User Tools

Sidebar

Add this page to your book

Remove this page from your book

Payroll > Payroll Processing > TRS Processing > Adjustment Days

This tab is used to add, edit, and delete adjustment days for TRS reporting.

The Extract function on this tab is used to extract the available days worked from the TRS calendar and from any leave docks that were processed through the payroll leave transmittals process for leave types with Use For Dock TRS Days selected on the Payroll > Tables > Leave > Leave Type Description tab. If the adjustment days are a result of a leave dock and the employee has multiple jobs with multiple position codes, then the adjustment days are recorded for each of the TRS position codes. After the data is extracted, the information can be retrieved for a specific employee in the Maintenance section of this tab. This data is used for the RP (Regular Payroll) and ER (Employment after Retirement) records.

The Maintenance function on this tab is used to view and maintain adjustment days for a specific employee. The information is automatically updated when the TRS adjustment days are extracted. In addition, the data can be manually added.

The TRS Month and TRS Year fields are disabled on this tab.

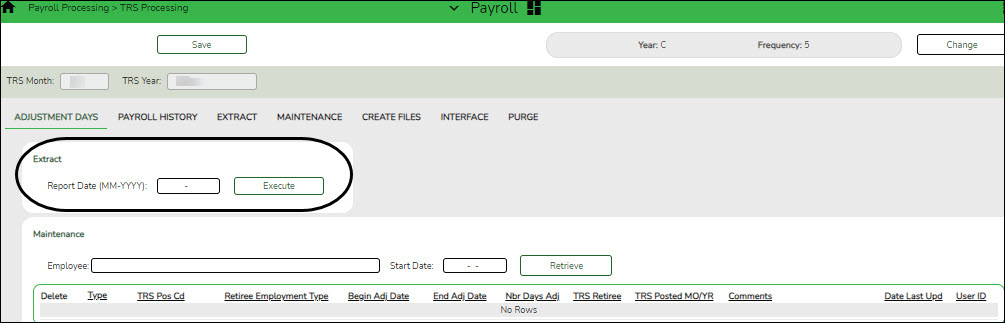

❏ Under Extract:

| Field | Description |

|---|---|

| Report Date (MM-YYYY) | Type the reporting month and year for the report. |

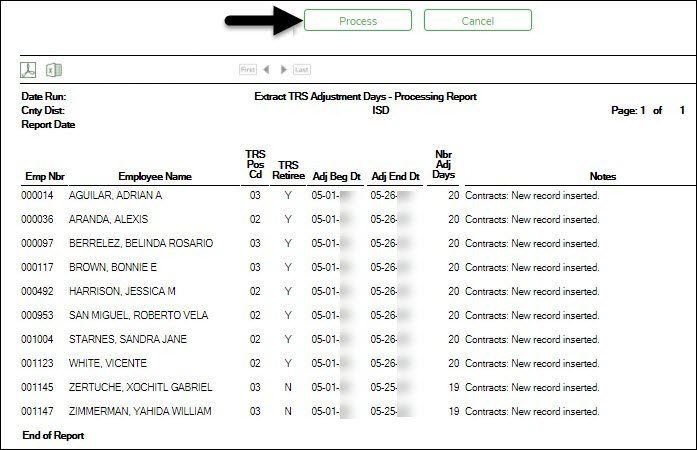

❏ Click Execute. The Extract TRS Adjustment Days - Processing Report is displayed. Review the report.

❏ Click Process to process the records. A message is displayed indicating that the process was successful. Or, click Cancel to return to the Adjustment Days tab.

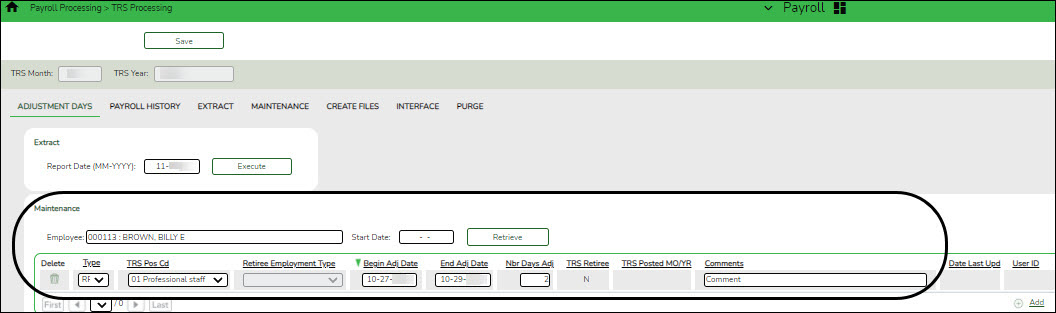

❏ Under Maintenance:

| Employee | Type the employee number or employee last name. As you type the data, a drop-down list of corresponding data is displayed. Select the employee name to be retrieved. |

|---|---|

| Start Date | Type the date in the MM-DD-YYYY format. Leave blank to display all available data for the selected employee. |

❏ Click Retrieve. The employee's existing adjustment day records are displayed; processed records cannot be changed.

❏ Click +Add to add a row.

| Type | Click  to select one of the following record types for the record. to select one of the following record types for the record.

• RP - Regular Payroll |

|---|---|

| TRS Pos Cd | |

| Retiree Employment Type | Click  to select the employee's retiree employment type code. to select the employee's retiree employment type code.

• B - Non-Profit Tutor Substitute See Calculating Retiree Surcharge for additional information. |

| Begin Adj Date | Type the beginning adjustment date in the MM-DD-YYYY format. |

| End Adj Date | Type the ending adjustment date in the MM-DD-YYYY format. |

| Nbr Days Adj | Type the number of adjustment days for the record. |

| TRS Retiree | Displays the employee's TRS retirement status:

• Y - Yes, the employee is a TRS retiree. |

| TRS Posted MO/YR | This field displays the month and year of the last TRS posting if any. |

| Comments | Type any comments or other information that pertains to the record. |

| Date Last Upd | This field displays the last date that the record was updated. |

| User ID | This field identifies the user who created the transaction. The user ID is tracked through the user’s logon to the system. |

❏ Click Save.

Other functions and features:

Americans with Disabilities Act (ADA) and Web Accessibility

The Texas Computer Cooperative (TCC) is committed to making its websites accessible to all users. It is TCC policy to ensure that new and updated content complies with Web Content Accessibility Guidelines (WCAG) 2.0 Level AA. We welcome comments and suggestions to improve the accessibility of our websites. If the format of any material on our website interferes with your ability to access the information, use this form to leave a comment about the accessibility of our website.