User Tools

Sidebar

Add this page to your book

Remove this page from your book

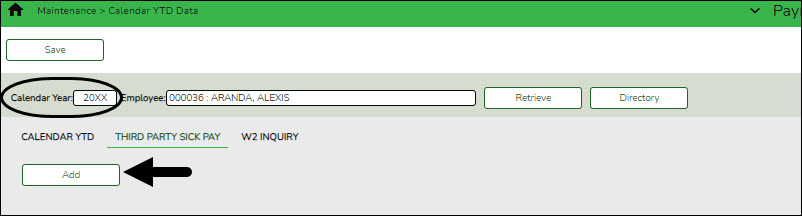

Payroll > Maintenance > Calendar YTD Data > Third Party Sick Pay

Skip this step if you do not use third-party sick pay.

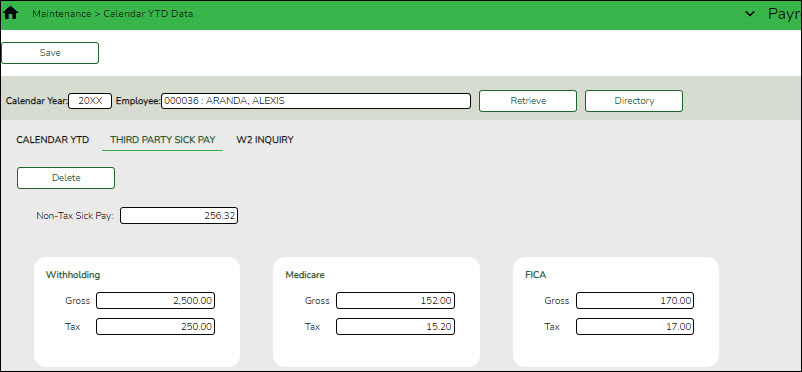

If the employee received sick or disability pay directly from a third party, enter the data from the third-party administrator report.

- Third-party sick pay is displayed in Box 12 - J on the W-2.

- The amounts paid to the employees must be entered on the employee’s W-2 and 941 reporting. If the taxable fields (Withholding, Medicare, and FICA) are populated, the third-party sick pay changes the W-2 totals. Be sure to generate the HRS5100 - W-2 Forms report for updated totals.

- Review IRS Publication 15-A and your LEA’s sick pay policy.

❏ Click Add to display the third-party data fields.

❏ Enter data from the third-party reports in the appropriate fields.

❏ Click Save.

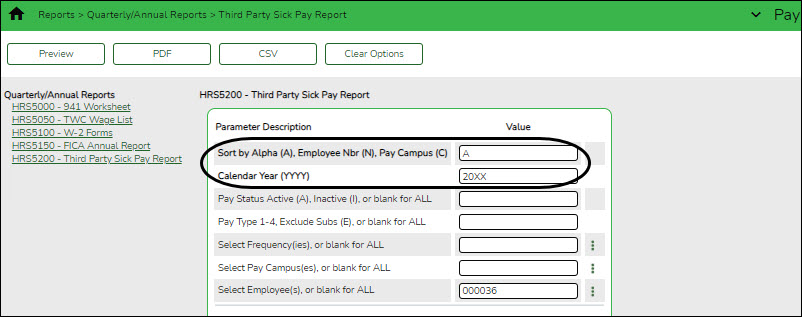

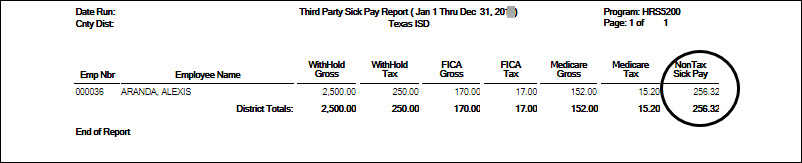

❏ Generate the Payroll > Reports > Quarterly Annual Report > HRS5200 – Third Party Sick Pay Report to verify the third-party sick pay totals against the third party provider statement.

Americans with Disabilities Act (ADA) and Web Accessibility

The Texas Computer Cooperative (TCC) is committed to making its websites accessible to all users. It is TCC policy to ensure that new and updated content complies with Web Content Accessibility Guidelines (WCAG) 2.0 Level AA. We welcome comments and suggestions to improve the accessibility of our websites. If the format of any material on our website interferes with your ability to access the information, use this form to leave a comment about the accessibility of our website.