User Tools

Sidebar

Add this page to your book

Remove this page from your book

Copy current year staff to next year

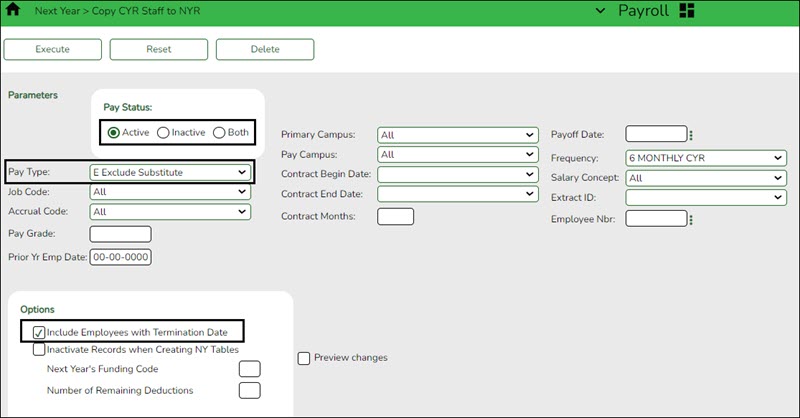

Payroll > Next Year > Copy CYR Staff to NYR

Log on to the current pay frequency.

Copy the employees from the current year payroll to the next year payroll. If you have multiple pay frequencies, complete this task in all pay frequencies.

Reminder: Be aware of where the budget is in terms of the fiscal year.

What happens?

A complete copy of the current employee record is moved to the next year. Employees can be inactivated or activated when copying to the next year and those with termination dates can also be included in the copy process. When copying, you can change the fiscal year in distribution as well as the remaining deductions in the employee master record. If you update the number of remaining deductions, all deductions on the employee Deduction tab are updated to the designated default value. Be careful of deductions that should not be activated for the next year and those that the number of remaining deductions should be different from the default value and perform any necessary cleanup. The Payroll > Utilities > Mass Update tabs can be used to modify remaining payments for deduction codes.

If this process is performed multiple times for employees without deleting their NYR records, the system either updates or inserts distribution records from CYR to NYR and cleanup may be necessary.

Employees in the next year must be active to extract distribution information to Budget. If you do not activate employees when copying to next year, you can activate them when you perform a mass update.

❏ Under Pay Status, select Active to copy only active employees.

❏ In the Pay Type field, select E Exclude Substitute.

❏ Under Options:

- It is recommended to select Include Employees with Termination Date to copy active employees with a termination date on the Personnel > Maintenance > Employment Info tab.

- Do not select Inactivate Records when Creating NY Tables.

- In the Next Year's Funding Code field, type the fiscal year to be used when updating the distribution account code fiscal year in the next year employee master distribution records.

Leave blank if the distribution account code fiscal year in the next year employee master distribution record is to remain the same as the current fiscal year until the next year budget is in place. Then, use the Mass Update utility to update to the correct fiscal year. - It is recommended that the Number of Remaining Deductions is left blank to copy deductions with the number of remaining deductions as they exist in the current pay frequency.

❏ Click Execute. If the process is successful, a preview report is displayed. Review the employee list to verify that the correct data was copied to the next year records. Also, review the total employee count at the end of the report.

❏ Click Process to accept the changes and continue. A message is displayed indicating that the process was completed successfully. In addition, a list of the database record tables that were copied is displayed. Click OK.

❏ Click Cancel to return to the Copy CYR Staff to NYR page without making the changes.

Prior to continuing this process, log on to the next year pay frequency.

Americans with Disabilities Act (ADA) and Web Accessibility

The Texas Computer Cooperative (TCC) is committed to making its websites accessible to all users. It is TCC policy to ensure that new and updated content complies with Web Content Accessibility Guidelines (WCAG) 2.0 Level AA. We welcome comments and suggestions to improve the accessibility of our websites. If the format of any material on our website interferes with your ability to access the information, use this form to leave a comment about the accessibility of our website.