Sidebar

Add this page to your book

Remove this page from your book

This is an old revision of the document!

August Accrual Overview

What does it mean to “accrue”?

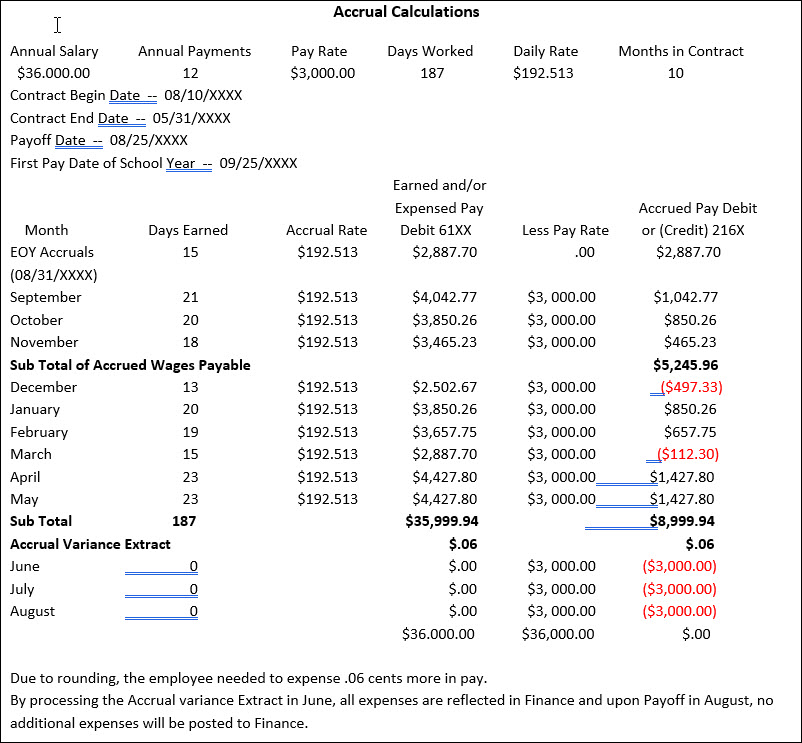

Accrue means to accumulate. Relative to payroll, it means to accumulate expenses actually incurred and owed, but not paid. Payroll accrual amounts occur when an employee’s days worked for a specific accounting period are not paid during that same accounting period.

The amount to accrue per pay period is calculated as follows: Amount to Accrue for the Pay Period = (Employee’s Accrual Rate times the Number of Days Worked in Pay Period) minus the Amount Paid for the Pay Period

Note: The total of the actual or standard pay and the calculated accrued pay is the expense pay for the pay period.

Why do we accrue?

TEA Finance Accountability System Resource Guide (FASRG):

- Payroll Accruals: “Expenditures should be recorded and reported in the period in which they are incurred. Therefore, unpaid salaries and related benefits that have been earned, but not yet paid should be recorded as accrued expenditures.”

- EOY Accruals: “Effective August 31, 1994, school districts were no longer allowed to defer the recognition of those expenditures incurred during one fiscal year that relates primarily to the next fiscal year.”

- The process of accruing salaries enables an LEA to accurately reflect expenses after each payday.

- This process enables LEAs to maintain earned but unpaid salary amounts for each employee in School YTD.

What are the pros and cons of accruing monthly?

Pros:

- Expenses are accurately reflected after each pay date. What is expensed is based on the accrual calendar (actual days worked).

Cons:

- Extra work involved to ensure accruals are set up correctly, balanced monthly, and cleared out at payoff.

- Time spent correcting accruals when they are out of balance.

How do accruals work?

- Accruals work by paying employees over 12 months what they have earned in 10 months (standard contract), districts accrue (accumulate) money in a ‘savings or reserve account code’ for employees.

- Accruing makes it possible for the district to account for an employee’s ‘earned pay’ each pay period while the employee is receiving a paycheck for the same standard pay amount for 12 months even though the employee does not work 12 calendar months.

- When payroll is run and salary is accrued, the system will debit the expenditure account (6XXX) and credit the accrual account (liability account-2XXX) and the cash account (1XXX), which increases the expenditure and increases the employee ‘savings’ account (accrual account code).

- When payroll is run and salary is withdrawn from accruals, the system will debit the accrual account (2XXX) and will credit cash (1XXX), which will decrease the employee savings account (accrual account code) and decrease cash.

What is a nonstandard employee accrual?

- Nonstandard employees are those who have a contract or work agreement beginning after June 30 but before September 1st of the same year and start receiving their new contract money in July or August. These employees must have the TRS Year field selected on the Payroll > Maintenance > Staff Job/Pay Data > Job Info tab.

- By selecting the TRS Year field for employees who accrue, when accruals are calculated and posted for July and/or August payrolls, the system will create a School YTD for the following school year (e.g., 2021-2022). The accrual amounts will display in the new school year and the actual pay amounts will remain in the current (e.g., 2020-2021) School YTD.

- The system determines whether a new School YTD record for the accruals should be created based on the employee’s contract begin date and pay date. If the TRS Year is selected and the year of the contract begin date is equal to the pay date year, then the calculated accruals for the payroll will be recorded in the next school year. It is recommended that this field is not selected when a nonstandard employee begins late in the school year; however, should be selected an employee contract starts again in July or August.

August Accrual Process Setup (EOY Payroll Accruals)

The August Accrual process is the beginning step in the process of accruing salaries and benefits through the Payroll application. The August Accrual process calculates salaries and benefits based on the employee’s days worked in August on their new contract salary, even though they will not be paid for the days worked in August until the new school year. The number of workdays in August is multiplied by the daily rate for each employee that accrues. This amount is expensed in Finance in August when it was earned or incurred.

The Payroll application will access this reserve during the next school year when the employee’s actual pay is less than the earned pay (March and December) and when they are paid but not actually working during the summer months. The date used for the August Accrual process should be a date after all actual August pay dates but not an actual pay date. It is recommended to use August 31 in this process. The August Accrual process is posted to payroll prior to the first September payroll being calculated for the new school year. At this point, the Account Distribution Journal reflects an ‘ADJUST’ entry for each employee indicating the amount of salary earned/accrued and the related benefits calculated in the August Accrual process.

Payroll > Tables > District HR Options

Select Calculate Accrual Salaries.

Verify the First Pay Date of School Year. (Do not change it.)

(Optional) Under Automatically Compute, select Accrual Rate.

Personnel > Tables > Job/Contract > Job Codes

Recommended: Comp accrual code information on the appropriate job codes. This information is used when entering a job code on the Job Info tab. The system refers to this table to determine if an accrual code should be added. If this table is not set up correctly, manual adjustments may be required.

Required for PMIS users who accrue: This field is important for LEAs using PMIS as accrual codes are not entered on the position for an employee. The accrual code pulls directly from this table and will be applied to the employee. For this reason, accuracy is crucial.

Payroll > Tables > Accrual Expense

It is important to maintain the fiscal years in this table so they reflect the proper fiscal year for account distribution history accrual withdrawal and posting. Failure to do so results in posting to Finance for an account with an incorrect fiscal year.

Payroll > Tables > Accrual Calendars > Accrual Calendar

Required: Accrual Calendars must be set up for those employees who will accrue. Pay dates on the Accrual Calendar MUST match the pay dates on the Tables > Pay Dates tab, except for the first entry which corresponds to the August Accrual process. This date is not entered on the Pay Dates tab.

Important: In order for accruals to balance correctly, you must enter a pay date and days worked for the end-of-year payroll accruals as the first entry for each Accrual Calendar for 10-month employees starting in August.

Be sure to enter the correct number of days used in the EOY accrual process. The date used for days in the August Accrual process can be the date the August Accruals were posted (typically 8/31) and should NOT be an actual pay date.

Continue entering pay dates and corresponding days to be used in the accrual calculations during the school year. If using the school calendars under Tables > Workday Calendars, you can get this information from the Workdays by Month section.

The total number of days should equal the number of days in the contract or the number of days employed for that group of employees.

Establish an accrual calendar for each group of ‘like’ employees who have the same begin and end contract dates and work the same number of days.

Be sure to include the June, July, and August pay dates even if there are no days worked.

In payroll calculations, the system references the days in the accrual calendar for each pay date and multiplies the number of days by the accrual rate for each accrued employee to reach the earned pay amount. For a monthly payroll, the employee will be paid 1/12th of his annual pay. The difference between these two amounts goes into accruals. The earned pay is expensed to Finance.

Update the following fields on the employee's master record:

Job Code

Pay Type

Payoff Date

TRS Year

Accrual Code

Accrual Rate

Account Code

Percent

TRS Grant Codes

Notes:

If you change an employee’s job code on the Job Info tab and the Accrual Code is blank on the Job Codes table for the new job code, then the Accrual Code field will blank out when the Job Info tab is saved and must be re-entered at that time. To avoid this situation, add the Accrual Code for each job code that will be accrued in the Job Codes table.

Accruals are tied to the job code. If a job code is changed, the accruals must be moved from the prior job code to the new job code. This can be accomplished with a special Adjustment.

When an employee is being paid off, the contract balance is paid and accruals will be reversed and zeroed if the Payoff Date field on the Job Info tab is the same as the pay date of the employee’s final paycheck. If the payoff date is not the same as the pay date, the accruals will remain in the 2161 and 2211 accounts and will need to be cleared by using the Zero School YTD Accruals utility.

Finance > Tables > District Finance Options > Clearing Fund Maintenance

Verify that the Payroll Automatic Posting Defaults are entered.

Balancing Accruals Monthly

This process will ensure that monthly accruals are booked accurately and consistently in Payroll and Finance. It is critical that these two areas balance to accomplish accurate grant reporting.

It is recommended that you balance your accruals monthly so that any errors are identified and resolved.

| ❏ | Finance > Tables > District Finance Options > Clearing Fund Maintenance Print the clearing fund maintenance table. |

|---|---|

| ❏ | Finance > Inquiry > General Ledger Inquiry > General Ledger Account Summary Print the following object codes:

Accrued Wages 2161 (refer to print from Step 1 for correct code) |

| ❏ | Payroll > Reports > Year to Date Reports > HRS3050 – School Year to Date Report

Verify the School Year (YYYY) parameter has the correct year. |

| ❏ | Compare the amounts from each General Ledger Summary (from step 2) to the totals on the HRS3050 report. Keep in mind that all processed payrolls need to be interfaced to Finance in order for the reports to match. |

TIP: It is recommended that you compare these reports from Finance to the totals on the HRS3050 - School Year to Date Report on a monthly basis in order to verify the accruals and the associated accrual benefit accounts.

Americans with Disabilities Act (ADA) and Web Accessibility

The Texas Computer Cooperative (TCC) is committed to making its websites accessible to all users. It is TCC policy to ensure that new and updated content complies with Web Content Accessibility Guidelines (WCAG) 2.0 Level AA. We welcome comments and suggestions to improve the accessibility of our websites. If the format of any material on our website interferes with your ability to access the information, use this form to leave a comment about the accessibility of our website.