Sidebar

Add this page to your book

Remove this page from your book

Generate accrual reports

Log on to the NYR payroll frequency.

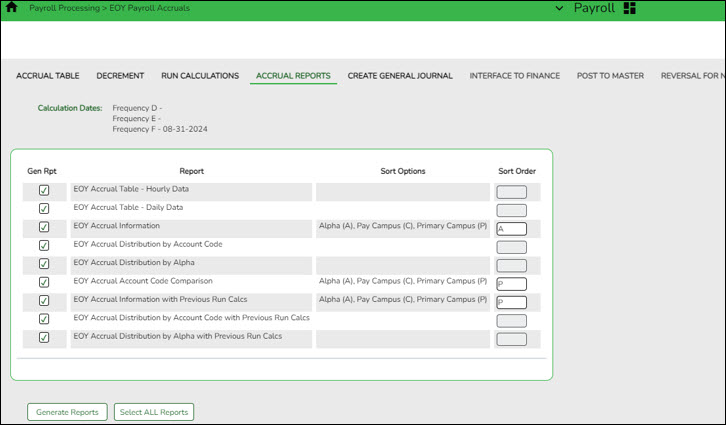

Payroll > Payroll Processing > EOY Payroll Accruals > Accrual Reports

After running the accrual calculations, run the following reports to verify that the list of employees for August accruals is accurate and that the employees should be included/excluded in the accrual process.

If calculations are run for multiple frequencies using the same calculation date, the reports include data from all payroll frequencies. Reports display data in payroll frequency order. Errors must be corrected before continuing. Once corrections are made, run the accrual calculations again to ensure that the corrections were completed.

Note: For all of the reports above except the EOY Accrual Table - Hourly Data and EOY Accrual Table - Daily Data reports, the information is retrieved from the accrual calculations temporary work file that is used to generate all transactions that are posted to the Finance application. The information cannot be modified; however, the LEA can adjust the information in the employee's record and rerun calculations to change the data stored in the employee's record in the temporary work file.

Run accrual reports:

❏ Click Generate Reports. All selected reports are generated with the new information.

- Verify the totals of each report and correct all errors.

If corrections are required:

- Navigate to the Payroll > Next Year > Copy CYR Tables to NYR > Clear Next Year Tables page.

- Select Clear EOY Accrual Data Only (do not move any tables)

- Click Execute to clear only the EOY accrual data.

- Run accrual calculations again and generate reports to verify the corrections.

The EOY Payroll Accrual Reports include:

- EOY Accrual Table - Hourly Data - displays the frequency, start date for each hourly job code, the estimated hours worked in August for the job code, and the current hourly job code description.

- EOY Accrual Table - Daily Data - displays the frequency, start date for each daily job code, the estimated days worked in August for the job code, and the current daily job code description.

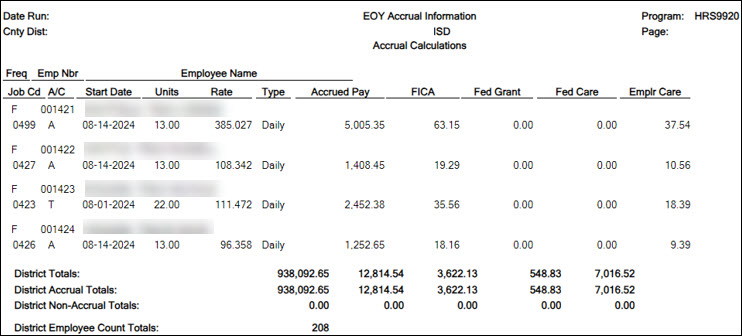

- EOY Accrual Information - displays the information of the August accrued pay by hourly/daily job codes.

- If the employee accrues monthly, verify that the accrual code (A/C) is accurate for the employee. If the employee does not accrue monthly, verify that the accrual code (A/C) is blank for the employee.

- At the end of the report, verify the accuracy of employee accruals, those who accrue monthly and those who do not accrue monthly.

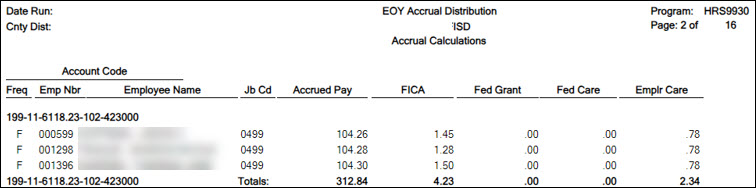

- EOY Accrual Distribution by Account Code - displays the distribution of the August accrued pay by account codes.

- Verify that the fund and fiscal year are accurate.

- Verify that an amount was calculated for the Federal Grant and Federal Care columns for the appropriate federal funds. If there is not an amount listed, review and update the Personnel > Tables > Salaries > Fund to Grant table.

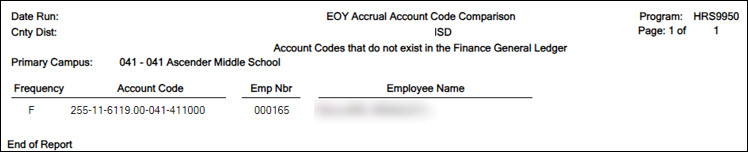

- EOY Accrual Account Code Comparison - compares the distribution of the August accrued pay by account codes and provides a listing of the employee master distribution records that are not changed to reflect the new fiscal year. The account may need to be added to the Finance > Maintenance > Create Chart of Accounts page or corrected on the employee's Distribution tab in Payroll. This information must be corrected before continuing the process.

- EOY Accrual Information with Previous Run Calcs - displays the information of the recalculated accrued pay by hourly/daily job codes.

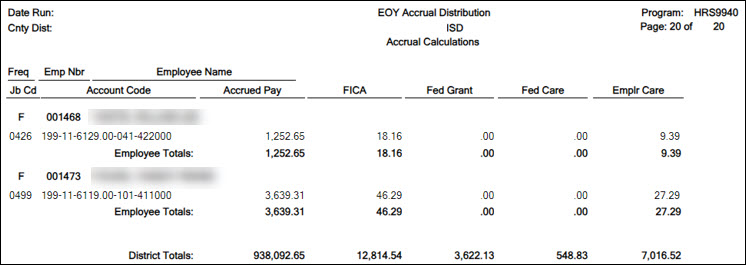

- EOY Accrual Distribution by Account Code with Previous Run Calcs - displays the distribution of the recalculated accrued pay by account codes.

- EOY Accrual Distribution by Alpha with Previous Run Calcs - displays the distribution of the recalculated accrued pay alphabetically.

Americans with Disabilities Act (ADA) and Web Accessibility

The Texas Computer Cooperative (TCC) is committed to making its websites accessible to all users. It is TCC policy to ensure that new and updated content complies with Web Content Accessibility Guidelines (WCAG) 2.0 Level AA. We welcome comments and suggestions to improve the accessibility of our websites. If the format of any material on our website interferes with your ability to access the information, use this form to leave a comment about the accessibility of our website.