User Tools

Sidebar

Add this page to your book

Remove this page from your book

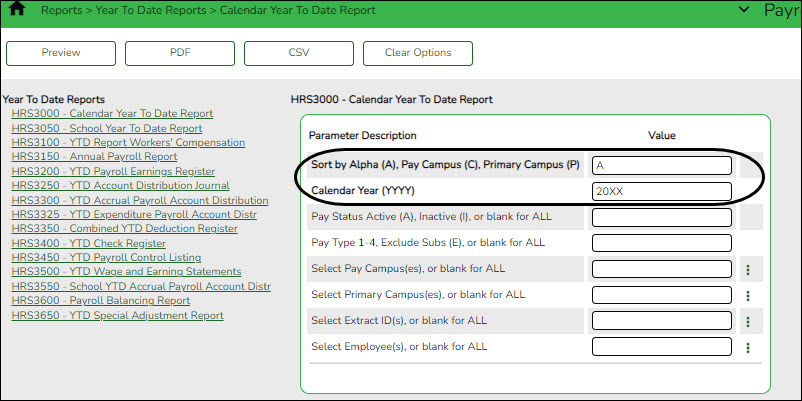

Payroll > Reports > Year To Date Reports > Calendar Year To Date Report

❏ Generate the HRS3000 - Calendar YTD and HRS5000 - 941 Worksheet reports to verify that the fourth quarter totals and the previously reported 941 Worksheet quarter totals equal the total YTD amounts.

- If the totals do not balance, it is possible that data changed in a previous quarter (in ASCENDER) and a 941C was not reported; if that is the case, make the necessary adjustments to correct the issues.

- The report provides a listing of employee earnings between January 1 and December 31. Typically, this report is printed after posting payroll information to the master file to verify employee earnings.

Note: Keep in mind that any manual adjustments made on the Payroll > Maintenance > Calendar YTD Data page are not reflected on this report.

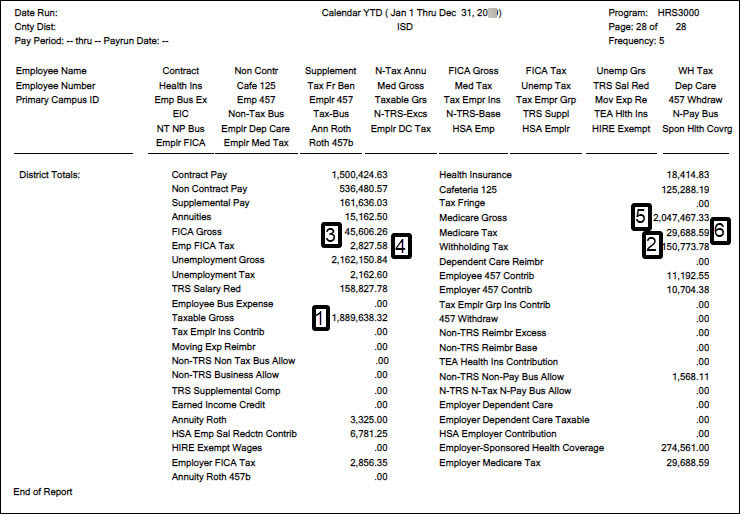

The last page of the report displays the LEA totals. Print the totals page to use later in the balancing process. Reference the following totals:

1. Taxable Gross

2. Withholding Tax

3. FICA Gross

4. Emp FICA Tax

5. Medicare Gross

6. Medicare Tax

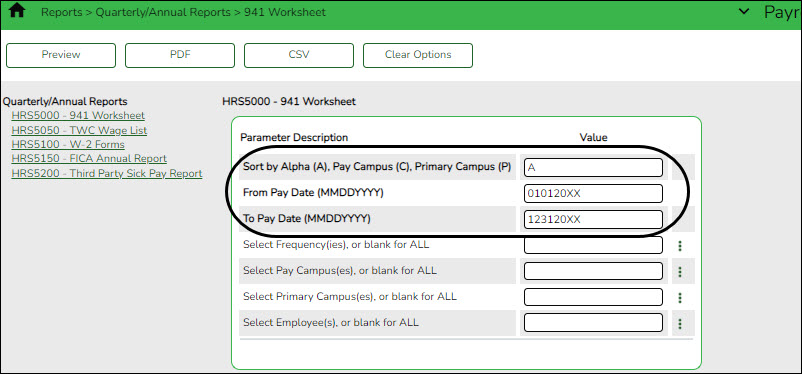

❏ Generate the Payroll > Reports > Quarterly/Annual Reports > HRS5000 - 941 Worksheet report.

The totals in this report include all regular payrolls, supplemental payrolls, and adjustments.

Only the district totals at the end of the report are used for comparison purposes in the balancing process.

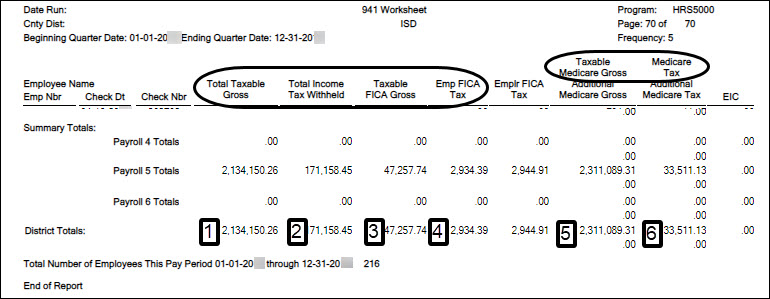

1. Taxable Gross

2. Withholding Tax

3. FICA Gross

4. Emp FICA Tax

5. Medicare Gross

6. Medicare Tax

Americans with Disabilities Act (ADA) and Web Accessibility

The Texas Computer Cooperative (TCC) is committed to making its websites accessible to all users. It is TCC policy to ensure that new and updated content complies with Web Content Accessibility Guidelines (WCAG) 2.0 Level AA. We welcome comments and suggestions to improve the accessibility of our websites. If the format of any material on our website interferes with your ability to access the information, use this form to leave a comment about the accessibility of our website.