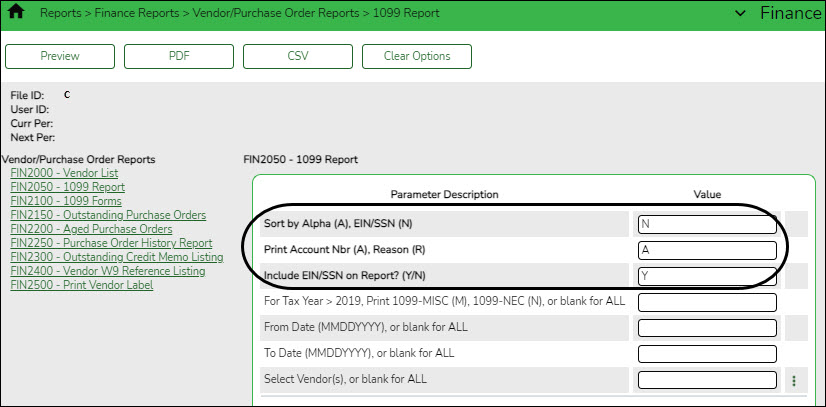

Finance > Finance Reports > Vendor/Purchase Order Reports > FIN2050 - 1099 Report

Generate this report to review the vendors and transactions for accuracy. It is recommended to sort the report by the Employer Identification Number (EIN)/Social Security Number (SSN). This sorting option allows those vendors without an EIN/SSN to be displayed at the beginning of the report. A 1099 form is not generated for vendors without an EIN/SSN.

Notes:

The 1099-MISC (M) form prints the sum of all transactions (if at least $600) in the 1099 work file except those tied to an object code with a Type Payment of N - Non-employee compensation on the Finance > Tables > 1099 Object Codes page.

The 1099-NEC (N) form prints the sum of all transactions (if at least $600, excluding credit card transactions) in the 1099 work file that are tied to an object code with a Type Payment of N - Non-employee compensation on the Finance > Tables > 1099 Object Codes page.

If a vendor is not displayed on the report and should be, verify the following:

- The EIN or SSN is populated and the 1099 Eligible field is selected on the Finance > Maintenance > Vendor Information > Vendor Name/Address tab.

- The object code used to pay the vendor exists in the object codes table in both the current and prior year file IDs.

If 1099 transactions exist for objects that you do not want to be included in the 1099s, update the 1099 object code table. If you remove a code from the Finance > Tables > 1099 Object Codes page, it is not included on the 1099 form or the 1099 file, but it is displayed on the 1099 Report without a payment type description.

Transactions can be deleted and added by running the Create 1099 Work Table utility again or manually deleting and adding transactions on the Finance > Maintenance > 1099 Record Maintenance page. If you delete a transaction from a vendor and the Create 1099 Work Table utility is processed again, delete the transaction on the Finance > Maintenance > 1099 Record Maintenance tab.

If the student activity check transactions are not maintained in ASCENDER, you must manually enter the information on the Finance > Maintenance > 1099 Record Maintenance page.

In addition to using the FIN2050 - 1099 Report, run the Finance > Inquiry > Vendor Inquiry > Vendor YTD Amounts Inquiry to verify that all 1099 eligible vendors are being reported.

- Generate the report in the prior file ID.

- In the From Date field, type 01-01-20XX.

- In the To Date field, type 12-31-20XX. This retrieves data from both file IDs.

- In the Greater Than Amount field, type 599.00.

- Click Retrieve.

This report displays all vendors that were paid 600.00 or more in the calendar year. These vendors are not necessarily 1099 eligible but the LEA can verify from which accounts the vendors are being paid to ensure that the 1099 object code table is accurate in both file IDs, and then compare this information to the FIN2050 - 1099 Report.