User Tools

Sidebar

Add this page to your book

Remove this page from your book

Update tax/deductions

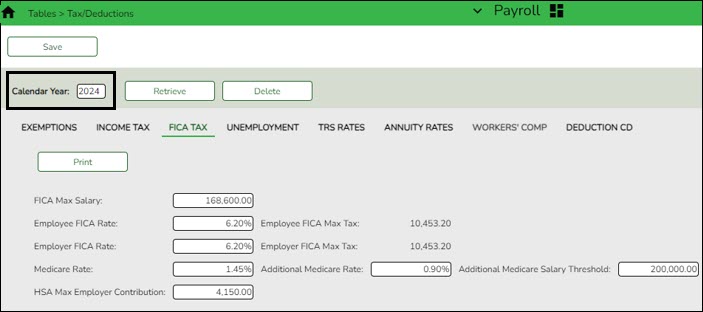

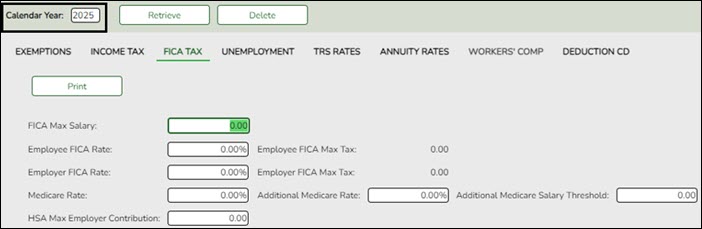

Payroll > Tables > Tax/Deductions > FICA Tax

Retrieve the FICA rates for the 2025 calendar year and print a copy for reference. Then, retrieve the 2026 calendar year record and manually enter the 2025 rates for 2026 and click Save.

CAUTION: Be sure to retrieve the 2026 year record prior to updating this tab.

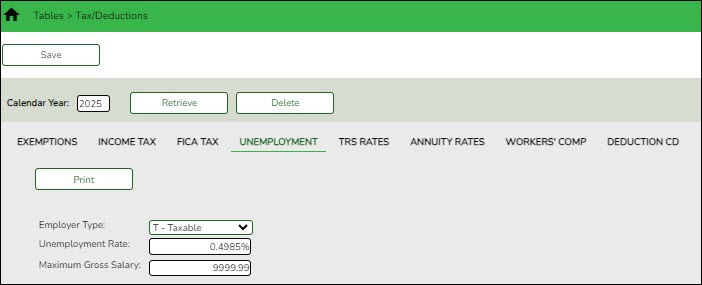

Payroll > Tables > Tax/Deductions > Unemployment

If your LEA allows ASCENDER to calculate unemployment, select T - Taxable in the Employer Type field and enter the Unemployment Rate. Type the percent rate determined or assigned by the TWC (e.g., 0.4985% for 0.004985).

The rates displayed in the below image are sample rates. Only use the rates provided by the Texas Workforce Commission (TWC).

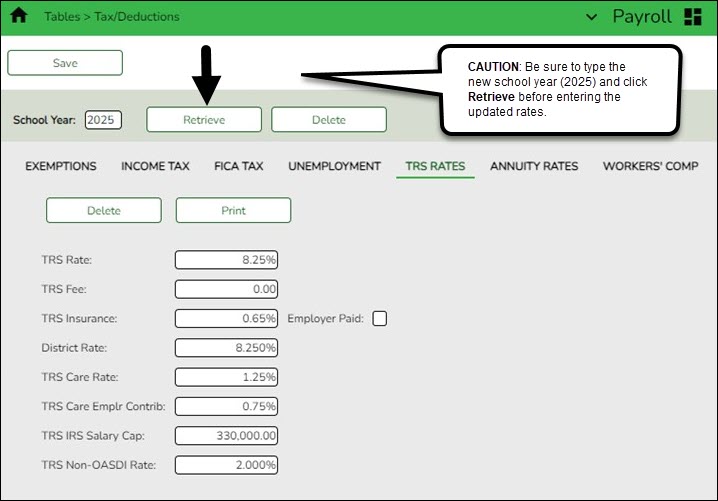

Payroll > Tables > Tax/Deductions > TRS Rates

Update the TRS rates.

CAUTION: Be sure to retrieve the 2026 data prior to updating this tab.

IMPORTANT: Be sure to visit the following TRS websites: https://www.trs.texas.gov/Pages/re_contribution_rates.aspx and https://www.trs.texas.gov/Pages/re_salary_cap_provision.aspx to obtain the updated rates for the next school year, and then return to this table to update the new rates.

Note: The below image displays the TRS rates for the 2024-2025 calendar year. This image will be updated to reflect the TRS rates for the 2025-2026 calendar year as soon as they are published.

❏ To create a new TRS rates record, type the new year (2026) and click Retrieve. A message is displayed indicating that the new record is populated based on the prior year's (2025) TRS rates record, click Save to retain the record.

❏ Complete the applicable fields. This information is used when performing calculations and extracts to Budget.

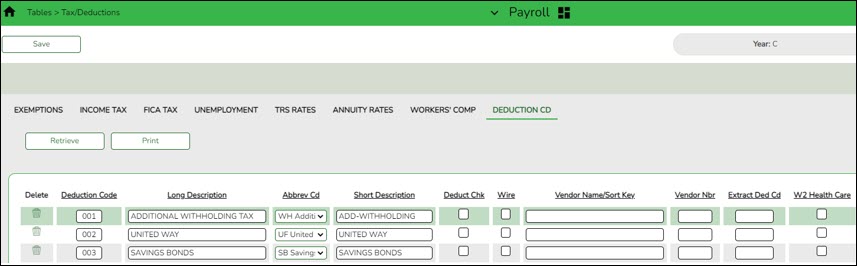

Payroll > Tables > Tax/Deductions > Deduction Code

❏ Update the deduction codes. The Deduction Code tab is shared between the current year and next year records; therefore, changes to the current year records are effective in the next year records, and vice versa.

Americans with Disabilities Act (ADA) and Web Accessibility

The Texas Computer Cooperative (TCC) is committed to making its websites accessible to all users. It is TCC policy to ensure that new and updated content complies with Web Content Accessibility Guidelines (WCAG) 2.0 Level AA. We welcome comments and suggestions to improve the accessibility of our websites. If the format of any material on our website interferes with your ability to access the information, use this form to leave a comment about the accessibility of our website.