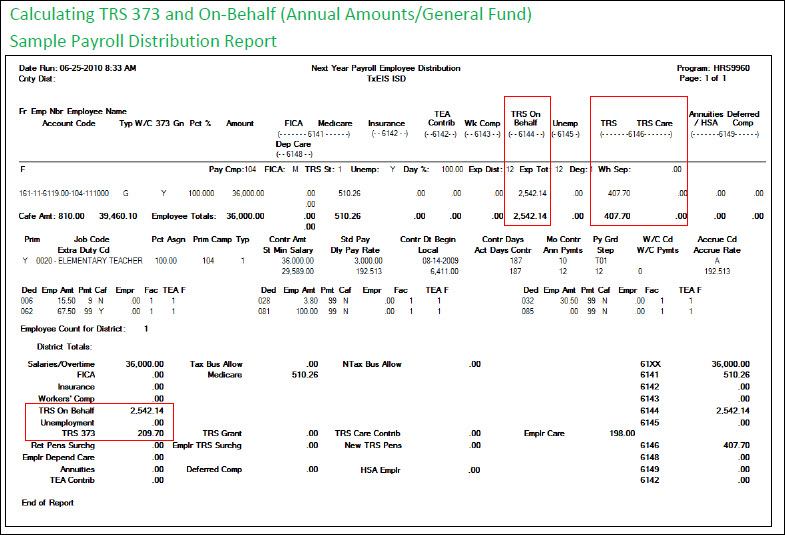

Calculating TRS 373 and On-Behalf (Annual Amounts/General Fund)

The following calculations are based on annual amounts and general fund distributions. These calculations should be used to verify the TRS 373* and On-Behalf** amounts on the Next Year Interface Budget Reports. These reports are created through the Interface NY Payroll to NY Budget Extract Reports.

Adjusted State Minimum Calculation

State Minimum Salary (as recorded on the Job Info tab) x District CEI Rate = Adjusted State Minimum Salary

| State Minimum Salary | multiplied by District CEI | Adjusted State Minimum Salary |

| $29,589.00 | x 1.11 | = $32,843.79 |

Adjusted TRS Salary above Adjusted State Minimum Calculation

Eligible TRS Salary - Adjusted State Minimum = Adjusted TRS Salary above Adjusted State Minimum

| Eligible TRS Salary | minus Adjusted State Minimum | Adjusted TRS Salary above Adjusted State Minimum |

| $36,000.00 | - $32,843.79 | = $3,156.21 |

TRS 373 District Contribution Calculation

Adjusted TRS Salary above Adjusted State Minimum x TRS 373 District Contribution Percentage (6.644%) = TRS 373 District Contribution

| Adjusted TRS Salary above Adjusted State Minimum | multiplied by TRS 373 District Contribution Percentage (6.644%) | TRS 373 District Contribution |

| $3,156.21 | x .06644 | = $209.70 |

State Matching Calculation

Eligible TRS Salary x TRS Rates (District 6.644% + TRS-Care 1%) = State Matching

| Eligible TRS Salary | multiplied by TRS Rates (District 6.644% + TRS-Care 1%) | State Matching |

| $36,000.00 | x .07644 | = $2,751.84 |

TRS On-Behalf Calculation

State Matching - TRS 373 District Contribution = TRS On-Behalf

| State Matching | minus TRS 373 District Contribution | TRS On-Behalf |

| $2,751.84 | - $209.70 | = $2,542.14 |

For additional information regarding TRS 373, go to the TRS website at: www.trs.state.tx.us/employers.jsp?submenu=traqs&page_id=/traqs/payroll_reporting_manual_main/traqs/payroll_reporting_manual_main.

For additional information regarding TRS On-Behalf, go to the TEA website at: http://tea.texas.gov/Finance_and_Grants/Financial_Accountability/Financial__Accountability_System_Resource_Guide/.