ASCENDER - Roll Balances Supplement

Created: 07/10/2020

Reviewed: 06/23/2025

Revised: 06/23/2025

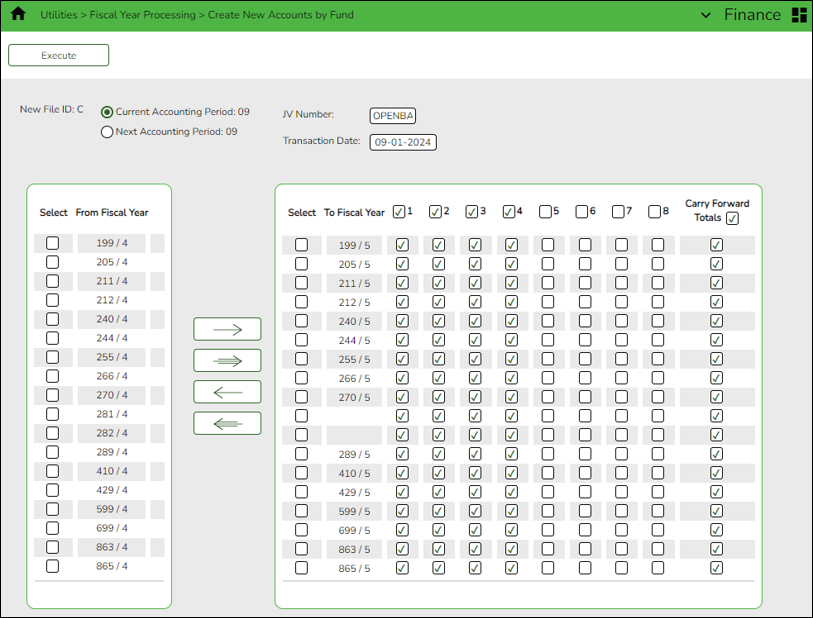

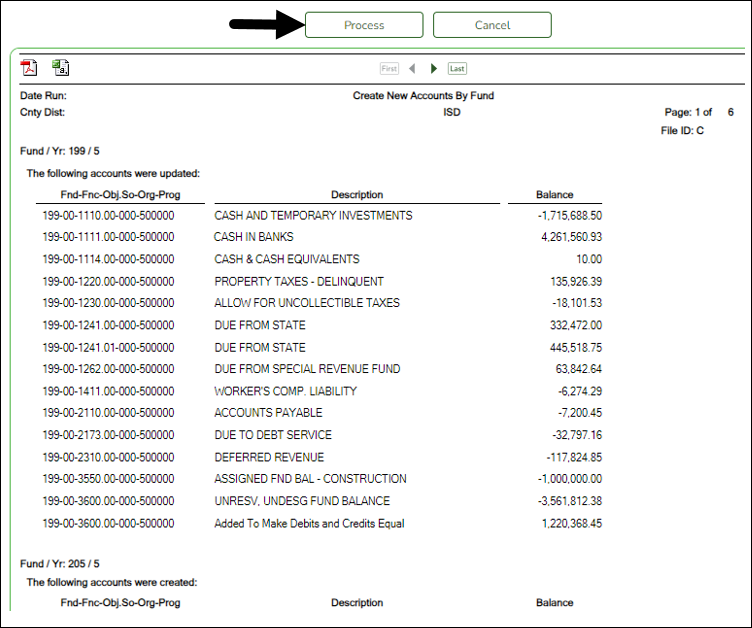

The purpose of this document is to assist LEAs that did not close revenues and expenditures and did not carry forward balance sheet account balances to the new fiscal year. This information will assist in posting the opening balance sheet amounts to file ID C.

After your auditor has provided the audit entries for file ID 5 and the audit entries have been posted, you have the option of closing the funds from file ID 5 and transferring the resulting balance sheet amounts to the current file ID for fiscal year 6. At that time, your Bank Reconciliation System Cash will reflect all cash amounts in the current file ID.

Notes:

- If your auditor provides opening entries that you will enter in file ID C, DO NOT use this option.

- If you continued funds in the Finance EOY Process, DO NOT use this option. Continued funds are not included in this process.

This document assumes you are familiar with the basic features of the ASCENDER Business system and have reviewed the ASCENDER Business Overview guide.

Roll Balances Supplement Process

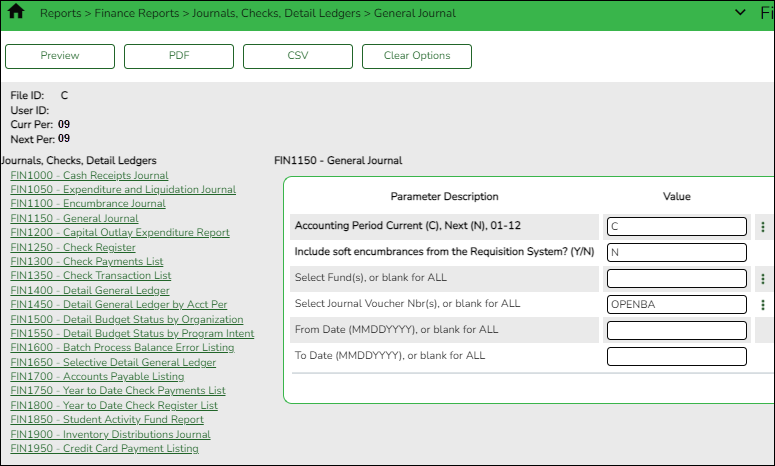

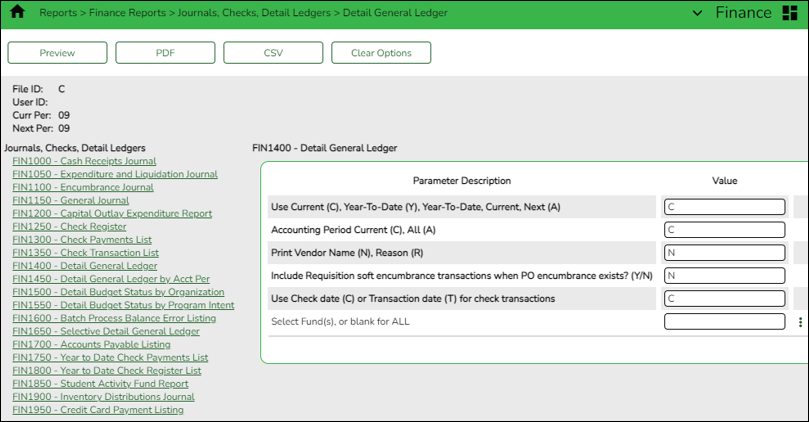

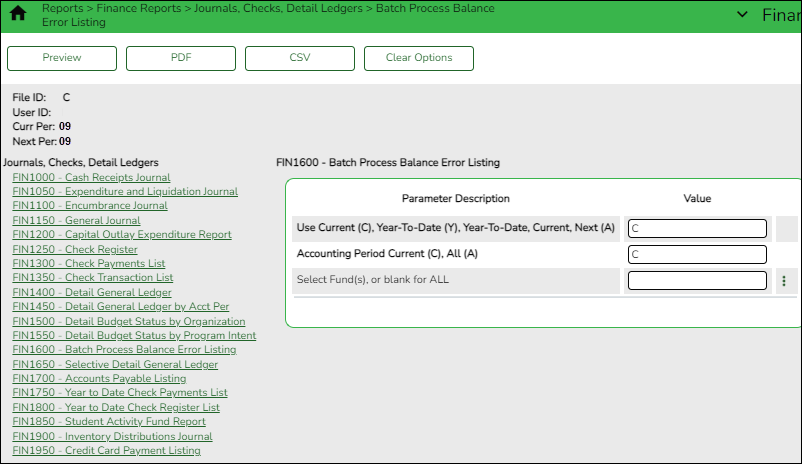

TIP: In the current file ID, run the Finance > Inquiry > General Ledger Inquiry > General Ledger Inquiry and verify that the correct fund balance amount is posted as an opening entry. These fund balance amounts should match your LEA’s Audit Report. Adjusting entries may need to be posted to balance these accounts.

Note: If you did not post auditor entries in file ID 5 before you rolled balances forward to file ID C, post auditor entries for FY4 in file ID 5 (for Mid-Yr PEIMS) and auditor adjusting entries for balance sheet accounts in file ID C.