(If applicable) Mass update employer contribution and remaining payments

Use the Mass Update utility to update employee data in preparation for the new school year. This utility allows you to quickly and easily mass change data resulting in minimal manual changes to individual employee records with less possibility of manual entry errors.

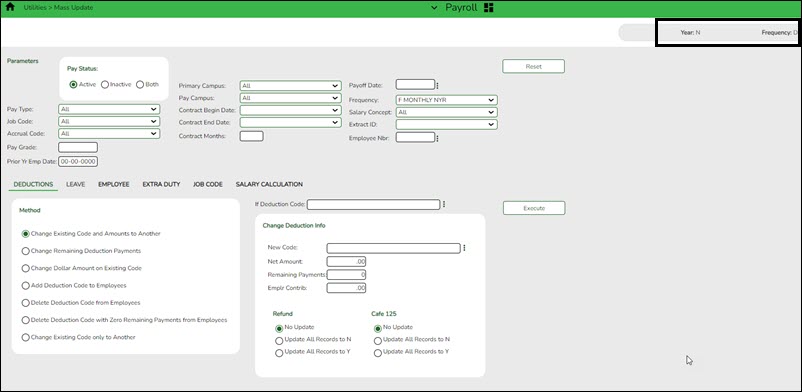

CAUTION: To avoid entering data in an incorrect pay frequency, be mindful of the pay frequency to which you are logged on as you may be changing back and forth between the current year and next year's pay frequencies for several months.

If applicable, mass update the Employer Contribution and Remaining Payments for all employees with health care and other employer paid deductions.

It is recommended to update the number of remaining payments for deductions to ensure they are fully budgeted for.

This utility is used to update deductions for a number of employees at a single time. Deduction data may be updated by a variety of criteria including pay type, pay grade, primary campus, and pay frequency. The Deductions tab allows users to add, change, and delete deduction codes as well as alter the number of remaining payments and the existing dollar amounts associated with the deductions. Mass deduction updates are very useful at the beginning of the year when many employees are being added to insurance programs. Once deductions are added using this tab, they are reflected in the individual deduction records.

❏ Under Parameters, select the employees whose deduction data is to be changed.

TIP: Prior to processing a mass update, capture a screenshot of the parameters used for future reference.

❏ Under Method, select the type of deduction change to be implemented.

❏ Click Execute. A preview report is displayed. Review the report.

❏ Click Process to accept the changes and continue. Or, click Cancel to return to the Mass Update page.