User Tools

Sidebar

Add this page to your book

Remove this page from your book

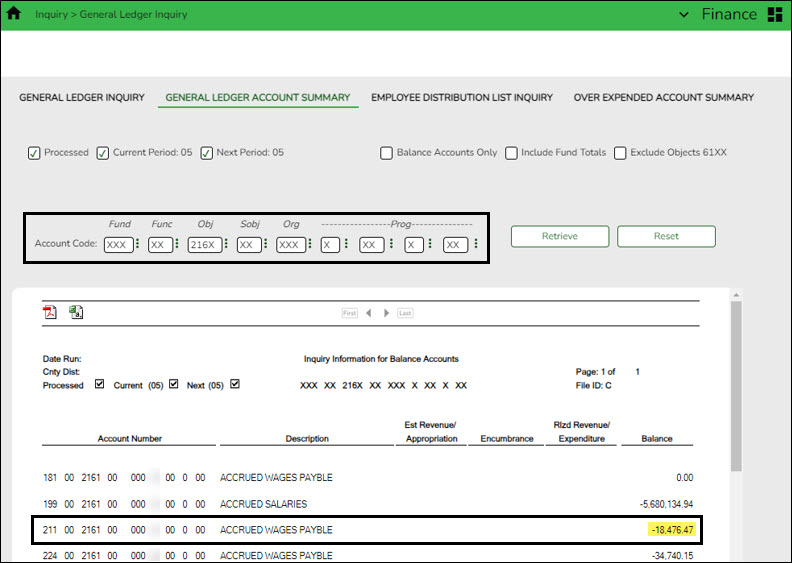

Run a general ledger inquiry

Finance > Inquiry > General Ledger Inquiry > General Ledger Account Summary

When considering potential journal entries to be made later in this step, use the following chart for reference.

Note: This chart derives from the Payroll Automatic Posting Default section on the Finance > Tables > District Finance Options > Clearing Fund Maintenance tab.

| General Ledger Inquiry Report | School YTD Report | Expenditure Object Code |

| 216X | Accrued Wages | 6119 or 6129 |

| 221X.11 | Accrued Federal Grant Deposit | 6146 |

| 221X.12 | Accrued Federal Grant Care | 6146 |

| 221X.14 | Accrued Employer FICA/Medicare | 6141 |

| 221X.15 | Accrued Employer Unemployment Tax | 6145 |

| 221X.16 | Accrued Health Insurance Contribution (Emplr Health Insurance Accrued + TEA Health Ins Accrued) | 6142 |

| 221X.17 | Accrued Employer 457 Contribution | 6149 |

| 221X.18 | Accrued Employer Annuity Contribution | 6149 |

| 221X.19 | Accrued Employer TRS Care Contribution | 6146 |

| 221X.20 | Accrued Employer Dependent Care | 6149 |

| 221X.21 | Accrued Employer Miscellaneous Deduction Contribution | 6149 |

| 221X.22 | Accrued Employer Miscellaneous Deduction Contribution | 6149 |

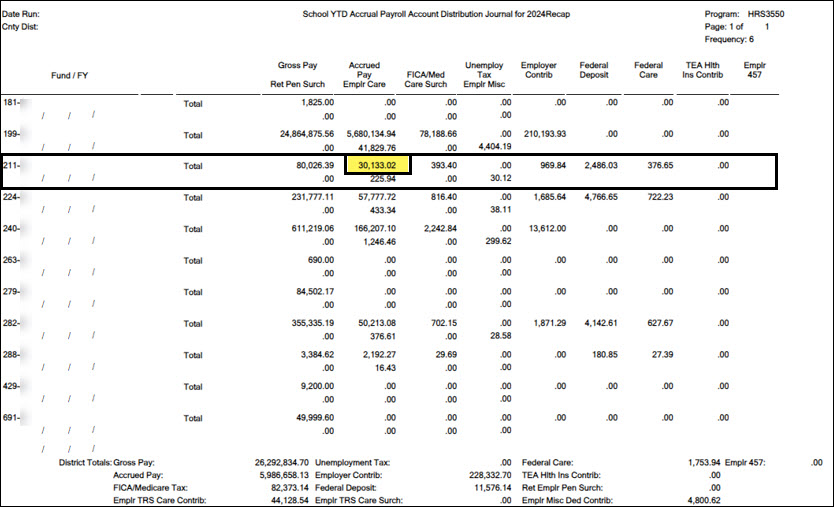

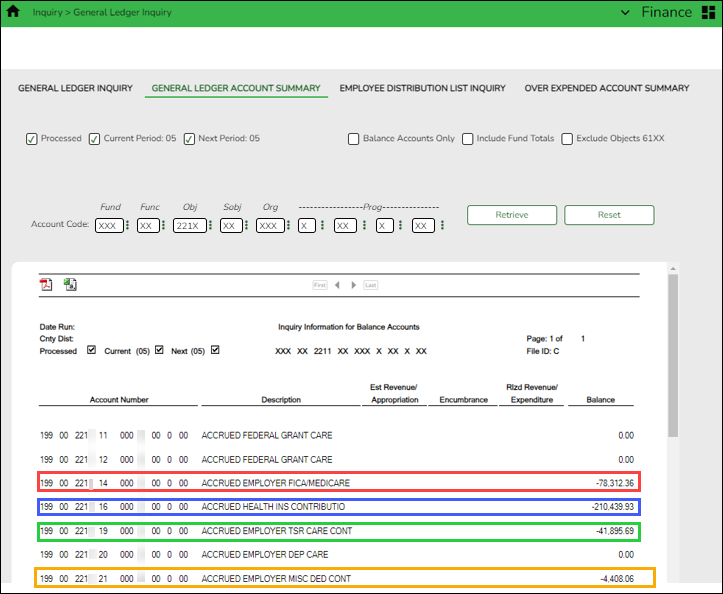

Run an inquiry on the 216X and 221X accounts from Finance and compare the balances to the Payroll > Reports > Year To Date Reports > HRS3550 - School YTD Accrual Payroll Account Distribution Journal.

This inquiry can also be run in Purchasing.

If there is a difference in any of the funds, a journal entry needs to be made to balance the general ledger to the HRS3550 - School YTD Accrual Payroll Account Distribution Journal.

Compare the HRS3550 report totals to the General Ledger Inquiry reports.

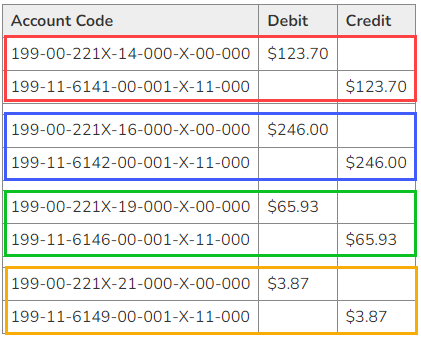

Review the following example entry:

| Account Code | Debit | Credit |

|---|---|---|

| 211-00-2161-00-000-X-00-000 | $11,656.55 | |

| 211-11-6119-00-001-X-11-000 | $11,656.55 |

This is the difference between the two amounts. The entry has to make the general ledger match the HRS3550 - School YTD Accrual Payroll Account Distribution Journal.

If there is a difference in any of the funds such as in the example shown below, a journal entry will need to be made to balance the general ledger to the HRS3550 - School YTD Accrual Payroll Account Distribution Journal.

Review the following example entry:

Note: Be sure to keep a clean final copy of both of the HRS3550 reports for the auditor. These reports cannot be recreated after the July and August payrolls are processed.

Americans with Disabilities Act (ADA) and Web Accessibility

The Texas Computer Cooperative (TCC) is committed to making its websites accessible to all users. It is TCC policy to ensure that new and updated content complies with Web Content Accessibility Guidelines (WCAG) 2.0 Level AA. We welcome comments and suggestions to improve the accessibility of our websites. If the format of any material on our website interferes with your ability to access the information, use this form to leave a comment about the accessibility of our website.