User Tools

Sidebar

Add this page to your book

Remove this page from your book

Verify/update Finance options

Log on to file ID C.

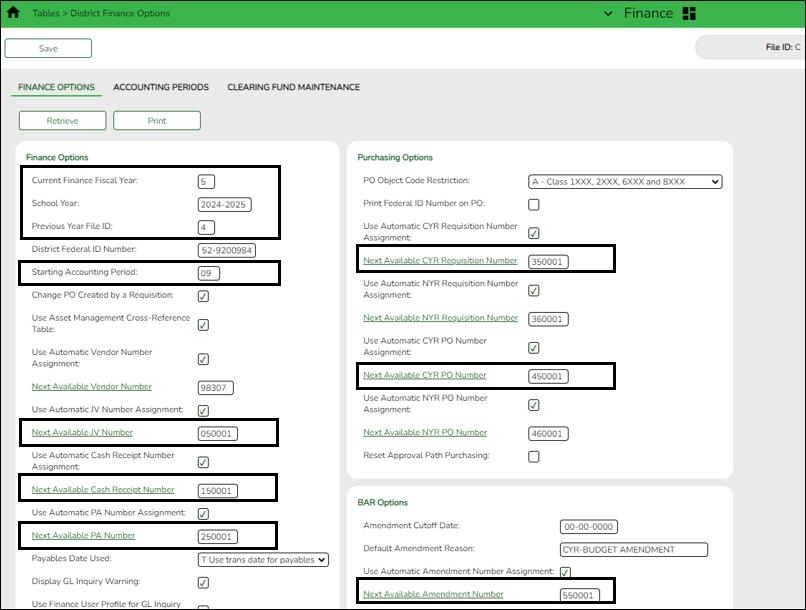

Finance > Tables > District Finance Options > Finance Options

Verify that the data is accurate for the new fiscal year and update the fields as needed.

❏ Under Finance Options, ensure that the following fields reflect data for the new school year:

- Current Finance Fiscal Year

- Previous Year File ID

- School Year and Starting Accounting Period - These fields should be automatically updated after the Fiscal Year Close utility is processed. The starting accounting period should be either 07 for June year-end LEAs or 09 for August year-end LEAs.

IMPORTANT: If the School Year and Starting Accounting Period fields were not automatically updated, contact your regional ESC consultant for further assistance.

While on this page, you can also update your next available numbers under Finance, Purchasing, and BAR if you choose to.

- It is recommended that you incorporate the year in the next available number sequences. In this example, for fiscal year 2024-2025, 5 is the second digit in the next available numbers.

- Do not update the Next Available Vendor Number as this number should remain in the same sequence from the prior year(s).

Notes:

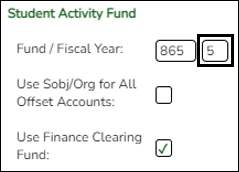

- If applicable, update the Student Activity Fund/Year field.

- If your LEA has started using the revenue and expenditure codes for the Student Activity Fund, then this section should be blank.

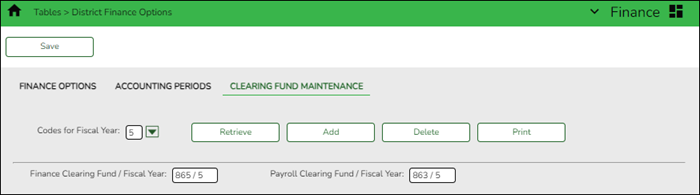

Finance > Tables > District Finance Options > Clearing Fund Maintenance

Update the Finance and Payroll Clearing Fund/Fiscal Year fields. Be sure to verify your offset accounts for the new fiscal year.

Verify that the data is accurate for the new fiscal year and update the fields as needed.

IMPORTANT: Some LEAs may have old data for fiscal year 5; therefore, it is required to complete the following steps to ensure that you are creating a new fiscal year 5 record.

❏ In the Codes for Fiscal Year field, select 5 and click Retrieve. If data exists for fiscal year 5, it is displayed.

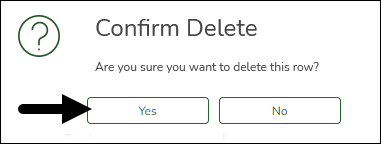

❏ Click Delete. The following message is displayed.

- Click Yes to continue.

- Click Save to save the changes.

- Click Add to create the 5 fiscal year record and complete the following fields:

- In the Finance Clearing Fund/Fiscal Year field, type the applicable fund (e.g., 164/5, 864/5, etc.) according to your LEA.

- In the Payroll Clearing Fund/Fiscal Year field, type the applicable fund (e.g., 163/5, 863/5, etc.) according to your LEA.

Review and complete the other fields on the page as needed.

The fiscal year value is automatically populated in the Overpayment Account field.

❏ Click Save.

Review the fields under Payroll Automatic Posting Defaults to ensure that all fields are correctly populated.

Americans with Disabilities Act (ADA) and Web Accessibility

The Texas Computer Cooperative (TCC) is committed to making its websites accessible to all users. It is TCC policy to ensure that new and updated content complies with Web Content Accessibility Guidelines (WCAG) 2.0 Level AA. We welcome comments and suggestions to improve the accessibility of our websites. If the format of any material on our website interferes with your ability to access the information, use this form to leave a comment about the accessibility of our website.