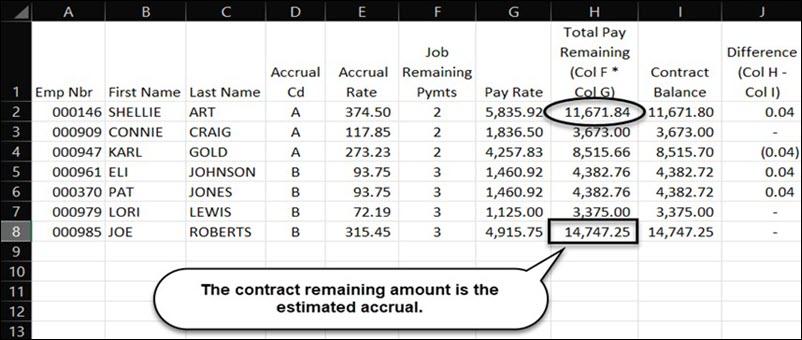

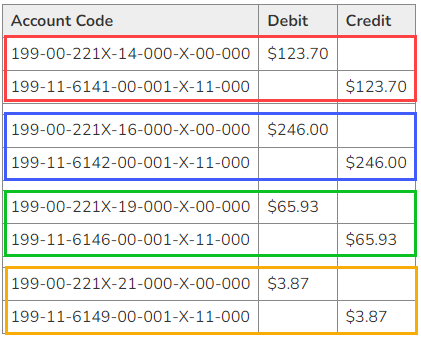

Review the following example entry:

| Account Code | Debit | Credit |

| 199-00-2161-00-000-X-00-000 | | $2,696.98 |

| 199-11-6119-00-001-X-11-000 | $2,696.98 | |

This is the difference between the two amounts. The entry has to make the general ledger match the HRS3550 - School YTD Accrual Payroll Account Distribution Journal.

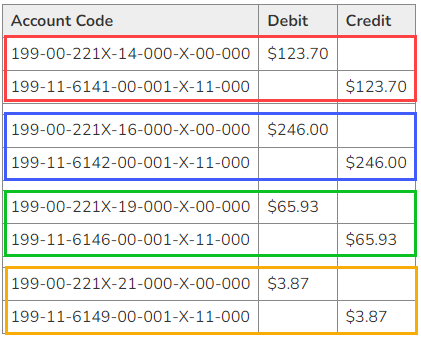

If there is a difference in any of the funds such as in the example shown below, a journal entry will need to be made to balance the general ledger to the HRS3550 - School YTD Accrual Payroll Account Distribution Journal.

Review the following example entry:

Note: Be sure to keep a clean final copy of both of the HRS3550 reports for the auditor. These reports cannot be recreated after the July and August payrolls are processed.