User Tools

Sidebar

Add this page to your book

Remove this page from your book

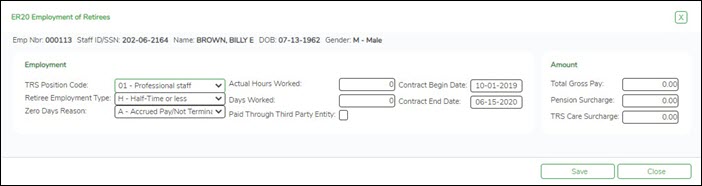

The ER20 record is used to report employment information for retirees, regardless of retirement date or retirement type.

Per TRS, if a retiree has multiple jobs, only one ER20 record should be submitted for each retiree. The Hours Worked, Days Worked, and Total Gross Compensation fields should be cumulative, regardless of how many positions the retiree works for the local education agency (LEA).

The Emp Nbr, Staff ID/SSN, Name, DOB, and Gender fields are displayed and cannot be changed.

❏ Under Employment:

❏ Under Amount:

| Total Gross Pay | Type the retiree’s total gross compensation amount. |

|---|---|

| Pension Surcharge | Type the amount of pension surcharge due based on retiree's employment, if any. |

| TRS Care Surcharge | Type the amount of TRS Care surcharge due based on retiree's employment, if any. |

Americans with Disabilities Act (ADA) and Web Accessibility

The Texas Computer Cooperative (TCC) is committed to making its websites accessible to all users. It is TCC policy to ensure that new and updated content complies with Web Content Accessibility Guidelines (WCAG) 2.0 Level AA. We welcome comments and suggestions to improve the accessibility of our websites. If the format of any material on our website interferes with your ability to access the information, use this form to leave a comment about the accessibility of our website.