User Tools

Sidebar

Add this page to your book

Remove this page from your book

Accrual Overview

What does it mean to “accrue”?

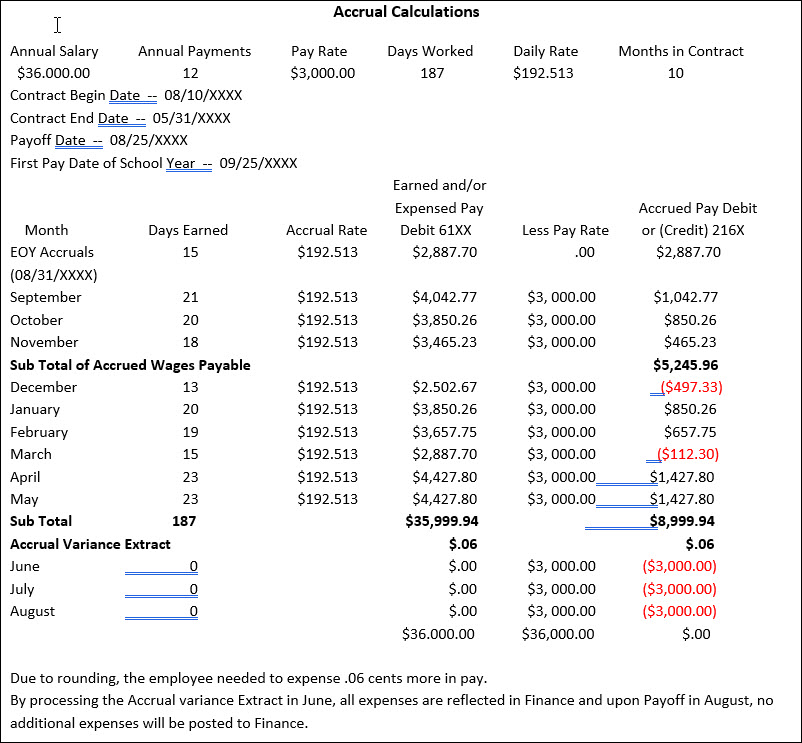

Accrue means to accumulate. Relative to payroll, it means to accumulate expenses actually incurred and owed, but not paid. Payroll accrual amounts occur when an employee’s days worked for a specific accounting period are not paid during that same accounting period.

The amount to accrue per pay period is calculated as follows: Amount to Accrue for the Pay Period = (Employee’s Accrual Rate times the Number of Days Worked in Pay Period) minus the Amount Paid for the Pay Period

Note: The total of the actual or standard pay and the calculated accrued pay is the expense pay for the pay period.

Why do we accrue?

TEA Finance Accountability System Resource Guide (FASRG):

- Payroll Accruals: “Expenditures should be recorded and reported in the period in which they are incurred. Therefore, unpaid salaries and related benefits that have been earned, but not yet paid should be recorded as accrued expenditures.”

- EOY Accruals: “Effective August 31, 1994, school districts were no longer allowed to defer the recognition of those expenditures incurred during one fiscal year that relates primarily to the next fiscal year.”

- The process of accruing salaries enables an LEA to accurately reflect expenses after each payday.

- This process enables LEAs to maintain earned but unpaid salary amounts for each employee in School YTD.

What are the pros and cons of accruing monthly?

Pros:

- Expenses are accurately reflected after each pay date. What is expensed is based on the accrual calendar (actual days worked).

Cons:

- Extra work involved to ensure accruals are set up correctly, balanced monthly, and cleared out at payoff.

- Time spent correcting accruals when they are out of balance.

How do accruals work?

- Accruals work by paying employees over 12 months what they have earned in 10 months (standard contract), LEAs accrue (accumulate) money in a ‘savings or reserve account code’ for employees.

- Accruing makes it possible for the LEA to account for an employee’s ‘earned pay’ each pay period while the employee is receiving a paycheck for the same standard pay amount for 12 months even though the employee does not work 12 calendar months.

- When payroll is run and salary is accrued, the system will debit the expenditure account (6XXX) and credit the accrual account (liability account-2XXX) and the cash account (1XXX), which increases the expenditure and increases the employee ‘savings’ account (accrual account code).

- When payroll is run and salary is withdrawn from accruals, the system will debit the accrual account (2XXX) and will credit cash (1XXX), which will decrease the employee savings account (accrual account code) and decrease cash.

What is a nonstandard employee accrual?

- Nonstandard employees are those who have a contract or work agreement beginning after June 30 but before September 1st of the same year and start receiving their new contract money in July or August. These employees must have the TRS Year field selected on the Payroll > Maintenance > Staff Job/Pay Data > Job Info tab.

- By selecting the TRS Year field for employees who accrue, when accruals are calculated and posted for July and/or August payrolls, the system will create a School YTD for the following school year. The accrual amounts will display in the new school year and the actual pay amounts will remain in the current School YTD.

- The system determines whether a new School YTD record for the accruals should be created based on the employee’s contract begin date and pay date. If the TRS Year is selected and the year of the contract begin date is equal to the pay date year, then the calculated accruals for the payroll will be recorded in the next school year. It is recommended that this field is not selected when a nonstandard employee begins late in the school year; however, should be selected an employee contract starts again in July or August.

August Accrual Process Setup (EOY Payroll Accruals)

The August Accrual process is the beginning step in the process of accruing salaries and benefits through the Payroll application. The August Accrual process calculates salaries and benefits based on the employee’s days worked in August on their new contract salary, even though they will not be paid for the days worked in August until the new school year. The number of workdays in August is multiplied by the daily rate for each employee that accrues. This amount is expensed in Finance in August when it was earned or incurred.

The Payroll application will access this reserve during the next school year when the employee’s actual pay is less than the earned pay (March and December) and when they are paid but not actually working during the summer months. The date used for the August Accrual process should be a date after all actual August pay dates but not an actual pay date. It is generally recommended to use August 31 in this process (only if there is not a payroll run on August 31). The August Accrual process is posted to payroll prior to the first September payroll being calculated for the new school year. At this point, the Account Distribution Journal reflects an ‘ADJUST’ entry for each employee indicating the amount of salary earned/accrued and the related benefits calculated in the August Accrual process.

- Set up district HR options.

Payroll > Tables > District HR Options❏ Select Calculate Accrual Salaries.

❏ Verify the First Pay Date of School Year. (Do not change it.)

❏ (Optional) Under Automatically Compute, select Accrual Rate.

- Set up job code table.

Personnel > Tables > Job/Contract > Job CodesRecommended: Complete the accrual code information on the appropriate job codes. This information is used when entering a job code on the Job Info tab. The system refers to this table to determine if an accrual code should be added. If this table is not set up correctly, manual adjustments may be required.

Required for Position Management users who accrue: This field is important for LEAs using Position Management as accrual codes are not entered on the position for an employee. The accrual code pulls directly from this table and will be applied to the employee. For this reason, accuracy is crucial.

- Set up accrual expense table.

Payroll > Tables > Accrual ExpenseIt is important to maintain the fiscal years in this table so they reflect the proper fiscal year for account distribution history accrual withdrawal and posting. Failure to do so results in posting to Finance for an account with an incorrect fiscal year.

- Set up accrual calendars.

Payroll > Tables > Accrual Calendars > Accrual CalendarRequired: Accrual Calendars must be set up for those employees who will accrue. Pay dates on the Accrual Calendar MUST match the pay dates on the Tables > Pay Dates tab, except for the first entry which corresponds to the August Accrual process. This date is not entered on the Pay Dates tab.

Important: In order for accruals to balance correctly, you must enter a pay date and days worked for the end-of-year payroll accruals as the first entry for each Accrual Calendar for 10-month employees starting in August.

❏ Be sure to enter the correct number of days used in the EOY accrual process. The date used for days in the August Accrual process can be the date the August Accruals were posted (typically 8/31) and should NOT be an actual pay date.

❏ Continue entering pay dates and corresponding days to be used in the accrual calculations during the school year. If using the school calendars under Tables > Workday Calendars, you can get this information from the Workdays by Month section.

❏ The total number of days should equal the number of days in the contract or the number of days employed for that group of employees.

❏ Establish an accrual calendar for each group of ‘like’ employees who have the same begin and end contract dates and work the same number of days.

❏ Be sure to include the June, July, and August pay dates even if there are no days worked.

❏ In payroll calculations, the system references the days in the accrual calendar for each pay date and multiplies the number of days by the accrual rate for each accrued employee to reach the earned pay amount. For a monthly payroll, the employee will be paid 1/12th of his annual pay. The difference between these two amounts goes into accruals. The earned pay is expensed to Finance.

- Update employee master record.

Payroll > Maintenance > Staff Job/Pay Data > Job InfoUpdate the following fields:

- Job Code

- Pay Type

- Payoff Date

- TRS Year

- Accrual Code

- Accrual Rate

Payroll > Maintenance > Staff Job/Pay Data > Distributions

Update the following fields:

- Account Code

- Percent

- TRS Grant Codes

Notes:

If you change an employee’s job code on the Job Info tab and the Accrual Code is blank on the job codes table for the new job code, then the Accrual Code field will be cleared when the Job Info tab is saved and must be re-entered at that time. To avoid this situation, add the Accrual Code for each job code that will be accrued in the job codes table.

Accruals are tied to the job code. If a job code is changed, the accruals must be moved from the prior job code to the new job code. This can be accomplished with a special adjustment or by running one of the following utilities:When an employee is being paid off, the contract balance is paid and accruals will be reversed and zeroed if the Payoff Date field on the Job Info tab is the same as the pay date of the employee’s final paycheck. If the payoff date is not the same as the pay date, the accruals will remain in the 2161 and 2211 accounts and will need to be cleared using the Zero School YTD Accruals utility.

- Update school year-to-date data.

Payroll > Maintenance > School YTD DataThis page is used to access and maintain the payroll year-to-date totals for individual employees including accrual data and accrued days worked by job code. The page is divided into three data groups: Payroll Data, Accrued Data, and Workers' Comp Data. Although the fields are populated as payroll is processed, you can change school YTD records.

Under Accrued Data, all fields are display-only and display the total accrued amount for the specified school year. You can make adjustments to the accrual amounts by using the Zero School YTD Accruals utility, the Payroll Accrual Variance Extract utility, voiding a check, or issuing a check.

The Accrued Data by Job section consists of a grid and a free-form area. The grid shows multiple records. If the employee had any jobs that accrued, the accrual days calculated for each job are displayed. Click

to view the job details.

to view the job details.

- Update posting defaults.

Finance > Tables > District Finance Options > Clearing Fund MaintenanceVerify that the Payroll Automatic Posting Defaults are entered.

Balancing Accruals Monthly

This process will ensure that monthly accruals are booked accurately and consistently in Payroll and Finance. It is critical that these two areas balance to accomplish accurate grant reporting.

It is recommended that you balance your accruals monthly so that any errors are identified and resolved.

| ❏ | 1. Finance > Tables > District Finance Options > Clearing Fund Maintenance Print the clearing fund maintenance table. |

|---|---|

| ❏ | 2. Finance > Inquiry > General Ledger Inquiry > General Ledger Account Summary Print the following object codes:

Accrued Wages 2161 (refer to print from Step 1 for correct code) |

| ❏ | 3. Payroll > Reports > Year to Date Reports > HRS3050 – School Year to Date Report

Verify the School Year (YYYY) parameter has the correct year. |

| ❏ | 4. Compare the amounts from each General Ledger Summary (from Step 2) to the totals on the HRS3050 report. Keep in mind that all processed payrolls need to be interfaced to Finance in order for the reports to match. |

TIP: It is recommended that you compare the Finance report totals to the HRS3050 - School Year to Date Report totals on a monthly basis to verify the accruals and the associated accrual benefit accounts.

Correcting Accruals

How do accruals get out of balance?

- Adding and/or removing the employee’s Accrual Code throughout the year. Once an employee begins accruing, the accrual code should NOT be removed, even for early payoff.

- The TRS Year checkbox was incorrectly selected/unselected causing the accruals to apply to the incorrect school year in Payroll.

- The Total Days Worked in the Accrual Calendar for the month of August does not match the number of days that were actually used in the August Accrual process.

- The Accrual Rate does not match the current Daily Rate.

- The Daily Rate used in the August Accrual process does not match the current Accrual Rate.

- The Contract Total was changed on the Job Info tab at some point during the year.

- The employee started late in the year and the Days Earned was not adjusted.

- The Job Code was changed on the Job Info tab. Since accruals are tied to the job code, there may be a possibility of the Accrual Code being removed from the Job Info tab as part of this change.

- The employee is assigned to the incorrect Accrual Calendar - Total Days Worked in the calendar does not match the employee’s total days worked for the school year.

- The employee was not included in the August Accrual process.

Note: Before making any corrections, the LEA should check and make sure the auditor did not make August accrual entries as audit entries. If they made August audit entries, you would not want to expense again in the current year.

How do you correct accruals?

There are 4 different ways to correct accruals:

- Days Earned field on the Absence Deduction tab – an employee starts late in the school year or when a replacement check is issued for an accrued employee.

- Payroll Accrual Variance Extract – process often to check accruals for accuracy

- Zero School YTD Accruals – utility to zero accruals for both active and inactive or terminated employees

- Special Adjustments – move accruals to another job code and/or fund code

Payroll > Maintenance > Hours/Pay Transmittals > Abs Ded

The Days Earned field can be used to correct the number of days an employee should accrue for the specified pay date and overrides the number of days on the accrual calendar for the same pay date. To calculate the adjustment to days worked for an employee, add the days in the accrual calendar to which the employee is assigned beginning with the pay date the employee will receive their first paycheck through the end of year. Compare this number of days to the actual number of days the employee will work for the year. The difference will then be added or subtracted, whichever is necessary, to the days in the accrual calendar for the pay date of his first paycheck. The resulting number of days will be entered in the Days Earned field for the pay date of his first paycheck.

Use this field when an employee starts late in the school year or when you are reissuing a paycheck to an accrued employee.

Payroll > Utilities > Payroll Accrual Variance Extract

The Extract tab is used to select an individual or group of employees and calculate the proposed accrual calculations for the remainder of the unprocessed pay dates from the pay dates table to show employees/accounts that may be over- or under-accrued. The purpose of this feature is to assist you in verifying your data and making corrections to the employee Staff Job/Pay Data or Accrual Calendar, as needed. The purpose of the extract is to provide an accurate view of the proposed accrual calculations at this moment in time. Therefore, all unprocessed absence deductions and coded absence deduction transmittals are used in calculating the future amounts for the accruals. Any amounts entered in the Days Earned column of the absence deduction transmittal override the days earned from the Accrual Calendar table for that pay date. Unprocessed leave transmittals that result in dock amounts for the employee are also considered.

Requirements for accurate calculations:

- The Accrual Rate on the Job Info tab must be correct.

- The Accrual Code on the Job info tab must match an accrual code in the Accrual Calendar.

- The Accrual Calendar must have Pay Dates that match the dates in the pay dates table.

- The Accrual Calendar must also have the accurate number of Total Days Worked.

- The Payoff Date on contract jobs (Pay Type 1 and 2) should be correct and should exist in the pay dates table.

- All future pay dates for the school year must exist on the pay dates table.

- No future supplemental (non regular payroll) pay dates should exist on the pay dates table.

Only employees that are active and currently have a job that accrues are displayed. If an employee has multiple jobs, only the jobs that are selected to accrue are calculated, and each job is listed separately. The Accrual Calendar table and the pay dates table must be completed for all school year pay dates. When performing calculations, the system uses the accrual calendar, the pay dates table, the pay distribution history, the master distribution records, and the Accrual Expense table.

Employees in payoff will usually appear on the accrual variance report, but you can disregard them. Do not include them in this process when posting the process to payroll and finance.

This extract process can be performed as often as necessary to review the status of employee accruals and to confirm employee accruals are correct. At the very least, this extract should be processed before the September payroll and after the May payroll. It is highly recommended that a limited number of employees be selected for calculation as it takes some time to process the information and provide a report.

Note: Resolve the following payroll calculation error message for all employees prior to running the accrual variance extract: “Warning: School YTD Job record exists with accrual amounts for job: XXXX which does not exist in the employee’s job master. This situation will cause a FAILURE message upon payoff.” Use special adjustments or Zero SYTD Accruals utility to fix this issue for an accrued employee.

CAUTION: If no pay dates have been processed for the school year, only pay dates that are greater than or equal to the first pay date of the school year in HR Options are considered. If pay dates have been processed for the school year, only unprocessed pay dates that are greater than the last processed pay date are considered. For example, if there is an unprocessed pay date for May 25 and a processed pay date for May 26, the May 25 pay date is not considered for the variance calculations.

Americans with Disabilities Act (ADA) and Web Accessibility

The Texas Computer Cooperative (TCC) is committed to making its websites accessible to all users. It is TCC policy to ensure that new and updated content complies with Web Content Accessibility Guidelines (WCAG) 2.0 Level AA. We welcome comments and suggestions to improve the accessibility of our websites. If the format of any material on our website interferes with your ability to access the information, use this form to leave a comment about the accessibility of our website.