Sidebar

Add this page to your book

Remove this page from your book

Update Tax Tables

The purpose of this document is to guide you through the necessary steps to update tax tables for the new tax year.

This document assumes you are familiar with the basic features of the ASCENDER Business system and have reviewed the ASCENDER Business Overview guide.

IMPORTANT: The tax tables must be updated in Payroll BEFORE processing your January payroll.

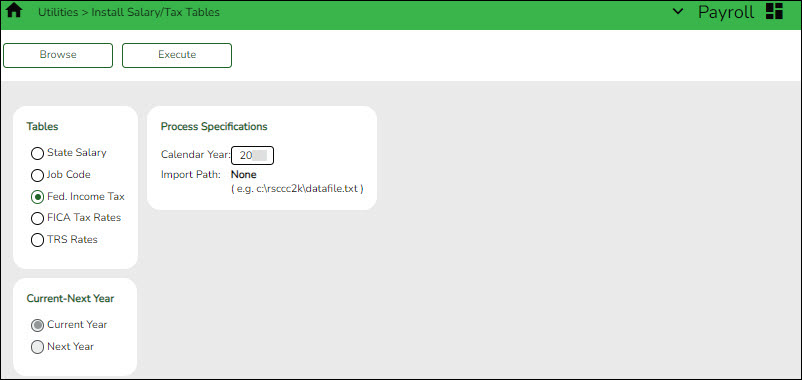

After obtaining and downloading the Federal Income Tax and FICA Tax files, use the Payroll > Utilities > Install Salary/Tax Tables page to upload the files.

❏ Under Tables, select Fed. Income Tax.

❏ Under Current-Next Year, select Current Year.

❏ Under Process Specifications, in the Calendar Year field, type the new tax year (e.g., 2024). The Import Path will populate the file name once it is selected in the next step.

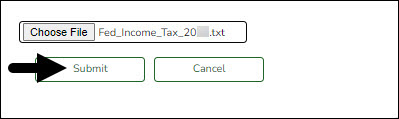

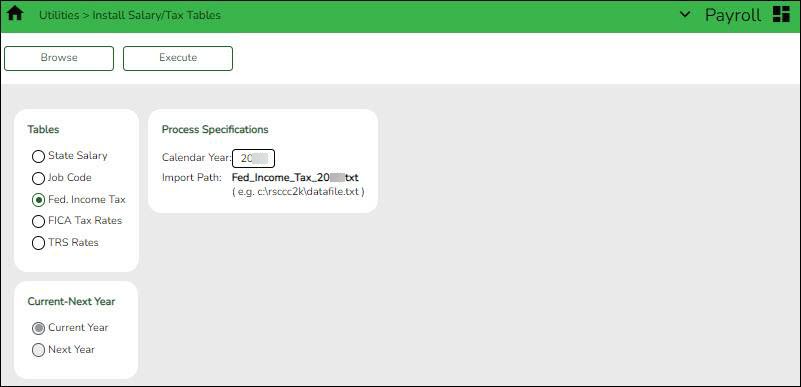

❏ Click Browse. Locate and select the Fed_Income_Tax_20XX.txt file from your computer or network, and then click Submit to accept the import file and return to the Import Salary/Tax Tables page.

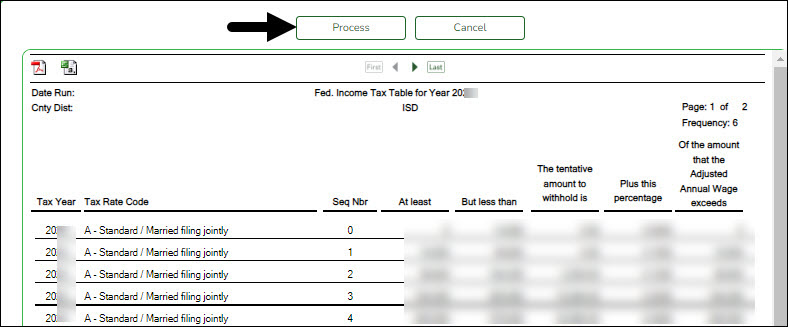

❏ Click Execute. A preview report displays the name of the table being updated (e.g., Fed. Income Tax Table for year 20XX).

❏ Click Process to complete the import.

Repeat the same process to upload the FICA tax file, except under Tables, select FICA Tax Rates, and then click Browse to select and import the FICA_Tax_20XX.txt file.

Use the Payroll > Tables > Tax/Deductions > Income Tax or FICA Tax tabs to verify that the tables were updated successfully.

Americans with Disabilities Act (ADA) and Web Accessibility

The Texas Computer Cooperative (TCC) is committed to making its websites accessible to all users. It is TCC policy to ensure that new and updated content complies with Web Content Accessibility Guidelines (WCAG) 2.0 Level AA. We welcome comments and suggestions to improve the accessibility of our websites. If the format of any material on our website interferes with your ability to access the information, use this form to leave a comment about the accessibility of our website.