User Tools

Sidebar

Add this page to your book

Remove this page from your book

This is an old revision of the document!

ASCENDER - Warehouse End-of-Year Process

Created: 05/02/2023

Reviewed: in progress

Revised: in progress

The purpose of this document is to guide you through the process of ending the current fiscal year and beginning the new fiscal year.

This document assumes that you are familiar with the basic features of the ASCENDER Business System and have reviewed the ASCENDER Business Overview guide.

Some of the images and/or examples provided in this document are for informational purposes only and may not completely represent your LEA’s process.

Warehouse End-of-Year Process

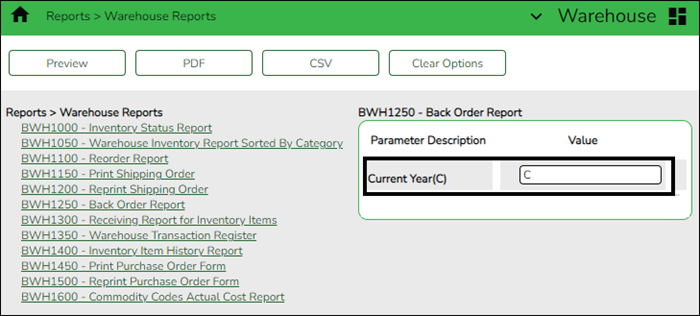

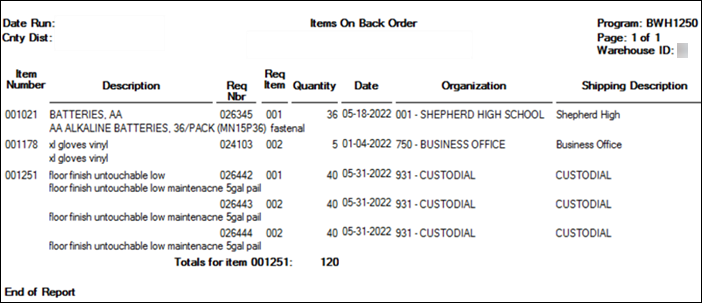

- Generate the BWH1250 - Back Order Report.

Generate the BWH1250 - Back Order Report

Warehouse > Reports > Warehouse Reports > BWH1250 - Back Order Report

Generate the report for the current year and save a copy.

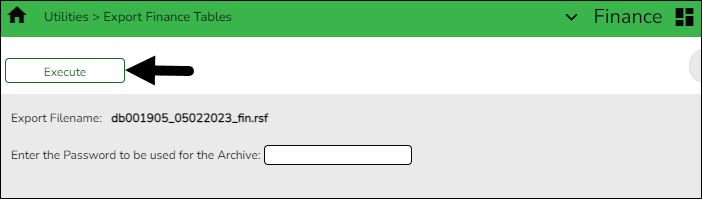

- Create a Finance export (backup).

Create a Finance export

Finance > Utilities > Export Finance Tables

Export a copy of all current finance tables, requisition tables, and accounts receivable tables and save the file.

❏ In the Enter the Password to be used for the Archive, enter the password to be used to retrieve the data from the file.

❏ Click Execute.

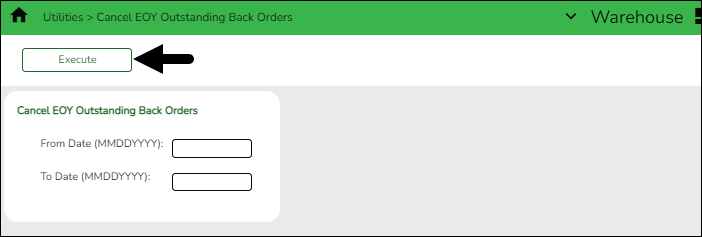

- Cancel EOY outstanding back orders.

Cancel EOY outstanding back orders

Warehouse > Utilities > Cancel EOY Outstanding Back Orders

Cancel back orders for a specific date range depending on your fiscal year start and end dates.

For June Year-End LEAs:

- In the From Date field, enter 07012022.

- In the To Date field, enter 06302022.

For August Year-End LEAs:- In the From Date field, enter 09012022.

- In the To Date field, enter 08312022.

❏ Click Execute. Print and save the report and click Process. Perform the requested backup. - Mass delete requisition records by fund.

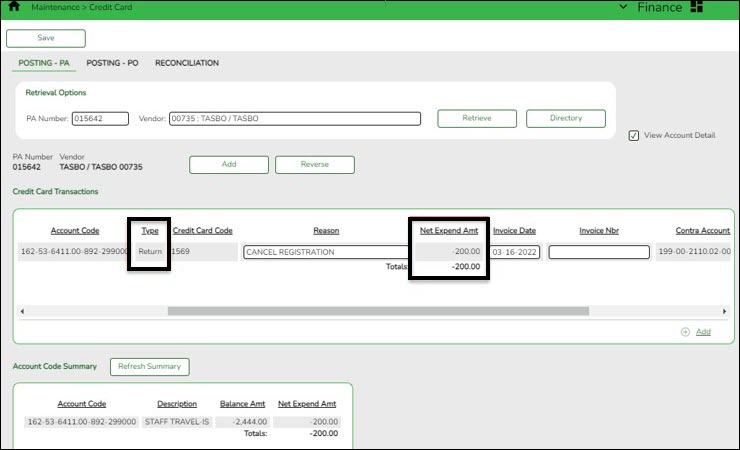

Post returns

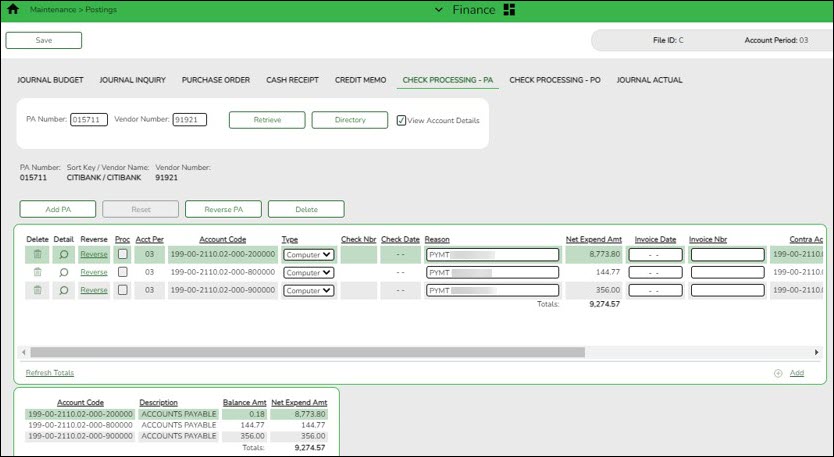

Finance > Maintenance > Credit Card > Posting - PA or Posting PO

To ensure that the check to the credit card company is correct, all returns must be posted before reconciling the credit card statement.

Verify that the following fields are completed for a return:

- The Type field must be set to Return.

- The Net Expend Amt field must be a negative amount.

- A credit memo number must be entered in the Credit Memo Nbr field on this tab prior to saving the record.

In the above example, a return for $200 to cancel a TASBO registration was created on the Finance > Maintenance > Credit Card > Posting - PA tab.

Reverse expenditure:

162-00-2177-99-000-200000 Debit 162-53-6411-00-892-299000 Credit 199-00-2110-01-000-200000 Debit 199-00-1261-00-000-200000 Credit - Reverse pending requisitions.

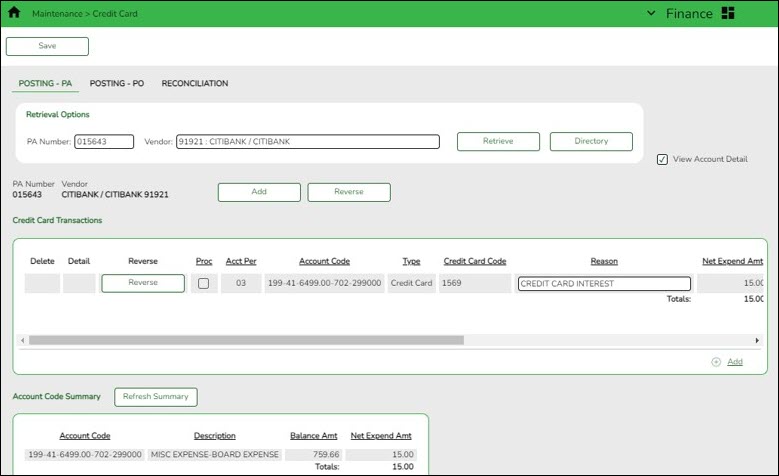

Post interest and miscellaneous charges

Finance > Maintenance > Credit Card > Posting - PA

As needed, create transactions for interest and other miscellaneous charges as a credit card PA transaction.

In the above example, a transaction of $15 for credit card interest was posted.

Expenditure:

199-41-6499-00-702-299000 Debit 199-00-2110-01-000-200000 Credit - Initialize year inventory files.

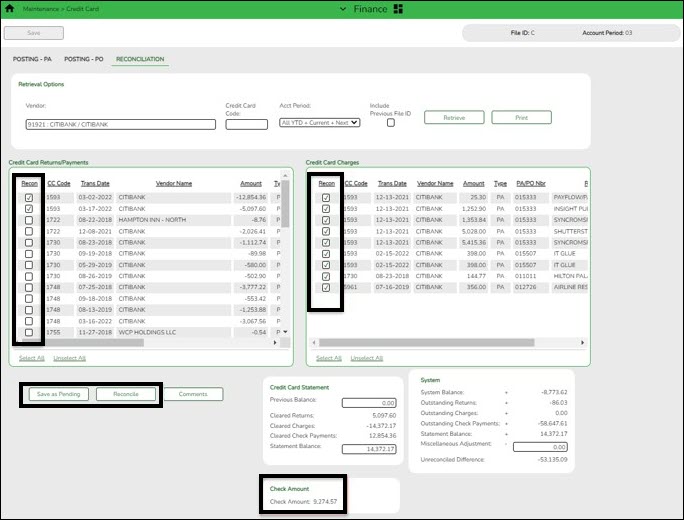

Reconcile the credit card statement

Finance > Maintenance > Credit Card > Reconciliation

After all credit card transactions are entered, reconcile the credit card statement to the credit card transactions.

❏ Use the following fields to begin the reconciliation process:

- In the Vendor field, select the credit card vendor (company).

- In the Credit Card Code field, select the applicable credit card code to retrieve all transactions that were entered for that credit card.

- In the Statement Balance field, enter the credit card balances from the credit card statement.

- Proceed to reconcile the credit card transactions. As returns/payments or charges are selected, the balance and the check amount totals are updated.

❏ Click Save as Pending to save and then when finished, click Reconcile.

During the reconciliation process in the next month, the payment transaction(s) to the credit card company will be displayed on the Finance > Maintenance > Credit Card > Reconciliation tab.

Expenditure:

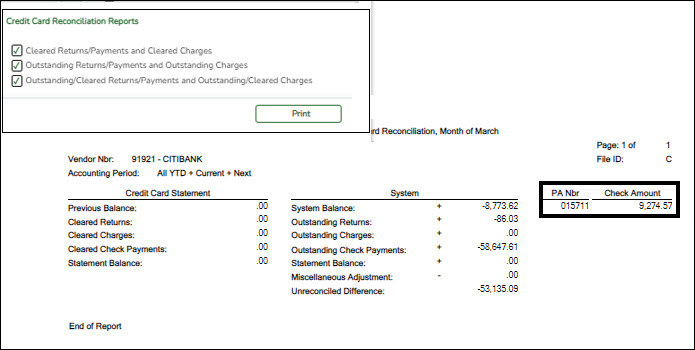

199-00-2110-01-000-200000 Debit 199-00-2110-00-000-200000 Credit After you click Reconcile and the credit card statement is reconciled, a PA is created for the credit card company on the Finance > Maintenance > Postings > Check Processing - PA tab.

It is helpful for tracking purposes to enter the statement date in the Invoice Date field and the statement month as the Invoice Number.

- Update the fiscal year for Warehouse ID(s).

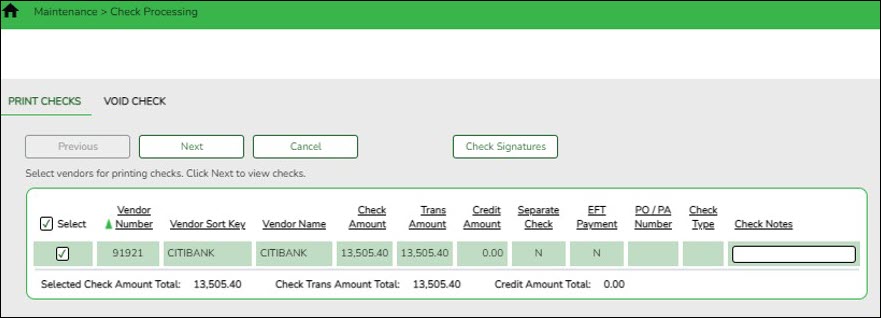

Process payment to the credit card company

Finance > Maintenance > Check Processing > Print Checks

Process the payment to the credit card company.

The transaction for the check to be issued to the credit card company is displayed.

To post check:

199-00-2110-00-000-200000 Debit 199-00-1110-00-000-200000 Credit During the reconciliation process in the next month, the payment transaction(s) to the credit card company will be displayed on the Finance > Maintenance > Credit Card > Reconciliation tab.

Americans with Disabilities Act (ADA) and Web Accessibility

The Texas Computer Cooperative (TCC) is committed to making its websites accessible to all users. It is TCC policy to ensure that new and updated content complies with Web Content Accessibility Guidelines (WCAG) 2.0 Level AA. We welcome comments and suggestions to improve the accessibility of our websites. If the format of any material on our website interferes with your ability to access the information, use this form to leave a comment about the accessibility of our website.