User Tools

Sidebar

Add this page to your book

Remove this page from your book

(For LEAs that accrue monthly) Balance accruals in Finance and Payroll

If your LEA accrues monthly, complete the following steps to verify the accurate posting of monthly accruals in both Finance and Payroll. It is critical that both areas agree to ensure accurate reporting of federal funds.

It is recommended that you balance accruals during the end-of-month Finance process to quickly identify and rectify errors.

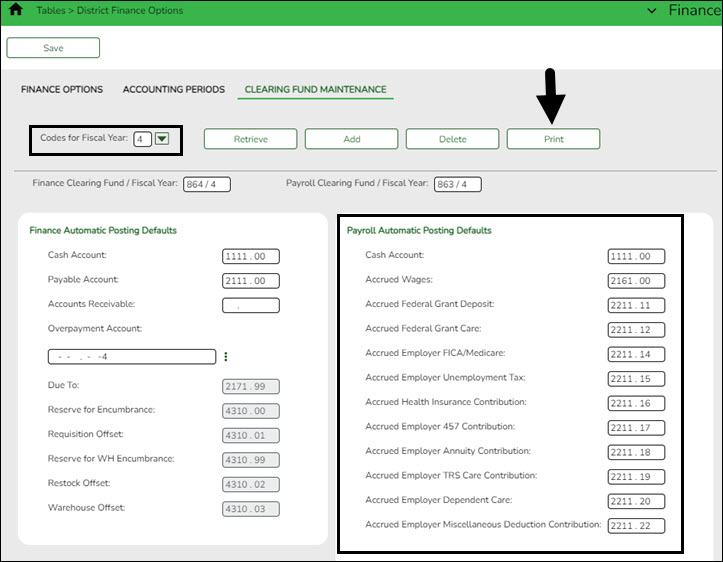

Finance > Tables > District Finance Options > Clearing Fund Maintenance

Note: Object codes at your LEA may differ as this is a sample screenshot.

❏ Click Print to print the table. You can reference this information each month as the table is rarely updated during the year.

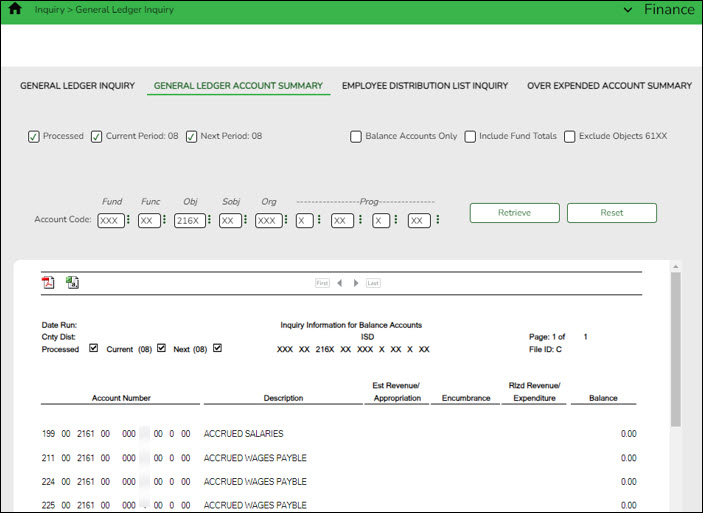

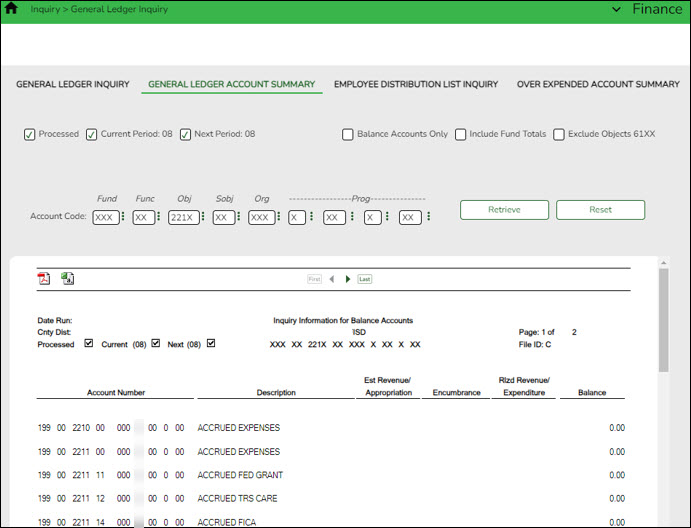

Finance > Inquiry > General Ledger Inquiry > General Ledger Account Summary

Run and print an inquiry for object code 216X (accrued wages).

Run and print an inquiry for object code 221X and each sub-object listed in the Clearing Fund Maintenance table (printed above (accrued benefits)). It is recommended that you print each sub-object separately to simplify the balancing process. The screenshot shows multiple sub-objects to save space.

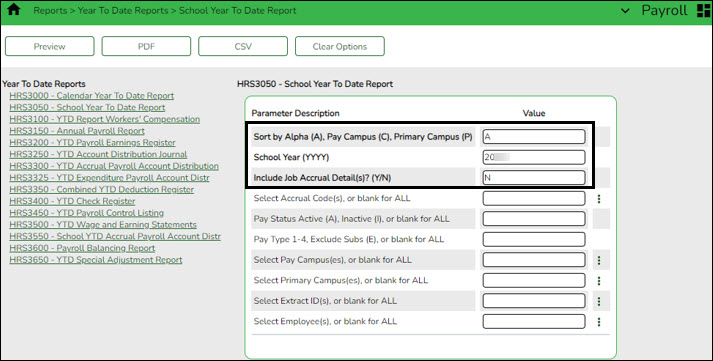

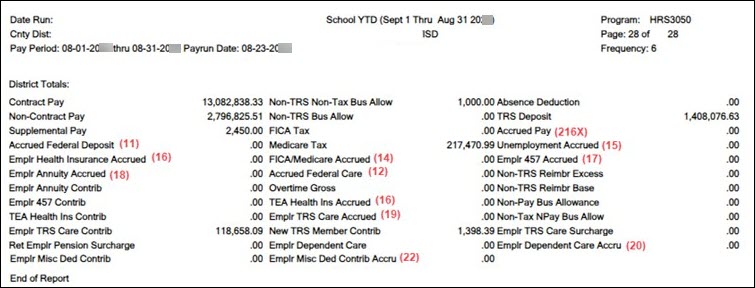

Payroll > Reports > Year To Date Reports > HRS3050 - School Year To Date Report

Generate the report with the following parameters:

Print or save only the last page of the report.

Note: The numbers in parentheses are the sub-objects that will be compared to the General Ledger Inquiry report in the following step.

Compare the HRS3050 report totals to the General Ledger Inquiry reports.

| General Ledger Inquiry Report | School YTD Report | Expenditure Object Code |

| 216X | Accrued Pay | 6119 or 6129 |

| 221X.11 | Accrued Federal Deposit | 6146 |

| 221X.12 | Accrued Federal Care | 6146 |

| 221X.14 | FICA/Medicare Accrued | 6141 |

| 221X.15 | Unemployment Accrued | 6145 |

| 221X.16 | Emplr Health Insurance Accrued + TEA Health Ins Accrued | 6142 |

| 221X.17 | Emplr 457 Accrued | 6149 |

| 221X.18 | Emplr Annuity Accrued | 6149 |

| 221X.19 | Emplr TRS Care Accrued | 6146 |

| 221X.20 | Emplr Dependent Care Accrued | 6149 |

| 221X.22 | Emplr Misc Ded Contrib Accrued | 6149 |

Assuming that only your 10-month employees accrue, the easiest time to complete accrual balancing is after completing the August payroll but before completing the August accruals. At this time, the amounts displayed on the School Year to Date Report and the General Ledger Inquiry liability accounts (216X and 221X.XX) are typically all zeros. Employees who accrue monthly and receive the first payment of their new contract prior to September will have accruals in Finance and the upcoming School Year to Date Report if the TRS Year field is selected on the Job info tab. These amounts should be considered during the accrual balancing process. Here are five common scenarios to consider.

| Scenario | Accrued amounts from the HRS3050 - School Year To Date Report | Finance General Ledger Accrued Liabilities | Action Needed |

| 1 | Zeros | Zeros | None |

| 2 | Show amounts | Zeros | Run the Zero School YTD Accruals utility in Payroll and Post to Master only |

| 3 | Zeros | Show balances | Compare to upcoming School Year to Date report Add manual entries in Finance as needed |

| 4 | Show amounts that match GL | Show amounts that match School Year to Date | Compare to upcoming School Year to Date report Run the Zero School YTD Accruals utility in Payroll and Post to Master and Interface to Finance if needed |

| 5 | Show amounts but DO NOT match GL | Show amounts but DO NOT match School Year to Date | Compare to upcoming School Year to Date report Run the Zero School YTD Accruals utility in Payroll and Post to Master Consider Interface to Finance and manual entries in Finance if needed |

Review the following scenarios, choose the best fit, then follow the appropriate steps.

Scenario 1: The current School Year to Date Report shows zeros for accrued totals and the liability accounts in Finance are zero.

Action: No action required.

Scenario 2: The current School Year to Date Report shows amounts for accrued totals but the liability accounts in Finance are zero.

Action: In the current year payroll frequency, zero the amounts in Payroll. Post to Master but DO NOT Interface to Finance.

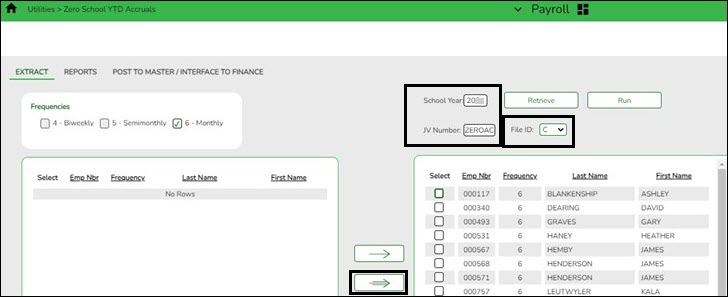

Payroll > Utilities > Zero School YTD Accruals > Extract

❏ Verify the School Year field and click Retrieve.

❏ In the JV Number field, type ZEROAC.

❏ Verify that the File ID field is C.

❏ Employees with School YTD accruals that were not cleared during payoff are displayed on the left side of the page. Use the arrows to move the employees to the right side of the page.

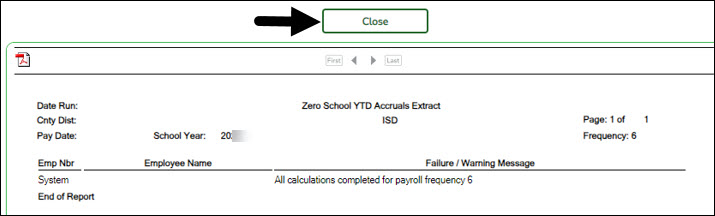

❏ Click Run. The Zero School YTD Accruals Extract report is displayed.

If the process is successful, close the Extract report.

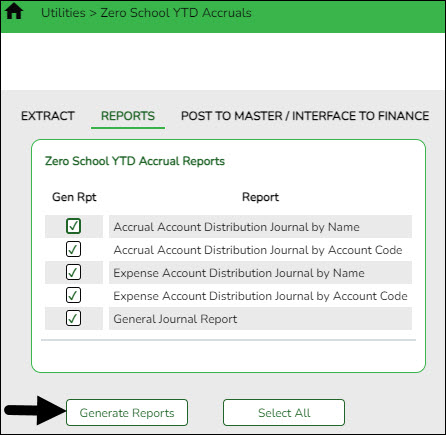

Payroll > Utilities > Zero School YTD Accruals > Reports

Generate and save the reports as needed.

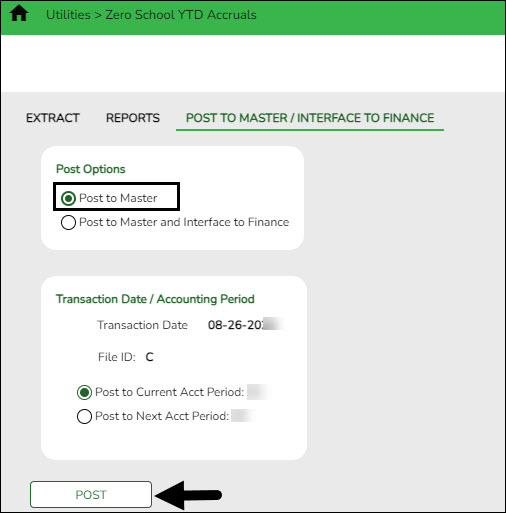

Payroll > Utilities > Zero School YTD Accruals > Post to Master/Interface to Finance

❏ Under Post Options, select Post to Master.

❏ Click Post.

Scenario 3: The current School Year to Date Report shows zeros for accrued totals but the liability accounts in Finance have balances.

Action: Generate the School Year to Date Report for the upcoming school year.

- If these amounts match Finance, no action needed.

- If these amounts do not match in Finance, enter a JV on the Finance > Postings > Journal Actual tab to match the School Year to Date amounts.

Refer to the above chart to see the expenditure object that ties to each liability. For example, if the accrued FICA/Medicare liability line (object 221X.14) shows a balance of -

$158.56, you will need to debit a payroll expenditure account with an object code of 6141.

Scenario 4: The current School Year to Date Report shows amounts for accrued totals and the liability accounts in Finance have matching amounts.

Action: In the current year payroll frequency, use the Payroll > Utilities > Zero School YTD Accruals utility to zero the amounts in Payroll and Interface to Finance so that both are zeroed at the same time.

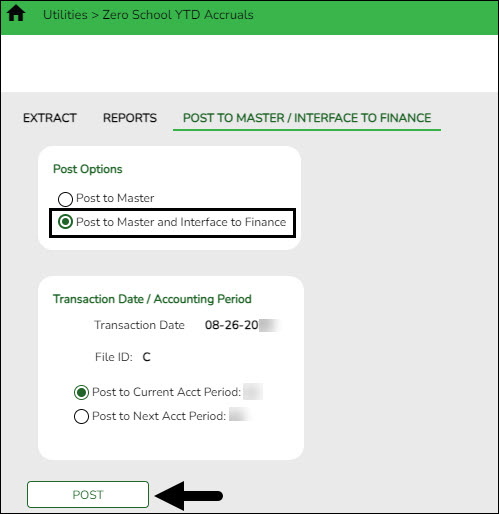

Complete the same steps listed in Scenario 2 EXCEPT on the Post to Master/Interface to Finance tab:

❏ Select Post to Master and Interface to Finance.

❏ Enter a Transaction Date.

❏ Select the desired accounting period.

❏ Click Post.

Scenario 5: The current School Year to Date Report shows amounts for accrued totals and the liability accounts in Finance show amounts but the amounts do not match.

Action: Run the upcoming School YTD report and compare the totals from both School Year to Date reports to Finance. Analyze the report to determine which accrual amounts should remain if any.

In the current year payroll frequency, use Payroll > Utilities > Zero School YTD Accruals to zero the amounts if needed.

Consider whether Interfacing to Finance will correct the liability balances in Finance.

- If yes, select Post to Master and Interface to Finance.

- If no and the differences will be greater, select Post to Master. You may need to manually enter additional JVs on the Finance > Maintenance > Postings > Journal Actual tab to reconcile any remaining differences.

Complete the same steps listed in Scenario 2 and 4 except on the Post to Master/Interface to Finance tab:

❏ Select Post to Master or Post to Master and Interface to Finance as needed. If you interface to Finance:

❏ Enter a Transaction Date.

❏ Select the desired accounting period

❏ Click Post.

Americans with Disabilities Act (ADA) and Web Accessibility

The Texas Computer Cooperative (TCC) is committed to making its websites accessible to all users. It is TCC policy to ensure that new and updated content complies with Web Content Accessibility Guidelines (WCAG) 2.0 Level AA. We welcome comments and suggestions to improve the accessibility of our websites. If the format of any material on our website interferes with your ability to access the information, use this form to leave a comment about the accessibility of our website.