Sidebar

Add this page to your book

Remove this page from your book

Special Adjustment, Percent Example

Some of the images and/or examples provided in this document are for informational purposes only and may not completely represent your LEA’s process.

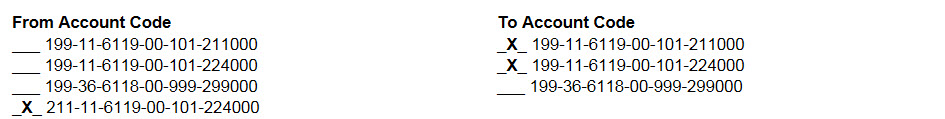

| From Pay Date: 09012001 | To Pay Date: 08302002 |

| From Job Code: 001 - Teacher | To Job Code: 001 - Teacher |

| From Primary Campus: 101 - Elem. | To Primary Campus: 101 - Elem. |

Percent of Account: 30.00%

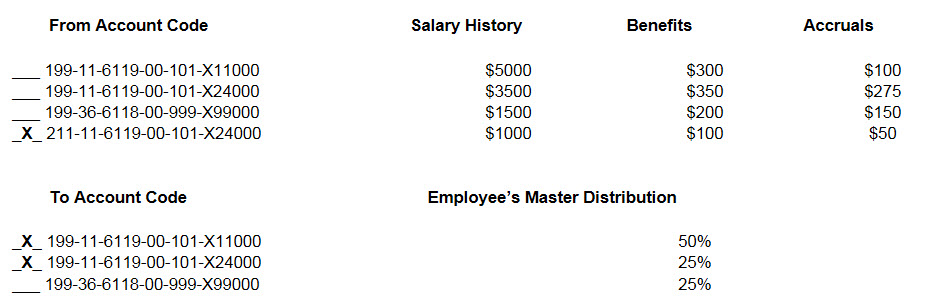

The calculated amount, based on defined percentage, is disbursed among the account codes selected in To Account Code. Disbursement among two or more accounts will then be made according to the percentages in the employee Staff Pay/Job distribution page.

Internal Calculations

50% plus 25% = 75% (what percentage of the whole do 50% and 25% represent?)

50%/75% = 66.666%

25%/75% = 33.334%

From Account Code - 211-11-6119-00-101-X24000 Calc of salary x percentage

(6119) Transaction Pay History = $1,000 x 30% = $300

(614X) Trans Health Benefit History = $100 x 30% = $30

(216X) Transaction Accrual History = $50 x 30% = $15

To Acct Codes 199-11-6119-00-101-X11000 199-11-6119-00-101-X24000

(and associated benefit codes)

| Pay | $300 x 66.666% = $200 (rounded) | $300 x 33.334% = $100 (rounded) |

| Health | $100 x 66.666% = $20 (rounded) | $100 x 33.334% = $10 (rounded) |

| Accruals | $15 X 66.666% = $5 | $50 X 33.334% = $10 |

Americans with Disabilities Act (ADA) and Web Accessibility

The Texas Computer Cooperative (TCC) is committed to making its websites accessible to all users. It is TCC policy to ensure that new and updated content complies with Web Content Accessibility Guidelines (WCAG) 2.0 Level AA. We welcome comments and suggestions to improve the accessibility of our websites. If the format of any material on our website interferes with your ability to access the information, use this form to leave a comment about the accessibility of our website.