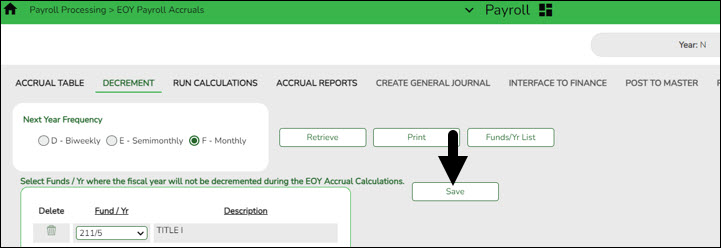

Note: The system default is to decrement (subtract by one) the fiscal year in the account distribution code in the next year payroll files. If you do not want to decrement a Fund activity, then the fund must be added to this tab to prevent it from being decremented. For example, if your LEA needs the August accruals for federal funds to be posted to the new fund/yr, then that fund/yr should be added to this tab.

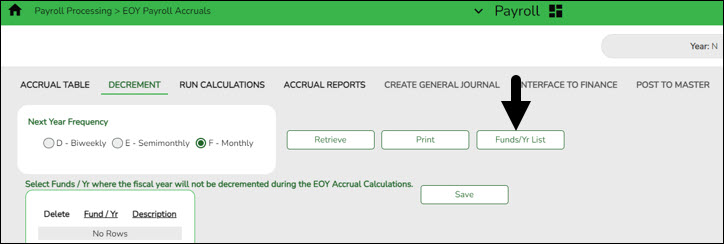

❏ Under Next Year Frequency, select one of the following payroll frequencies:

D - Biweekly

E - Semimonthly

F - Monthly

Notes:

If the user is not authorized to access a payroll frequency, it is disabled.

Only one payroll frequency can be selected at a time.

❏ Click +Add to manually add fund/yrs.

| Field | Description |

| Fund/Yr | Click  to select the federal funds that should not have the FY decremented (decreased). to select the federal funds that should not have the FY decremented (decreased).

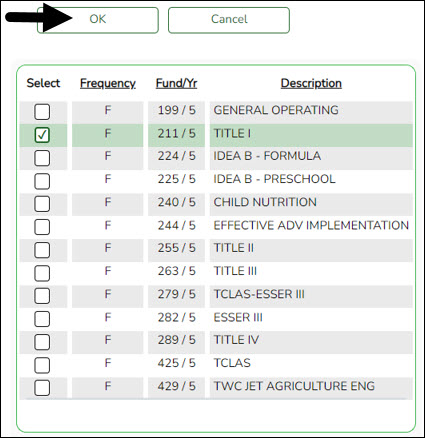

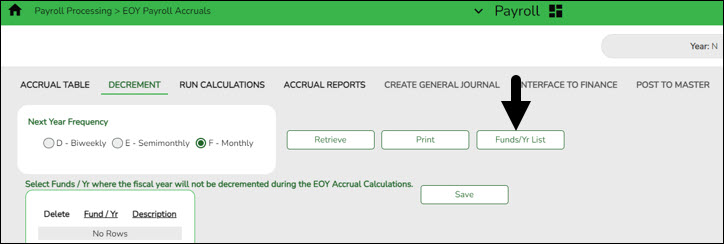

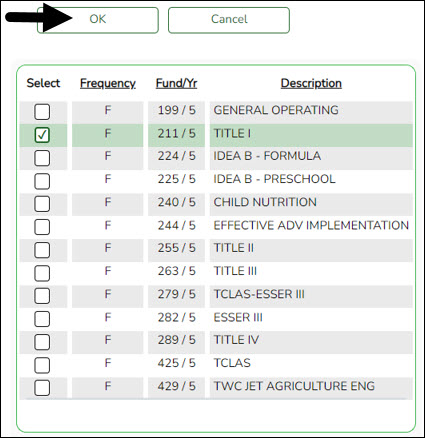

For multiple entries, click Funds/Yr List. A list of available fund/yrs is displayed.

To select multiple rows when the funds/fiscal years are consecutive, select a fund/fiscal year to start at, and then press and hold SHIFT while selecting a fund/fiscal year to end the selection process. All funds/fiscal years (between the first and last item) in the sequence are selected.

To select multiple rows when the funds/fiscal years are not consecutive, select a fund/fiscal year, and then other individual funds/fiscal years from different areas of the list.

Click OK to select the funds/fiscal years and close the listing. Otherwise, click Cancel. |

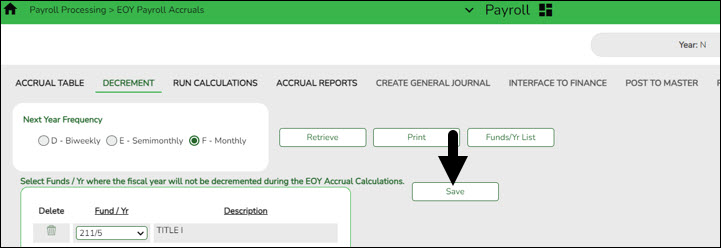

| Description | This field is automatically populated when the Fund/Yr field is populated from the Funds/Yr List. If a fund/yr is manually added, click Refresh Description to populate this field. |

❏ Click Save.