User Tools

Sidebar

Add this page to your book

Remove this page from your book

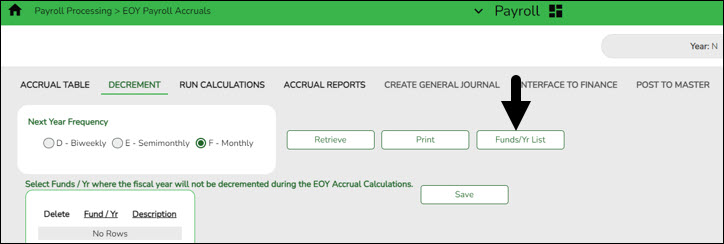

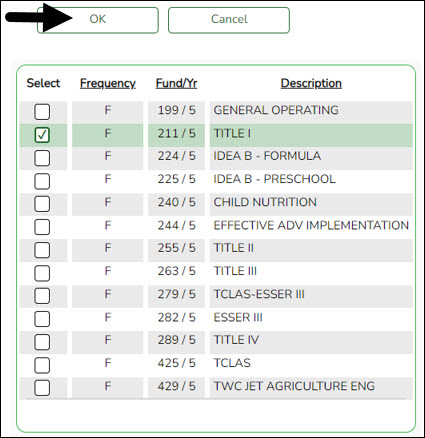

Note: The system default is to decrement (subtract by one) the fiscal year in the account distribution code in the next year payroll files. If you do not want to decrement a Fund activity, then the fund must be added to this tab to prevent it from being decremented. For example, if your LEA needs the August accruals for federal funds to be posted to the new fund/yr, then that fund/yr should be added to this tab.

❏ Under Next Year Frequency, select one of the following payroll frequencies:

- D - Biweekly

- E - Semimonthly

- F - Monthly

Notes:

- If the user is not authorized to access a payroll frequency, it is disabled.

- Only one payroll frequency can be selected at a time.

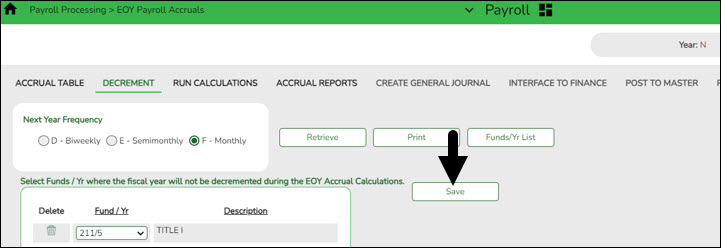

❏ Click +Add to manually add fund/yrs.

❏ Click Save.

Americans with Disabilities Act (ADA) and Web Accessibility

The Texas Computer Cooperative (TCC) is committed to making its websites accessible to all users. It is TCC policy to ensure that new and updated content complies with Web Content Accessibility Guidelines (WCAG) 2.0 Level AA. We welcome comments and suggestions to improve the accessibility of our websites. If the format of any material on our website interferes with your ability to access the information, use this form to leave a comment about the accessibility of our website.