Sidebar

This is an old revision of the document!

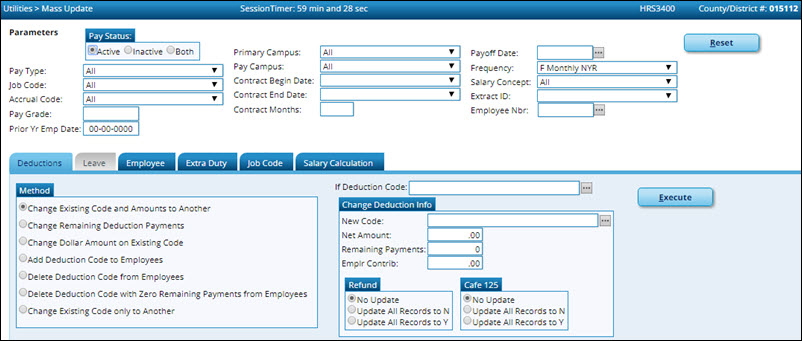

Deductions - HRS3400

Human Resources > Utilities > Mass Update > Deductions

This tab is used to update deductions for a number of employees at a single time. Deduction data may be updated by a variety of criteria including pay type, pay grade, primary campus, and payroll frequency. The Deductions tab allows users to add, change, and delete deduction codes as well as alter the number of remaining payments and the existing dollar amounts associated with the deductions. Mass deduction updates are very useful at the beginning of the year when many employees are being added to insurance programs. Once deductions are added using this tab, they are reflected in the individual deduction records.

Mass update deductions:

Under Parameters, select the employees whose deduction data is to be changed.

TIP: Prior to processing a mass update, capture a screenshot of the used parameters for possible future reference.

Under Method, select one of the following types of deduction changes to implement:

Click Execute. A preview report is displayed.

Click Process to accept the changes and continue. Or, click Cancel to return to the Mass Update page.

If you click Process, a message is displayed prompting you to create a backup. A backup is highly recommended.

Other functions and features:

Click Reset to reset all previously selected parameter options to the default.

Americans with Disabilities Act (ADA) and Web Accessibility

The Texas Computer Cooperative (TCC) is committed to making its websites accessible to all users. It is TCC policy to ensure that new and updated content complies with Web Content Accessibility Guidelines (WCAG) 2.0 Level AA. We welcome comments and suggestions to improve the accessibility of our websites. If the format of any material on our website interferes with your ability to access the information, use this form to leave a comment about the accessibility of our website.