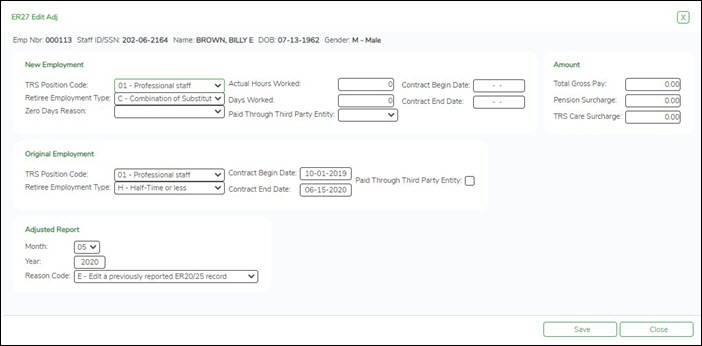

The ER27 record is used to report an adjustment (i.e., edit or deletion of a record) to a previously reported record on an Employment After Retirement report.

The ER27 is used to edit a previously submitted and TRS-accepted ER20 or ER25 record. If one or more of the following fields is adjusted, a net difference transaction must be reported:

- Actual Hours Worked

- Days Worked

- Total Gross Pay

- Pension Surcharge

- TRS-Care Surcharge

Additionally, the ER27 is used to delete a previously submitted and TRS-accepted ER20 or ER25 record. When deleting a record that was previously reported in error, all of the following data must net to zero:

- Actual Hours Worked

- Days Worked

- Total Gross Pay

- Pension Surcharge

- TRS-Care Surcharge

❏ Under New Employment:

❏ Under Original Employment:

❏ Under Amount:

| Total Gross Pay | Type the net difference between the originally reported amount and the correct total gross compensation amount. |

|---|---|

| Pension Surcharge | Type the net difference between the amount originally reported and the correct amount of pension surcharge due, if any. |

| TRS Care Surcharge | Type the net difference between the amount originally reported and the correct amount of TRS Care surcharge due, if any. |

❏ Under Adjusted Report: