User Tools

Sidebar

Add this page to your book

Remove this page from your book

If report totals match, perform depreciation calculations

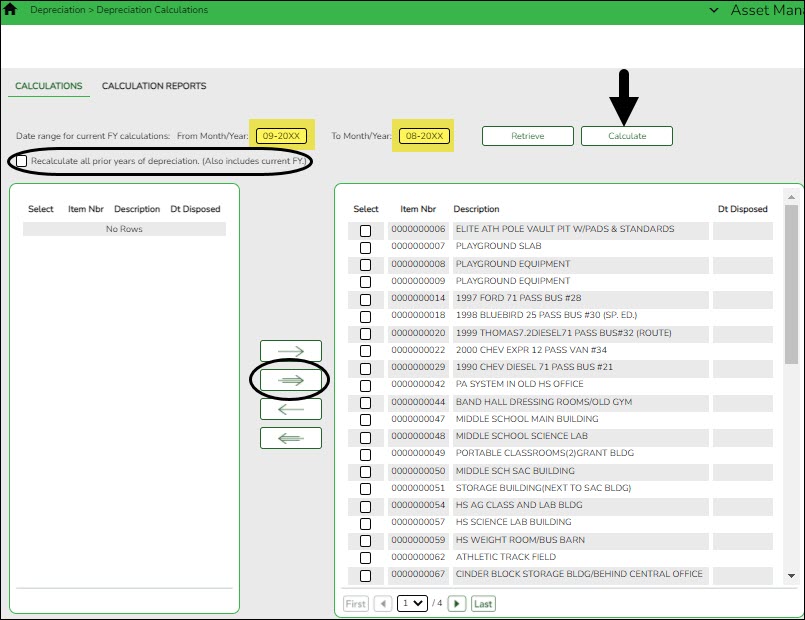

Asset Management > Depreciation > Depreciation Calculations > Calculations

If the Capital Asset Listing, Auditor’s Analysis, and Property Class reports are correct/balanced and you have reviewed the Requirements for Depreciation Calculations Checklist, perform your depreciation calculations for the year.

Use the arrow buttons to move inventory items to the right side of the page.

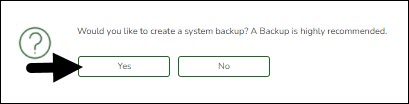

❏ Click Calculate to calculate the depreciation of all selected inventory numbers. A message is displayed prompting you to create a backup.

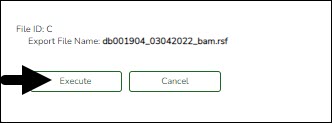

❏ Click Yes. A pop-up window is displayed with the export file name.

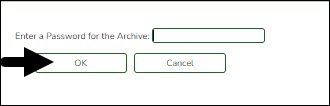

❏ Click Execute. A pop-window is displayed prompting you for a password for the archive.

❏ Enter the password and click OK. Continue the process to save the file in the appropriate location.

❏ Print the report and verify that the new items are listed for depreciation calculations before you process. Other Depreciation Reports are listed in Reports menu.

❏ Select Recalculate all prior years of depreciation (Also includes current FY.) check box to recalculate the depreciation of the selected assets for all years in service. If not selected, then the depreciation is only calculated for the current fiscal year.

If necessary, you can run the depreciation calculations screen multiple times. For example, if you added an item that should have been depreciated in a previous year, you can select the recalculate option and it will retro process calculations. Be sure to keep your auditors informed about which items are involved.

If you receive an error report when you calculate the depreciations, review the report and reconcile any issues prior to continuing this process.

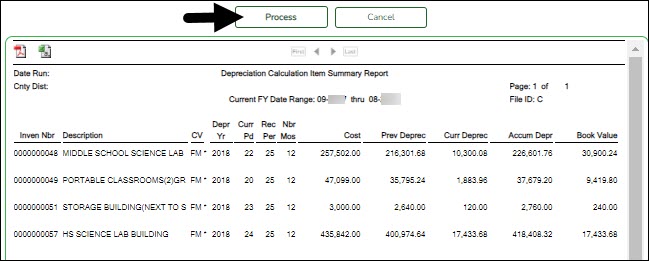

❏ Click Continue. The Depreciation Calculation Item Summary Report is displayed.

❏ Click Process to continue.

Americans with Disabilities Act (ADA) and Web Accessibility

The Texas Computer Cooperative (TCC) is committed to making its websites accessible to all users. It is TCC policy to ensure that new and updated content complies with Web Content Accessibility Guidelines (WCAG) 2.0 Level AA. We welcome comments and suggestions to improve the accessibility of our websites. If the format of any material on our website interferes with your ability to access the information, use this form to leave a comment about the accessibility of our website.