ASCENDER - Process 1099 Forms

Created: 12/07/2018

Reviewed: DRAFT

Revised: DRAFT

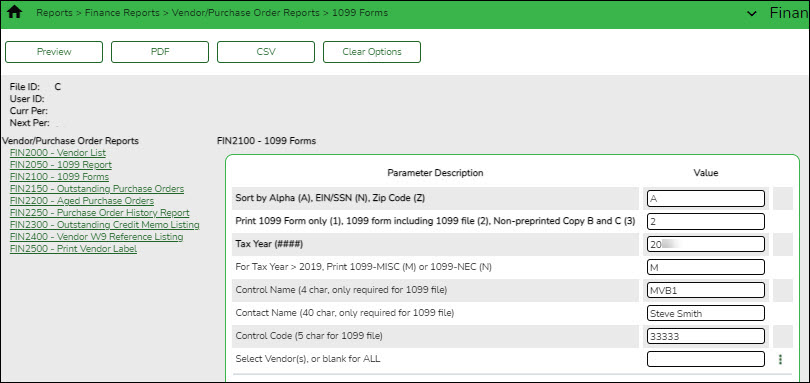

The purpose of this document is to guide you through the process of verifying and producing 1099-MISC (Miscellaneous Income) and 1099-NEC (Nonemployee Compensation) forms in Finance.

Beginning with the 2020 tax year, non-employee compensation (i.e., payments to a non-employee, such as an independent contractor) totaling $600 or more must be reported on the new Form 1099-NEC. Previously, non-employee compensation was reported in box 7 on Form 1099-MISC.

This document assumes you are familiar with the basic features of the ASCENDER Business system and have reviewed the ASCENDER Business Overview guide.

Before You Begin

Review the following information and/or complete the tasks listed before you begin the 1099 forms processing steps:

Terms

| Term | Description |

|---|---|

| FIRE | Filing Information Returns Electronically |

| Form 1099-MISC |

Reference the following page on the IRS website for specific instructions about Form 1099-MISC: |

| Form 1099-NEC |

Reference the following page on the IRS website for specific instructions about Form 1099-NEC: |

| IRIS | Information Returns Intake System |

| IRS | Internal Revenue Service |

| SSA | Social Security Administration |

| SSN | Social Security Number |

Helpful Links

| About Form 1099-MISC, Miscellaneous Information | https://www.irs.gov/forms-pubs/about-form-1099-misc |

|---|---|

| About Form 1099-NEC, Nonemployee Compensation | https://www.irs.gov/forms-pubs/about-form-1099-nec |

| Filing Information Returns Electronically (FIRE) | https://www.irs.gov/e-file-providers/filing-information-returns-electronically-fire |

| Form 1099-MISC | https://www.irs.gov/pub/irs-pdf/f1099msc.pdf |

| Form 1099-NEC | https://www.irs.gov/pub/irs-pdf/f1099nec.pdf |

| E-file information returns with IRIS | https://www.irs.gov/filing/e-file-information-returns-with-iris |

| Information Returns Intake System (IRIS) IRIS 101 | https://www.irs.gov/pub/irs-efile/iris-101-07292025.pdf |

| IRS Homepage | https://www.irs.gov |

| Publication 1220, Specifications for Electronic Filing of Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G | https://www.irs.gov/pub/irs-pdf/p1220.pdf |

| Publication 15 (2023), (Circular E), Employer's Tax Guide | https://www.irs.gov/publications/p15 |

❏ Complete 1099-NEC filing to the IRS by the due date indicated in the 1099-NEC instructions.

❏ Complete the 1099-MISC filing to the IRS by the due date indicated in the 1099-MISC instructions.

❏ If your LEA has more than 10 applicable information returns of any type covered by TD 9972, you MUST file electronically. Refer to the appropriate IRS page: Filing Information Returns Electronically (FIRE) or Information Returns Intake System (IRIS) for additional information and a list of applicable information returns covered by TD 9972.

- The existing FIRE format is still available for 2025 processing; however, according the IRS website, the targeted date for the retirement of the FIRE system is tax year 2026/filing season 2027.

- The Information Returns Intake System (IRIS) will be the only intake system for information returns for tax year 2026/filing season 2027.