Sidebar

Add this page to your book

Remove this page from your book

Verify August EOY payroll accruals

This step applies to LEAs that included non-accrued employees in the EOY payroll accrual process.

❏ If ASCENDER is used for the EOY payroll accruals, verify that the accrual reversal process was completed in September 2024.

Log on to Finance file ID 4.

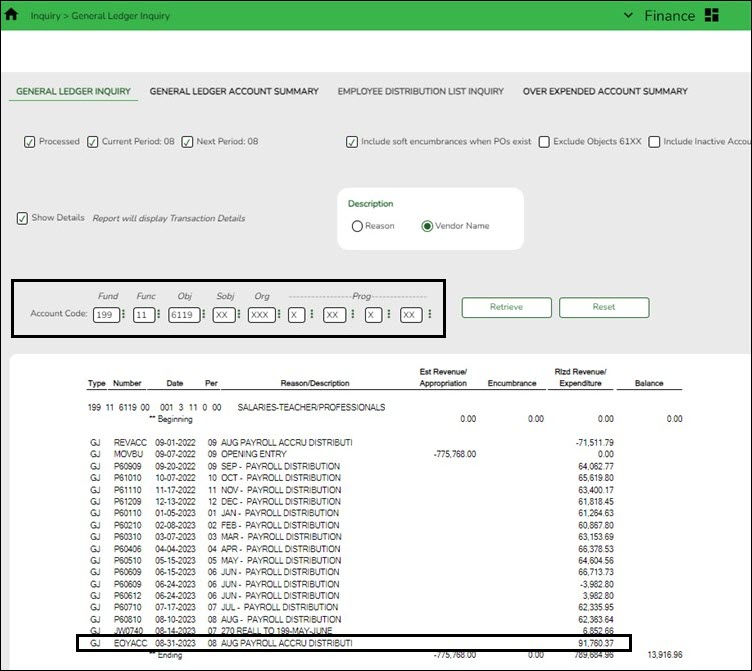

Finance > Inquiry > General Ledger Inquiry > General Ledger Inquiry

- Type 199.11.6119 or 199.00.2161 in the Fund, Function, and Object Code fields.

- Leave all other fields masked (Xs).

- Click Retrieve.

- Verify that “Payroll Accrual” (or an LEA-defined description) with a positive expenditure amount was posted (typically in August 2024).

Log on to Finance file ID C.

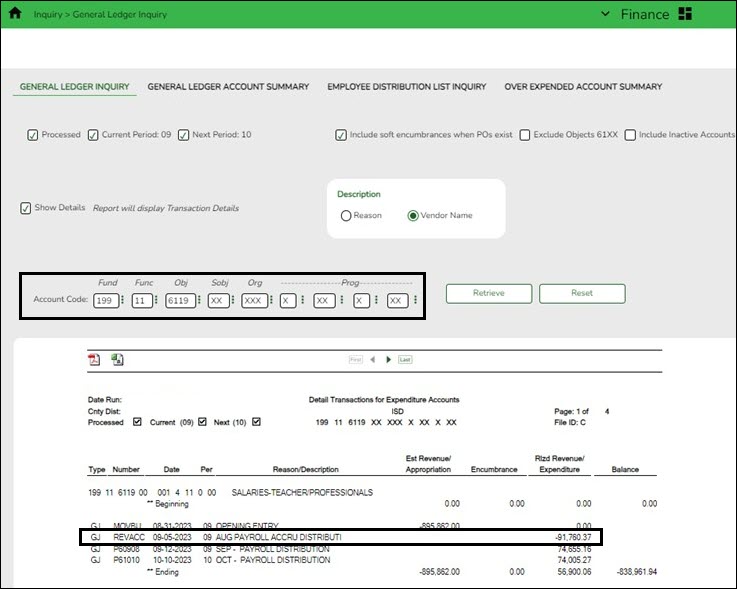

Finance > Inquiry > General Ledger Inquiry > General Ledger Inquiry

- Type 199.11.6119 or 199.00.2161 in the Fund, Function, and Object Code fields.

- Leave all other fields masked (Xs).

- Click Retrieve.

- Verify that “August Payroll Accru” (or an LEA-defined description) reversal entry with a negative expenditure amount was posted (typically in September 2024).

❏ If ASCENDER is not used for the EOY payroll accruals (days worked in August), there is no computer journal entry. Verify that the manual JV entries were posted for EOY payroll accruals.

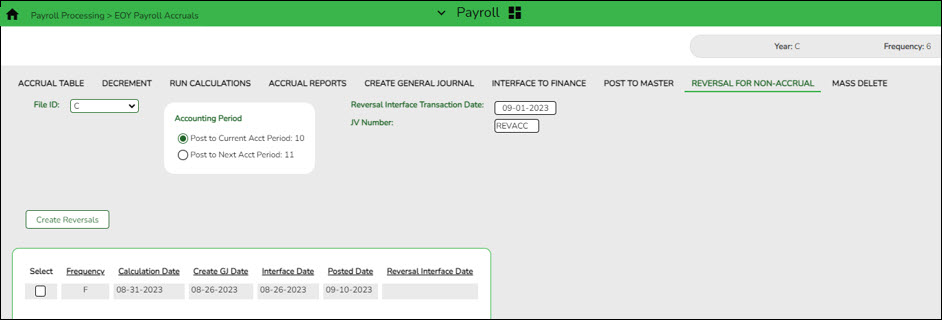

❏ If a reversal entry is not displayed, use the Payroll > Payroll Processing > EOY Payroll Accruals page to complete the process.

Americans with Disabilities Act (ADA) and Web Accessibility

The Texas Computer Cooperative (TCC) is committed to making its websites accessible to all users. It is TCC policy to ensure that new and updated content complies with Web Content Accessibility Guidelines (WCAG) 2.0 Level AA. We welcome comments and suggestions to improve the accessibility of our websites. If the format of any material on our website interferes with your ability to access the information, use this form to leave a comment about the accessibility of our website.