Sidebar

Add this page to your book

Remove this page from your book

Notes:

- If an 11-month employee is listed with 2019 accruals, zero the accruals. If an 11-month employee is listed with 2020 accruals, do not clear the accruals.

- If new employees are set to receive 13 checks in the 2019-2020 school year with their first check paid in August, review whether the pay is posted to accruals or the expense account. If the pay is posted to accruals, perform the Zero School YTD utility to record it to the expense account.

❏ Review and reconcile each employee’s accrual balances from your School Year to Date detail report.

❏ Verify each employee was correctly paid.

❏ Use the Payroll > Utilities > Zero School YTD Accruals page to clear the accrual balances in the current pay file.

- Perform the extract.

Payroll > Utilities > Zero School YTD Accruals > Extract❏ Retrieve employees.

❏ Use the arrow buttons to move the applicable employees from the left side to the right side of the page.

❏ Click Run. If there any errors are encountered during the extract, the Zero School YTD Accruals Errors report is displayed. Review the report and correct any errors. If there are no errors, the Zero School YTD Accruals Extract report is displayed.

❏ Click Close to close the report. - Print reports from the Reports tab.

Payroll > Utilities > Zero School YTD Accruals > Reports

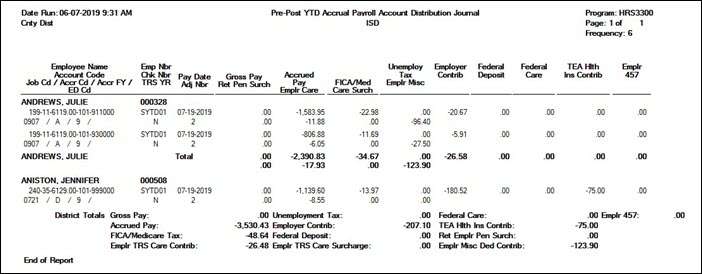

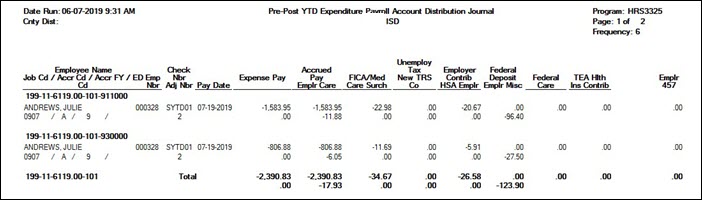

Review the following reports:

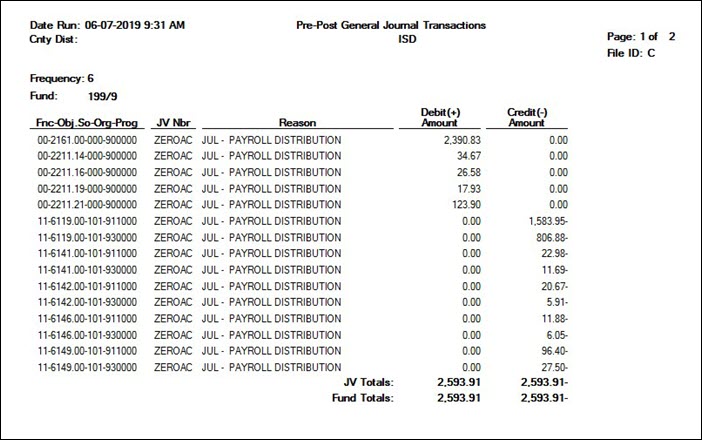

- Post to Master and Interface to Finance using the Post to Master/Interface to Finance tab.

Payroll > Utilities > Zero School YTD Accruals > Post to Master/Interface to Finance

❏ Select Post to Master and Interface to Finance.

❏ Type a Transaction Date.

❏ Select the posting accounting period.

❏ Click Post. You are prompted to create a backup. A message is displayed indicating that the general journal transactions were interfaced to Finance successfully.

❏ Click OK. A message is displayed indicating that the post to master process was completed successfully.Click OK to close the message box.

- Make a backup and save in the EOY Accruals folder.

When the school YTD accruals are zero, any accrual amounts are sent back to the fund. If this is the case, consult with the business manager before interfacing.

Reprint the Payroll > Reports > Year To Date Reports > HRS3050 - School Year To Date Report to verify that the accruals were cleared. ALL accrual fields should be zero. Save this as the last report prior to performing the EOY payroll accrual process.

Americans with Disabilities Act (ADA) and Web Accessibility

The Texas Computer Cooperative (TCC) is committed to making its websites accessible to all users. It is TCC policy to ensure that new and updated content complies with Web Content Accessibility Guidelines (WCAG) 2.0 Level AA. We welcome comments and suggestions to improve the accessibility of our websites. If the format of any material on our website interferes with your ability to access the information, use this form to leave a comment about the accessibility of our website.