User Tools

Sidebar

Add this page to your book

Remove this page from your book

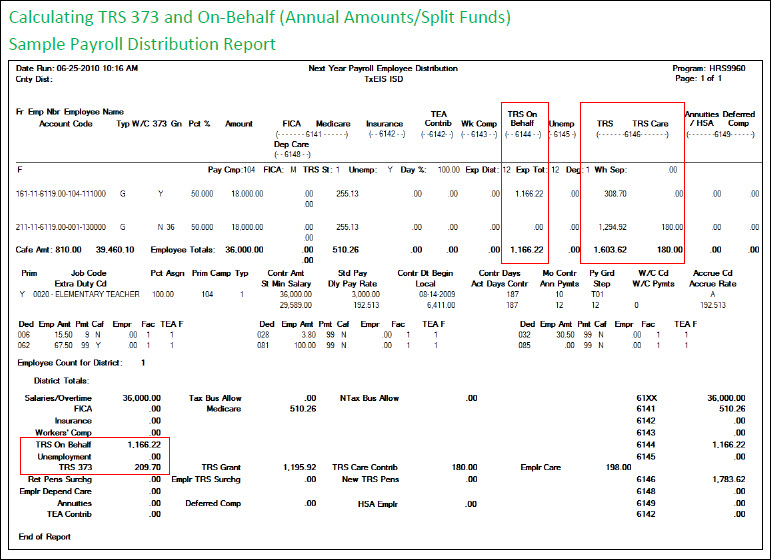

Calculating TRS 373 and On-Behalf (Annual Amounts/Split Funds)

The following calculations are based on annual amounts and split-fund (general/federal funds with a grant code) distributions. These calculations should be used to verify the TRS 373* and On-Behalf** amounts on the Next Year Interface Budget Reports. These reports are created through the Interface NY Payroll to NY Budget Extract Reports. TRS 373 and TRS On-Behalf should not calculate for federally funded employees with a grant code. However, the TRS 373 amount for the federal fund is calculated and used for the TRS On-Behalf calculation of the general fund.

Some of the images and/or examples provided in this document are for informational purposes only and may not completely represent your LEA’s process.

Adjusted State Minimum Calculation

A. State Minimum Salary (as recorded on the Job Info tab) x Fund Percentage = State Minimum Salary by Fund

B. State Minimum Salary by Fund x District CEI Rate = Adjusted State Minimum Salary

| (A) State Minimum Salary | (A) x Fund Percentage | (A) and (B) equals State Minimum Salary by Fund | (B) multiplied by District CEI | (B) Adjusted State Minimum Salary |

| $29,589.00 | 161/50% | = $14,794.50 | x 1.11 | = $16,421.90 |

| 211/50% | = $14,794.50 | x 1.11 | = $16,421.90 | |

| = $32,843.79 |

Adjusted TRS Salary above Adjusted State Minimum Calculation

A. Eligible TRS Salary x Fund Percentage = Annual Eligible TRS Salary by Fund

B. Annual Eligible TRS Salary by Fund - Adjusted State Minimum = Adjusted TRS Salary above Adjusted State Minimum

| (A) Eligible TRS Salary | (A) x Fund Percentage | (A) and (B) equals Annual Eligible TRS Salary by Fund | (B) minus Adjusted State Minimum | (B) Adjusted TRS Salary above Adjusted State Minimum |

| $36,000.00 | 161/50% | = $18,000.00 | - $16,421.90 | = $1,578.11 |

| 211/50% | = $18,000.00 | - $16,421.90 | = $1,578.11 | |

| = $3,156.21 |

TRS 373 District Contribution Calculation

Adjusted TRS Salary above Adjusted State Minimum x TRS 373 District Contribution Percentage (6.644%) = TRS 373 District Contribution

| Adjusted TRS Salary above Adjusted State Minimum | multiplied by TRS 373 District Contribution Percentage(6.644%) | TRS 373 District Contribution |

| $1,578.11 (Fund 161) | x .06644 | = $104.85 (1) |

| $1,578.11 (Fund 211) | x .06644 | = $104.85 (2) |

| = $209.70 |

State Matching Calculation

A. Eligible TRS Salary x Fund Percentage = Annual Eligible TRS Salary by Fund

B. Annual Eligible TRS Salary by Fund x TRS Rates (District 6.644% + TRS-Care 1%) = State Matching

Note: State Matching is not calculated on any fund with a grant code.

| (A) Eligible TRS Salary | (A) x Fund Percentage | (A) and (B) equals Annual Eligible TRS Salary by Fund | (B) multiplied by TRS Rates (District 6.644% + TRS-Care 1%) | (B) State Matching (Fund 161) |

| $36,000.00 | 161/50% | $18,000.00 | x .07644 | = $1,375.92 |

TRS Federal Grant and Care Amount Calculation

A. Eligible TRS Salary x Fund Percentage = Annual Eligible TRS Salary by Fund

B. Annual Eligible TRS Salary by Fund x TRS Rates (Federal 6.644% + TRS-Care 1%) = TRS Federal Grant and Care Amount

| (A) Eligible TRS Salary | (A) x Fund Percentage | (A) and (B) equals Annual Eligible TRS Salary by Fund | (B) multiplied by Federal (6.644%) + TRS-Care (1%) | (B) TRS Federal Grant and Care Amount |

| $36,000.00 | 211/50% | $18,000.00 | x .07644 | = $1,375.92 |

TRS On-Behalf Calculation

State Matching (Fund 161) - TRS 373 District Contribution for General Fund (161) = TRS On-Behalf

| State Matching (Fund 161) | minus TRS 373 District Contribution for General Fund (161) | TRS On-Behalf (Fund 161) |

| $1,375.92 | - $104.85 (1) | = $1,271.07 |

TRS On-Behalf (Fund 161) - TRS 373 District Contribution for the Federal Fund with Grant Code (211) = TRS On-Behalf

| TRS On-Behalf (Fund 161) | minus TRS 373 District Contribution for the Federal Fund with Grant Code (211) | TRS On-Behalf |

| $1,271.07 | - $104.85 (2) | = $1,166.22 |

For additional information regarding TRS 373, go to the TRS website at: www.trs.state.tx.us/employers.jsp?submenu=traqs&page_id=/traqs/payroll_reporting_manual_main.

For additional information regarding TRS On-Behalf, go to the TEA website at: www.tea.state.tx.us/school.finance/audit/resguide12/far/far-91.html#P4151_336554.

Americans with Disabilities Act (ADA) and Web Accessibility

The Texas Computer Cooperative (TCC) is committed to making its websites accessible to all users. It is TCC policy to ensure that new and updated content complies with Web Content Accessibility Guidelines (WCAG) 2.0 Level AA. We welcome comments and suggestions to improve the accessibility of our websites. If the format of any material on our website interferes with your ability to access the information, use this form to leave a comment about the accessibility of our website.