User Tools

Sidebar

Add this page to your book

Remove this page from your book

(If necessary) Calculate TRS On-Behalf

Log on to the CYR payroll frequency.

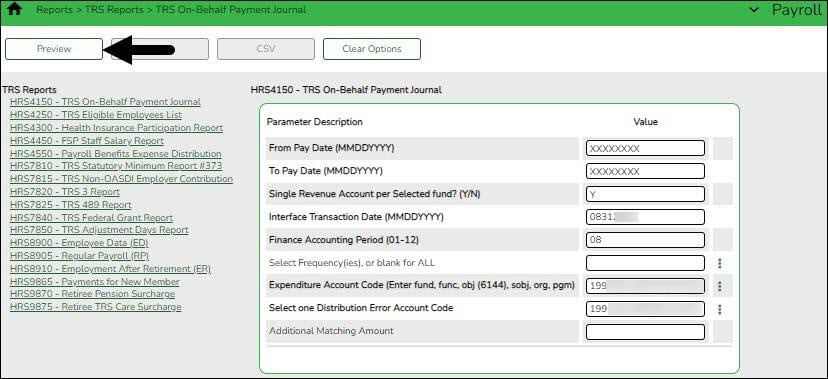

Payroll > Reports > TRS Reports > HRS4150 - TRS On-Behalf Payment Journal

If you do not post your TRS On-Behalf on a monthly basis:

- Calculate your TRS On-Behalf for the year.

- Verify On-Behalf revenue and expenditures are posted for 12 months.

This report must be processed and interfaced after the TRS 373 Stat. Min. report is interfaced to Finance.

Generate the HRS4150 - TRS On-Behalf Payment Journal report to calculate the TRS On-Behalf payments, create a journal, and interface the amounts to Finance.

❏ Enter the necessary parameters and generate the report.

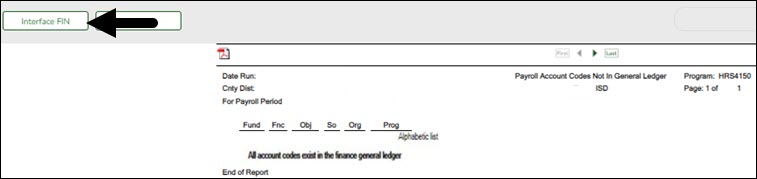

❏ Click Interface to Finance. The following message is displayed.

❏ Click OK.

These are just suggested codes, review your general ledger to verify what codes have been budgeted. It is acceptable under GASB Statement No. 24 for ALL of the “On-Behalf” payments to be charged to the general fund by function. Reference Item 5 section 1.3.3.2 of the Financial Accountability System Resource Guide (FASRG).

Americans with Disabilities Act (ADA) and Web Accessibility

The Texas Computer Cooperative (TCC) is committed to making its websites accessible to all users. It is TCC policy to ensure that new and updated content complies with Web Content Accessibility Guidelines (WCAG) 2.0 Level AA. We welcome comments and suggestions to improve the accessibility of our websites. If the format of any material on our website interferes with your ability to access the information, use this form to leave a comment about the accessibility of our website.