Update tax/deductions

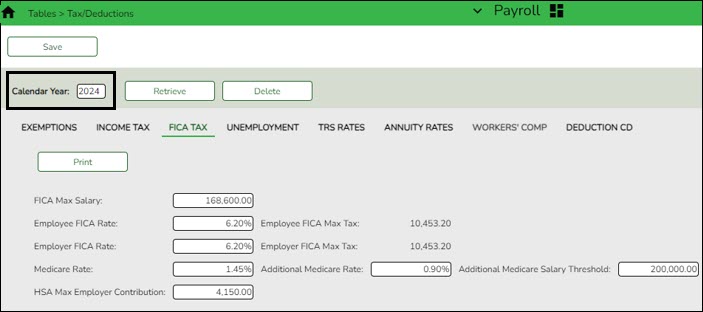

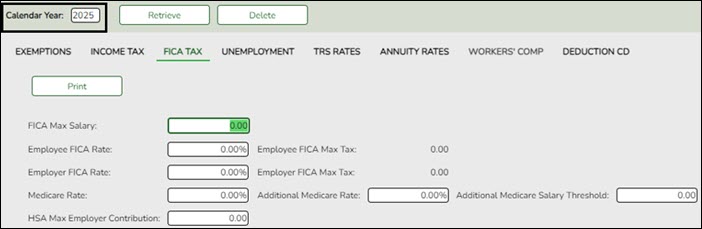

Payroll > Tables > Tax/Deductions > FICA Tax

Retrieve the FICA rates for the 2025 calendar year and print a copy for reference. Then, retrieve the 2026 calendar year record and manually enter the 2025 rates for 2026 and click Save.

CAUTION: Be sure to retrieve the 2026 year record prior to updating this tab.

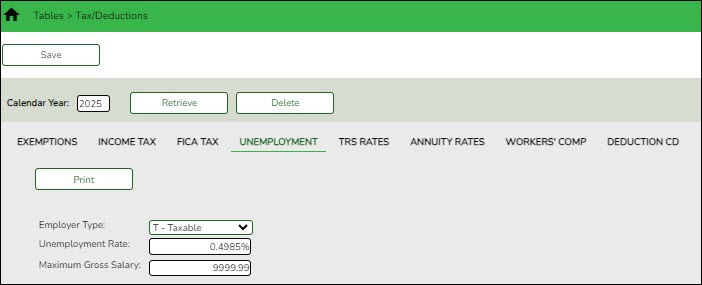

Payroll > Tables > Tax/Deductions > Unemployment

If your LEA allows ASCENDER to calculate unemployment, select T - Taxable in the Employer Type field and enter the Unemployment Rate. Type the percent rate determined or assigned by the TWC (e.g., 0.4985% for 0.004985).

The rates displayed in the below image are sample rates. Only use the rates provided by the Texas Workforce Commission (TWC).

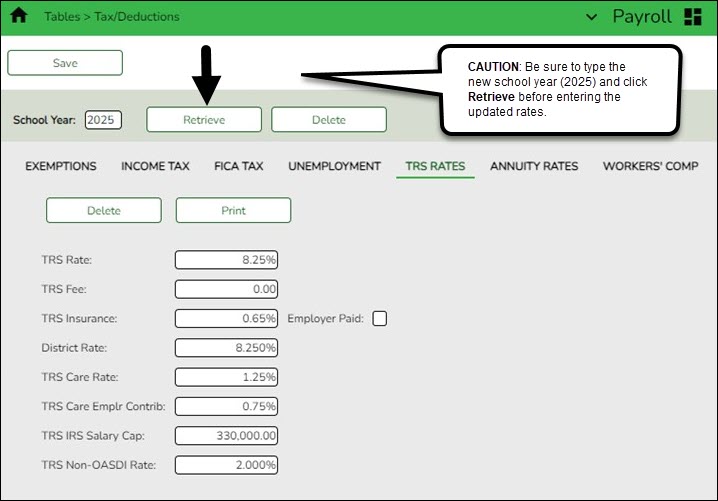

Payroll > Tables > Tax/Deductions > TRS Rates

Update the TRS rates.

CAUTION: Be sure to retrieve the 2026 data prior to updating this tab.

IMPORTANT: Be sure to visit the following TRS websites: https://www.trs.texas.gov/Pages/re_contribution_rates.aspx and https://www.trs.texas.gov/Pages/re_salary_cap_provision.aspx to obtain the updated rates for the next school year, and then return to this table to update the new rates.

Note: The below image displays the TRS rates for the 2024-2025 calendar year. This image will be updated to reflect the TRS rates for the 2025-2026 calendar year as soon as they are published.

❏ To create a new TRS rates record, type the new year (2026) and click Retrieve. A message is displayed indicating that the new record is populated based on the prior year's (2025) TRS rates record, click Save to retain the record.

❏ Complete the applicable fields. This information is used when performing calculations and extracts to Budget.

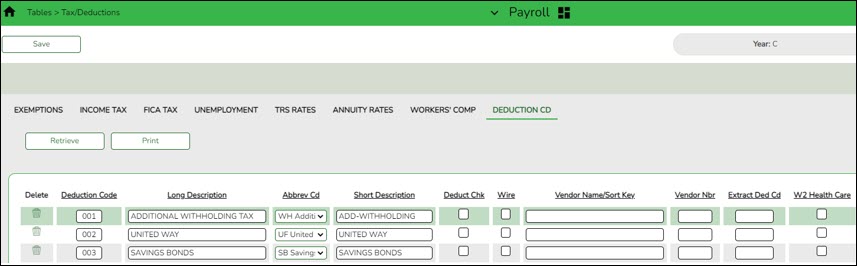

Payroll > Tables > Tax/Deductions > Deduction Code

❏ Update the deduction codes. The Deduction Code tab is shared between the current year and next year records; therefore, changes to the current year records are effective in the next year records, and vice versa.