Sidebar

Add this page to your book

Remove this page from your book

Move Budget to Finance

Log on to file ID C.

Finance > Utilities > Fiscal Year Processing > Move Budget To Finance OR Budget > Utilities > Move Budget To Finance

Once the next year budget is approved and in the Approved column, the Budget is ready to be moved to Finance.

❏ Click here if you need to copy Budget from the Recommended level to the Approved level.

❏ It is important to address account locks prior to moving Budget to Finance.

- Use the Maintenance > Budget Data or Budget Data - Quick Entry pages to review account locks.

- Use the Budget > Utilities > Mass Lock/Unlock Funds page to unlock funds.

Use one of the following to ensure accuracy:

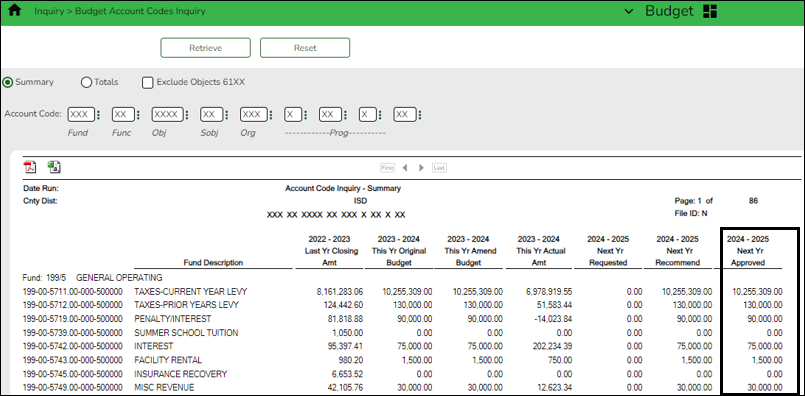

❏ Run an inquiry on the Budget > Inquiry > Budget Account Codes Inquiry page and compare the Next Year Approved column to the board-approved budget.

❏ Generate the BUD2050 - Budget Board Report by Function report and compare it to the board-approved budget.

❏ It is recommended that the federal fund budget is verified with the NOGA/Grant application.

❏ All federal and state grant funds should be in balance (estimated revenues = appropriations).

When data is moved from Budget to Finance, the following occurs:

- The JV Number Description field is populated with MOVE BUDGET TO FINANCE.

- The Reason field is populated with OPENING ENTRY.

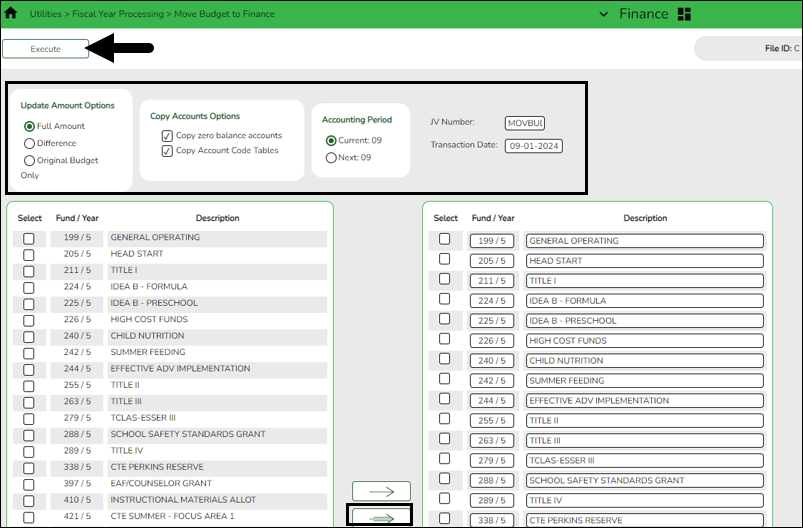

Under Update Amount Options:

| Full Amount | Select if you are moving your budget to Finance for the first time. If Capture Original Budget Flag is selected on the Tables > District Budget Options page, Finance is populated with the original budget. The estimated revenues, appropriations, and if necessary, a 3XXX balancing account are updated/created each time this option is performed. If an account has an existing balance in Finance, the Budget amount is added to the existing balance (e.g., an existing account has a $1000.00 balance, and the Budget amount is $1500.00; the Budget amount is added to the balance to equal $2500.00). |

|---|

Other options include:

| Difference |

Select if an account has an existing balance in Finance, the difference between the Budget amount and the existing balance is added to the account (e.g., an existing account has a $1000.00 balance, and the Budget account is $1500.00; only $500.00 is added to make it $1500.00, or if Finance has $1500.00 and Budget has $500.00, $1000.00 is subtracted to make it $500.00). If Capture Original Budget Flag is selected on the Tables > District Budget Options page, Finance is populated with the original budget. The Estimated Revenues, Appropriations, and if necessary, a 3XXX balancing account is updated/created each time this option is performed. |

|---|---|

| Original Budget Only |

Select to allow to capture the original budget. No other columns in the Finance general ledger are updated, and no transactions are inserted. If the account does not exist in the general ledger, it is created. When this option is used, Capture Original Budget Flag on the Tables > District Budget Options page is ignored. If an account has an existing original budget amount in Finance, the Budget amount is added to the existing original budget amount (e.g., an existing account has a $1000.00 balance, and the Budget amount is $1500.00; the Budget amount is added to the original budget amount to make it $2500.00). |

If you need to run the utility again, contact your regional ESC consultant before continuing with the process.

A warning message is displayed with a preview of the accounts informing you that account codes with balances exist in Finance.

❏ Under Copy Account Options, select the following option to ensure that any new account component is available in Finance. If there is a missing account code component, Finance will not update the budget. If you select Copy zero balance accounts, general ledger accounts that do not have a value in the Approved Budget column are created.

| Copy Account Code Tables |

Select to add this account code table to the existing Finance account code table for all funds, functions, objects, etc. that do not exist in the current Finance account code table. If accounts do exist in the current Finance account code table and changes were made to the descriptions, the existing description in the Finance account codes are replaced. Note: If you manually added the new account codes to the Finance account code table, this option does not need to be selected. However, if the account codes do not exist in the current Finance account code table and this option is not selected, database errors may occur. |

|---|

❏ Select one of the following Accounting Period options:

- If Current Accounting Period Close is not selected on the Finance > Tables > District Finance Options > Accounting Periods tab, Current is selected.

- If Current Accounting Period Close is selected on the Tables > District Finance Options > Accounting Periods tab, Next is selected.

| JV Number | Set to 999999 by default but can be changed. Type an alphanumeric journal voucher number. If a duplicate journal voucher number other than 999999 is entered, an error message is displayed. If a duplicate journal voucher number other than 999999 is typed, an error message is displayed. This field is required. |

|---|---|

| Transaction Date | Defaults to the system date but can be changed. Type 09-01-20XX for standard fiscal year LEAs. Type 07-01-20XX for early start LEAs. This field is required. |

❏ Select the current fund/years. Use the arrow buttons to move the selected fund/years from the left side to the right side of the page.

❏ Click Execute to move the budget funds to the Finance general ledger. If performing this process in Budget, you are prompted to create a backup (export).

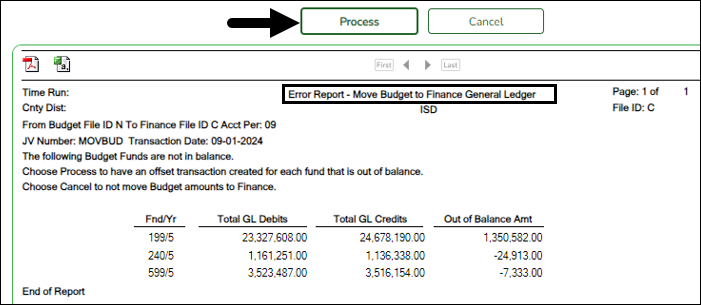

Review the error report, if available.

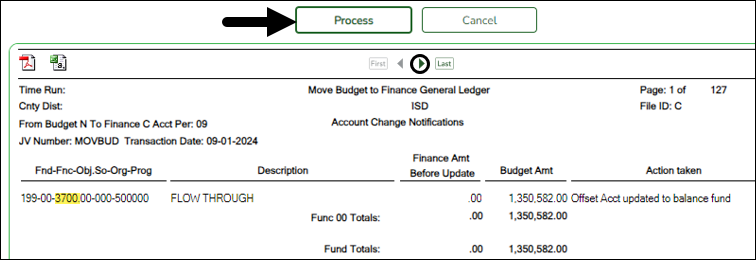

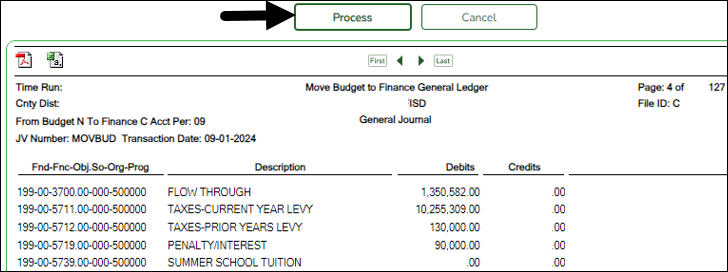

If an error report is not displayed or if Process is clicked on the error report (for out-of-balance), the following reports are displayed:

Note: The first report displays the account changes (i.e., fund balance entries) and the second report displays the budget data.

- While users may manually enter fund balances, Account Change Notifications are produced if a fund being moved is not in balance (e.g., Estimated Revenues + Other Resources does not equal Appropriations + Other Uses). The journal voucher number and the transaction date are displayed in the report header. If the budget is not in balance, the move can still be processed. The difference is automatically entered in the Budgetary Fund Balance, or you can cancel the move and correct the budget. All federal and state grant funds should be in balance (estimated revenues = appropriations).

A general journal is produced if any accounts are updated for Finance. The journal voucher number and the transaction date are displayed in the report header.

❏ Click Process to post the selected accounts to the Finance general ledger. Either the estimated revenues, appropriations, or balance columns are updated based on the account class and the accounting period.

A message is displayed indicating that the Move Budget to Finance process was completed successfully.

❏ Click OK.

Americans with Disabilities Act (ADA) and Web Accessibility

The Texas Computer Cooperative (TCC) is committed to making its websites accessible to all users. It is TCC policy to ensure that new and updated content complies with Web Content Accessibility Guidelines (WCAG) 2.0 Level AA. We welcome comments and suggestions to improve the accessibility of our websites. If the format of any material on our website interferes with your ability to access the information, use this form to leave a comment about the accessibility of our website.