User Tools

Sidebar

Add this page to your book

Remove this page from your book

This is an old revision of the document!

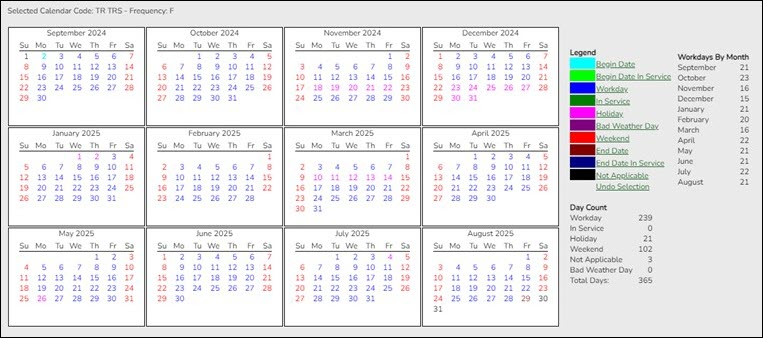

Update school calendar

Personnel > Tables > Workday Calendars > School Calendar

Only complete this step if it is applicable to your LEA. All LEA's must create a TR calendar.

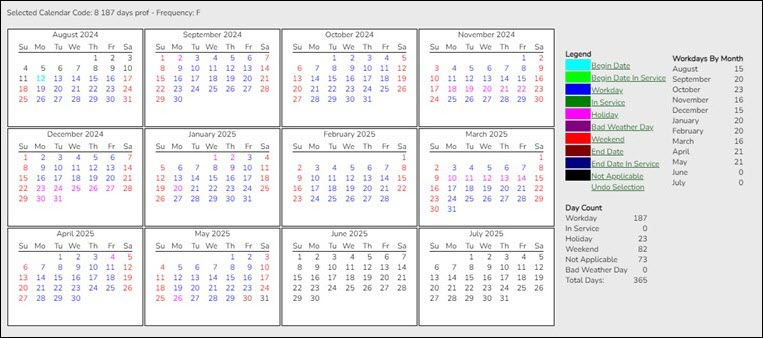

Create school calendars to accommodate the varied number of days employees work at the LEA. The calendar is used on the Payroll > Maintenance > Staff Job/Pay Data > Job Info tab to calculate the Number of Days Employed field if the beginning and ending contract dates are entered.

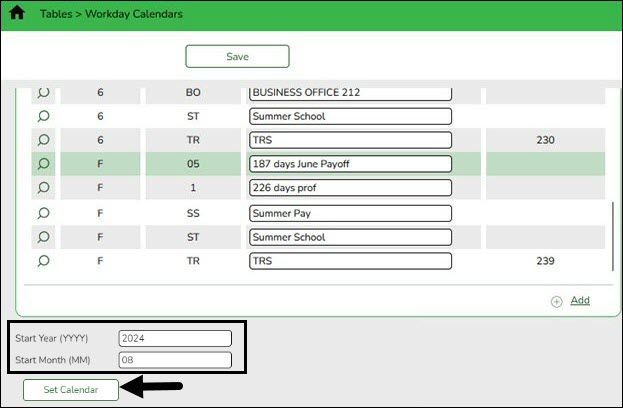

❏ Create calendars with the same calendar code as the current year to avoid having to update the calendar code on the individual employee's job info record.

❏ Select the calendar to be updated.

| Start Year | Type the starting calendar year in the YYYY format. |

|---|---|

| Start Month | Type the starting calendar month in the MM format (e.g., 07 for July). |

❏ Click Set Calendar to display the calendar. The calendar is rearranged to begin with the entered starting month.

It is recommended that you build the calendar with the greatest number of days worked first, and then use the Copy School Calendar tab to build other calendars by making modifications to the original.

IMPORTANT:

- For TRS purposes, a TR calendar with a calendar code of TR must be created for all available workdays beginning 09/01. (TIP: If 9/01 falls on a weekend day, select the first working day of the month.) The TR calendar is used to populate the number of days worked on the RP report for employees who are not assigned to a school calendar

- For TRS purposes, all TRS retirees contract days must begin on the first day of the month and end on the last day of the month.

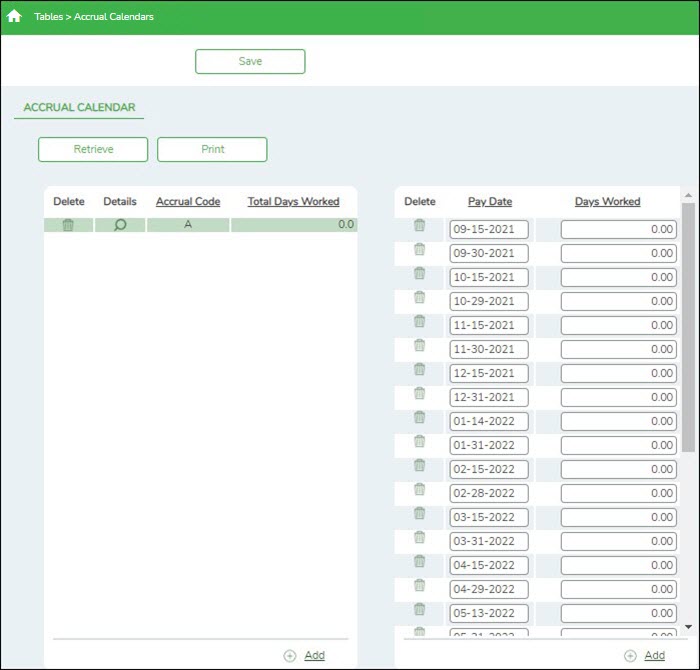

Payroll > Tables > Workday Calendars > Accrual Calendar

Create accrual calendars to accommodate the varied number of days employees work at the LEA. The calendar is used on the Payroll > Maintenance > Staff Job/Pay Data > Job Info tab to calculate the Accrual Rate when the calendar code is entered in the Accrual Info section.

❏ Verify that the calendar code reflects the actual number of days the employee will work for the new school year; otherwise, the salary amount that should accrue over the school year will be incorrect.

- You can use the school calendar created in the previous step to get the actual workdays by month.

- If you have not set up a budget for the 2021-2022 school year, you can only enter pay dates through the 2021 calendar year. If the Budget is set up for the 2021-2022 school year, you can enter 2022 pay dates in these fields.

Note: This table can be updated after the move to current. All pay dates should be entered even if zero days are accrued (e.g., summer months).

Americans with Disabilities Act (ADA) and Web Accessibility

The Texas Computer Cooperative (TCC) is committed to making its websites accessible to all users. It is TCC policy to ensure that new and updated content complies with Web Content Accessibility Guidelines (WCAG) 2.0 Level AA. We welcome comments and suggestions to improve the accessibility of our websites. If the format of any material on our website interferes with your ability to access the information, use this form to leave a comment about the accessibility of our website.