Special Adjustment, Percent Example

| From Pay Date: 09012001 | To Pay Date: 08302002 |

| From Job Code: 001 - Teacher | To Job Code: 001 - Teacher |

| From Primary Campus: 101 - Elem. | To Primary Campus: 101 - Elem. |

Percent of Account: 30.00%

The calculated amount, based on defined percentage, is disbursed among the account codes selected in To Account Code. Disbursement among two or more accounts will then be made according to the percentages in the employee Staff Pay/Job distribution page.

Internal Calculations

50% plus 25% = 75% (what percentage of the whole do 50% and 25% represent?)

50%/75% = 66.666%

25%/75% = 33.334%

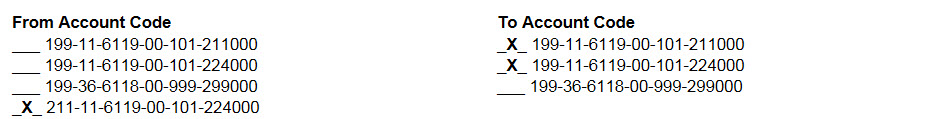

From Account Code - 211-11-6119-00-101-X24000 Calc of salary x percentage

(6119) Transaction Pay History = $1,000 x 30% = $300

(614X) Trans Health Benefit History = $100 x 30% = $30

(216X) Transaction Accrual History = $50 x 30% = $15

To Acct Codes 199-11-6119-00-101-X11000 199-11-6119-00-101-X24000

(and associated benefit codes)

| Pay | $300 x 66.666% = $200 (rounded) | $300 x 33.334% = $100 (rounded) |

| Health | $100 x 66.666% = $20 (rounded) | $100 x 33.334% = $10 (rounded) |

| Accruals | $15 X 66.666% = $5 | $50 X 33.334% = $10 |