User Tools

Sidebar

Add this page to your book

Remove this page from your book

ASCENDER - Process 1095 Forms

Created: 12/07/2018

Reviewed: 12/12/2025

Revised: 2/20/2026

The purpose of this document is to guide you through the necessary steps to verify and produce the Affordable Care Act (ACA) Forms 1095-B (Health Coverage) and 1095-C (Employer-Provided Health Insurance Offer and Coverage). After the 1095 data is finalized, provide 1095 forms to employees according to their EmployeePortal 1095 consent option. Also, create the ACA 1095-B or 1095-C electronic file to be submitted to the Internal Revenue Service (IRS).

This document assumes you are familiar with the basic features of the ASCENDER Business system and have reviewed the ASCENDER Business Overview guide.

Some of the images and/or examples provided in this document are for informational purposes only and may not completely represent your LEA’s process.

Description of Forms

Form 1095-B

Click here to view the current Form 1095-B.

An LEA is only responsible for filing Form 1095-B if the following two requirements are met:

- The LEA offers health coverage to its employees.

- The LEA is “self-insured”, meaning the LEA pays its employees' medical bills instead of an insurance company.

LEAs not meeting both of these requirements do not have to manage 1094/5-B forms and filings. However, employees may still receive a 1095-B form from their insurance carrier.

Applicable small employers (less than 50 full-time equivalents) must file the 1094-B transmittal form along with the 1095-B submission file with the IRS. This data allows the IRS to determine health insurance enrollment.

Form 1095-B provides information about individuals in a tax family (employee, spouse, and dependents) who had certain health coverage (referred to as “minimum essential coverage”) for some or all months during the year.

Form 1095-C

Click here to view the current Form 1095-C.

Applicable large employers must file the 1094-C transmittal form along with the 1095-C submission file with the IRS. This data (enrollment and offer of coverage) allows the IRS to determine if the ALE is subject to possible penalties outlined by the ACA guidelines.

Form 1095-C provides a list of covered individual and offer of coverage data and is required for ALE's (at least 50 or more full-time equivalents). This form is provided to any employee of an ALE who was a full-time employee for one or more months of the calendar year regardless if they were offered or enrolled in health insurance. Also, this form is provided to all full and part-time employees who were enrolled in health insurance offered by the employer. ALE's are required to report this information for each employee for all twelve months of the calendar year.

Before You Begin

Review the Affordable Care Act for Employers overview at https://www.irs.gov/affordable-care-act/employers. The ACA employer tax provisions are based on whether your organization is considered a small or large employer. After determining how your organization is classified, proceed with the applicable reporting requirements.

❏ ASCENDER only allows for the electronic filing of 1095s to the IRS.

Be sure to review the Affordable Care Act Information Returns (AIR) webpage at https://www.irs.gov/e-file-providers/affordable-care-act-information-returns-air for updated information about filing electronic information returns.

❏ Refer to the IRS website https://www.irs.gov/affordable-care-act for specific ACA reporting details and deadlines.

ACA Terms and Helpful Links

| Term | Description |

|---|---|

| ALE | Applicable Large Employers are those employers with at least 50 full-time employees including full-time equivalent employees in the prior calendar year. |

| IRS | Internal Revenue Service |

| MEC | Minimum Essential Coverage is a qualifying health coverage plan (e.g., marketplace plans; job-based plans; Medicare; and Medicaid/CHIP) that meets the Affordable Care Act (ACA) requirements. |

| Minimum Value | A health plan's share of total costs must pay at least 60% of the total cost of medical services in order to meet this standard and be considered “affordable”. TRS health coverage plans meet the minimum value requirements. |

| Small employer | Employers with fewer than 50 full-time employees. |

| Affordable Care Act Information Returns (AIR) | https://www.irs.gov/e-file-providers/air/affordable-care-act-information-return-air-program |

|---|---|

| Form 1095-B | https://www.irs.gov/pub/irs-pdf/f1095b.pdf |

| Form 1095-B Instructions | https://www.irs.gov/pub/irs-pdf/i109495b.pdf |

| Form 1095-C | https://www.irs.gov/pub/irs-pdf/f1095c.pdf |

| Form 1095-C Instructions | https://www.irs.gov/pub/irs-pdf/i109495c.pdf |

| IRS ACA Homepage | https://www.irs.gov/aca |

❏ If your LEA plans to use the extract method of creating 1095 records for the calendar year, use the following two steps to maintain employee insurance data in Personnel throughout the calendar year. Creating records via the extract is covered in step 2b of this document.

- Set up insurance company codes table.

Set up insurance company codes table

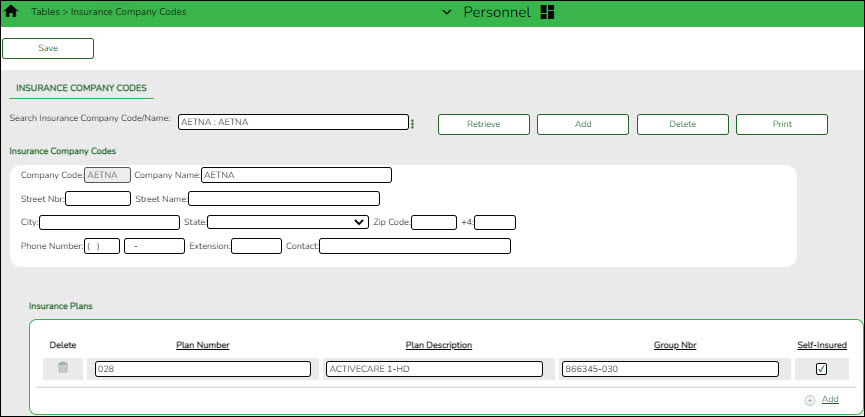

Personnel > Tables > Insurance Company Codes

Add codes for health insurance plans.

Note: It is not necessary to add separate codes for each health insurance plan since you can see the current detail in their deduction screens.

Add Click to add insurance company data. A blank insurance company code record is displayed.

OR

Retrieve an existing record. ❏ Under Insurance Company Codes:

❏ Under Insurance Plans, click +Add to add a plan number, description, and group number. The system populates the Code and Company Name fields with data from the selected company.

Plan Number Type the insurance plan number. The field can be a maximum of 20 digits. Plan Description Type the description of the type of insurance plan. The field can be a maximum of 20 characters. Group Nbr Type the group number for the district. The field can be a maximum of 20 digits. Self-Insured Select to identify the health insurance plan as being a plan in which the employer assumes the financial responsibility for providing health care benefits to its employees.

This field should be selected for PPO plans (e.g., TRS ActiveCare 1-HD, 2, and Select plans).❏ Click Save.

- Add/update staff insurance data.

Add or update staff insurance data

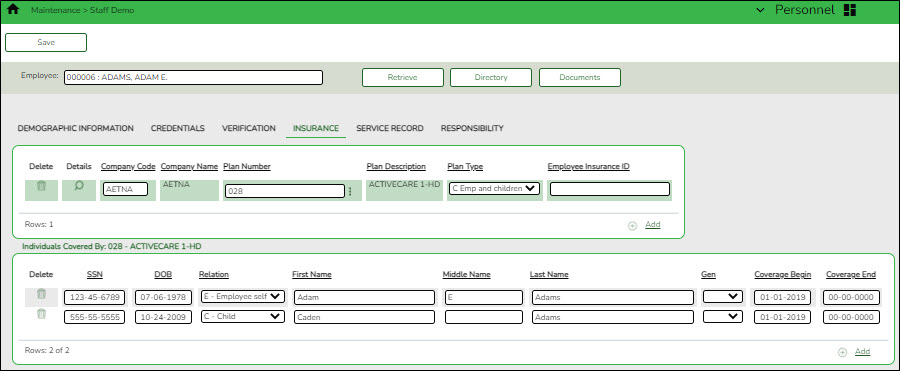

Personnel > Maintenance > Staff Demo > Insurance

This tab contains insurance information for the employee. The data includes the insurance company, the plan type, coverage information, the individuals covered by the plan, and the demographics of the covered dependents.

Since ACA is reported over a calendar year, some employees may have multiple rows if they changed insurance companies during the last enrollment period and you added insurance codes for each plan.

If this data is maintained throughout the calendar year for all applicable employees, you can use the Personnel > Utilities > Extract Insurance Data to 1095 Data page to extract insurance data from this tab to the Personnel > Maintenance > ACA 1095 YTD Data maintenance page(s). Most data will populate accurately; however, there are some records that may require manual edits.

Retrieve an existing record Begin typing the employee name or number. As you type the data, a drop-down list of corresponding data is displayed. Select an employee and click Retrieve. Or, click Directory to perform a search in the Employees Directory.

Note: The employee autosuggest field includes employees whose records were created in Personnel but do not have a Pay Info or Job Info record.

If the employee number does not exist in the system, a message is displayed prompting you to create a new employee. Click Yes.

❏ Click +Add to add a row.

Under Individuals Covered By:

❏ Click +Add to add a row for each individual (including the employee) covered by the selected plan in the top grid.

❏ Click Save.

❏ If your LEA plans to copy 1095 records from the prior year, manually enter records, or import a text file to create 1095 records, continue to step 1 of this document.

Keep in mind, regardless of what method is used to create 1095 records, in most cases, some manual changes will be required to ensure accurate reporting.

Process 1095 Forms

- Set up the ACA code table.

Set up ACA code table

Add or edit Offer of Coverage and Safe Harbor tabs as needed.

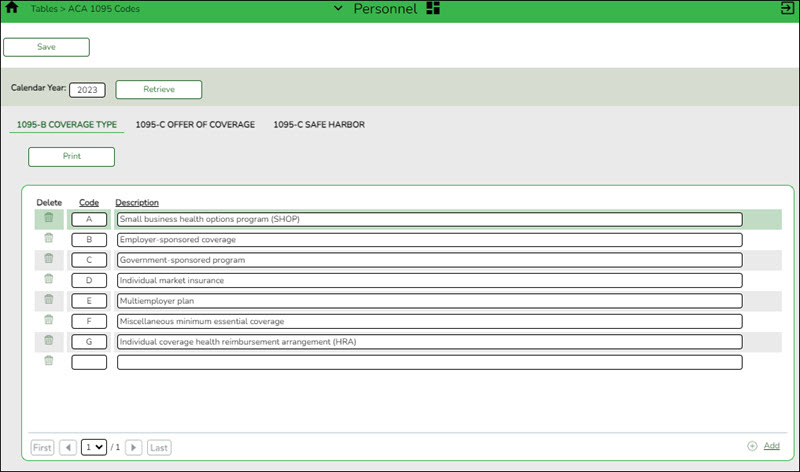

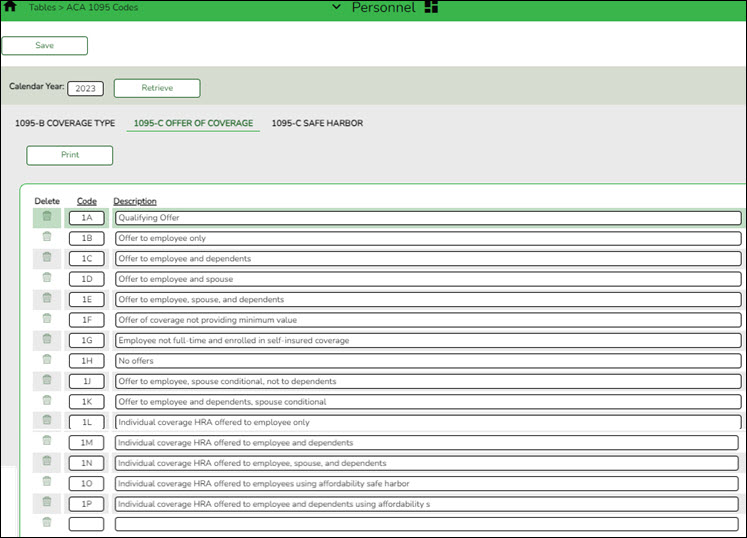

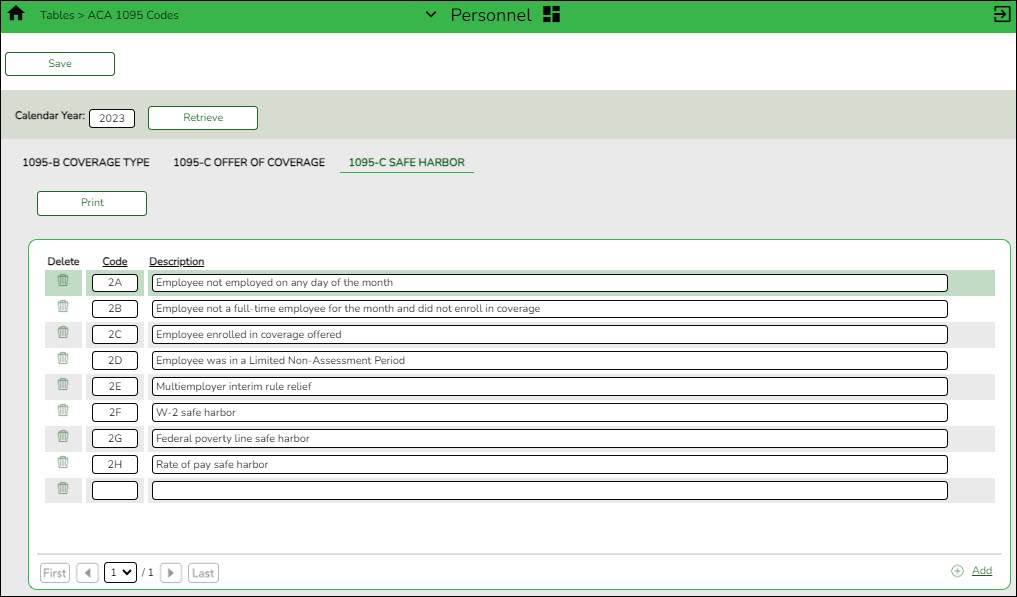

If your LEA is classified as a small employer and plans to file 1095-B forms, complete the Personnel > Tables > ACA 1095 Codes > 1095-B Coverage Type tab:

If your LEA is classified as an ALE and plans to file 1095-C forms, complete the following tabs:

Personnel > Tables > ACA 1095 Codes > 1095-C Offer of Coverage

For a complete list of codes, refer to pages 11 and 12 of the Instructions for Forms 1094-C and 1095-C

- Create 1095 records.

The following methods are available to create the 1095 records. Depending on your LEAs procedures, you can select the method that best meets your needs.Remember, if your LEA initially planned to maintain employee insurance data in Personnel throughout the calendar year, you can use the extract method (b.) to create 1095 records. If not, then you can manually create records, import records, or copy records from the prior year.

Manually create records

To manually add records 1095-B or 1095-C records for each employee, use one of the following maintenance tabs.

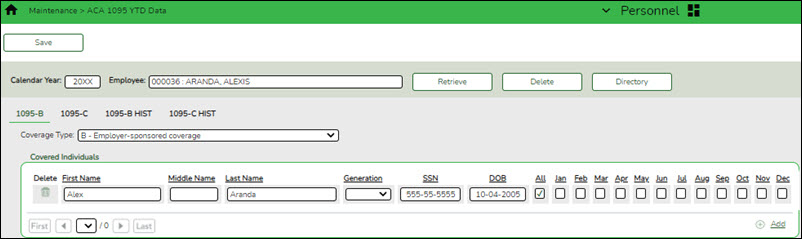

- Small LEAs with less than 50 FTEs will use the 1095‐B tab to add information on covered individuals.

- Large LEAs (ALEs) with 50 or more FTEs will use the 1095‐C tab to update information on covered individuals and Offers of Coverage for employees who were full‐time at least one month or more out of the year.

Personnel > Maintenance > ACA 1095 YTD Data > 1095-B

Extract records

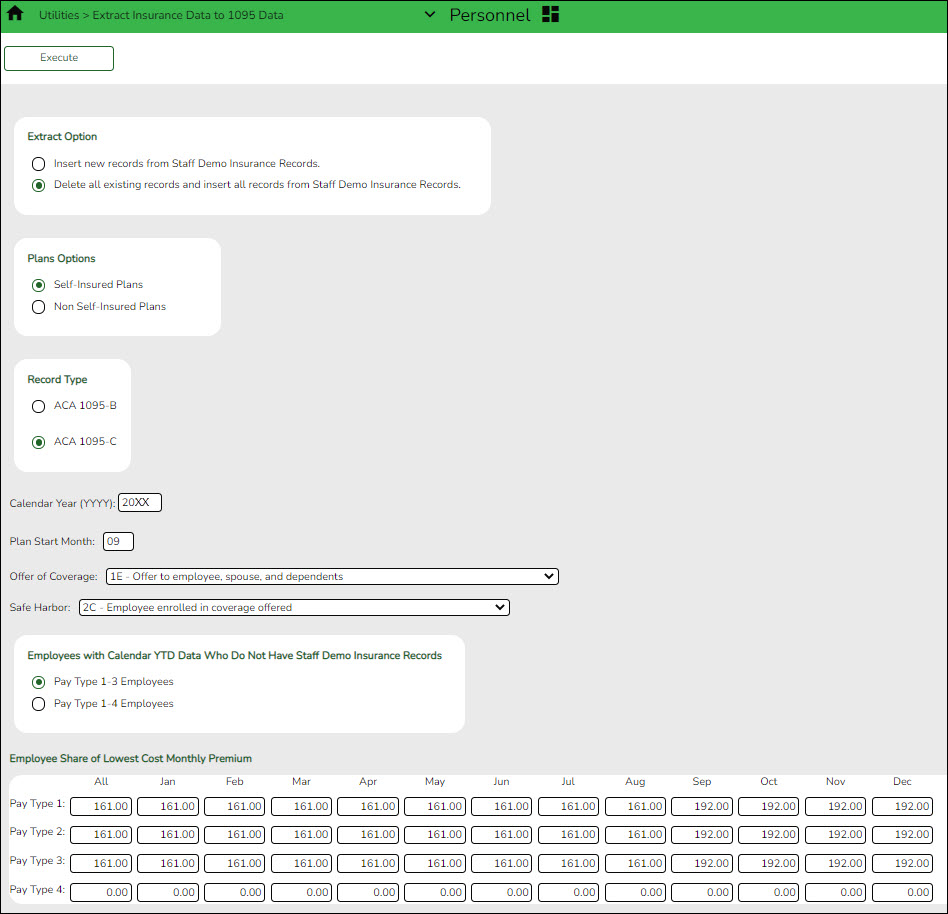

Use the Personnel > Utilities > Extract Insurance Data to 1095 Data page to extract insurance data from the Personnel > Maintenance > Staff Demo > Insurance tab to the Personnel > Maintenance > ACA 1095 YTD Data maintenance page(s). Most data will populate accurately; however, there are some records that may require manual edits.

❏ Under Extract Option, select one of the following options:

- Insert new records from Staff Demo Insurance Records. - This option only inserts new information entered on the Staff Demo page since the last time 1095 data was extracted.

- Delete all existing records and insert all records from Staff Demo Insurance Records. - This option clears previously extracted 1095 data for the calendar year indicated and replaces it with the current data available in the Staff Demo insurance records.

❏ Under Plan Options, select Self-Insured Plans.

❏ Under Record Type, select ACA 1095-C.

❏ In the Calendar Year (YYYY) field, type the calendar year for which you want to extract data.

❏ In the Plan Start Month, type the month for which you want to extract data. In this example, we will use 09.

❏ In the Offer of Coverage field, indicate the offer of coverage for which you want to extract. In this example, we will use 1E (offer to Employee, Spouse and Dependents).

❏ In the Safe Harbor field, indicate the safe harbor code for for which you want to extract. In this example, we will use 2C (Employee enrolled in coverage offered).

❏ Under Employees with Calendar YTD Data Who Do Not Have Staff Demo Insurance Records, select one of the following options:

- Pay Type 1-3 Employees (excludes subs)

- Pay Type 1-4 Employees

❏ Under Employee Share of Lowest Cost Monthly Premium, in the All field, type the set share of the lowest-cost monthly premium amount for employees in each pay type (1-4). This is the lowest premium the employee could have paid to obtain coverage.For example, if your LEA pays $225 toward insurance for all employees and TRS ActiveCare Primary had the lowest premium for employee only coverage, the amount will be $161 for Jan – Aug and $192 for Sept – Dec. ($386-$225=$161 and $417-$225-$192.)

Notes:

- This allows all employee forms to indicate that they were offered coverage all year and chose to enroll in that coverage all year. Although, this may not be the exact scenario, it will most likely be the case for the majority of employees.

- Be sure to manually correct the data for those employees who had a different situation. For example, employees who did not work all year at the LEA, employees who opted out of the insurance, substitutes for whom the LEA did not pay the $225, etc.

- You can make the manual corrections on the Personnel > Maintenance > ACA 1095 YTD Data. Be sure to retrieve data for the appropriate calendar year, update the necessary fields, and save the changes.

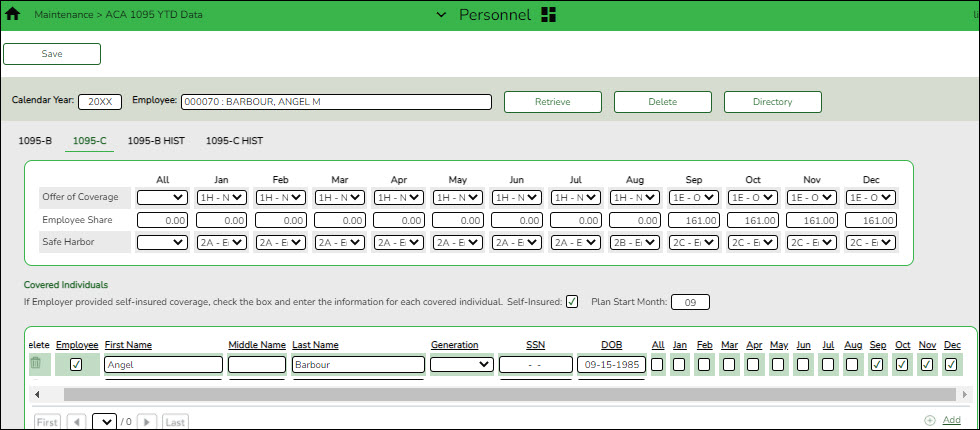

The below example provides a possible scenario of changes for this employee:

- 1H (No offer) for January through August assuming that the employee started at the LEA in late August.

- 1E (Offer to Employee, Spouse and Children) for September – December. This was extracted so no changes were made.

Employee Share:

- The Employee Share would be 0.00 for January – August since no coverage was offered as the employee started late August.

- $161.00 extracted for September – December, assuming the LEA's contribution was $225.00 and should not require a change.

Safe Harbor:

- 2A (Employee was not employed on any day of the month) for January – July

- 2B (Employee was not a full-time employee and not enrolled in coverage) for August with the assumption that the employee started late in August and did not enroll in coverage until September.

- 2C (Employee enrolled in coverage offered) for September – December

Covered Individuals:

- Selected Self-Insured as the LEA provided coverage.

- In the Plan Start Month, type 09 as the coverage started in September.

- Selected the Employee check box.

- Selected the September – December check boxes as those are the only months of coverage.

Import records

Use the Personnel > Utilities > Import ACA 1095-B/1095-C Data page to import 1095 records.

Review the 1095-C Offers of Coverage File Layout.

d. Copy prior year 1095-B and 1095-C records.

Copy prior year 1095-B and 1095-C records

If you choose, you can copy records from the prior year to the new year. After you have copied the data, you can manually edit the records or add new records.

On the Personnel > Tables > ACA 1095 Codes tabs, review the ACA tables to ensure that the relevant data exists.

- For 1095-Bs, add or edit the Coverage Type tab as needed.

- For 1095-Cs, add or edit the Offer of Coverage and Safe Harbor tabs as needed. Be sure to verify that you are using valid codes for the applicable calendar year.

Use the Personnel > Utilities > Copy 1095 Data page to copy 1095 records.

❏ Under Extract Option, select whether you want to Copy new records only. or Delete all existing records and copy all records..

TIP: If the LEA is just starting the process this year, it is recommended to select Delete all existing records and copy all records..

❏ Under Record Type, select the form type ACA 1095-B or ACA 1095-C.

If copying 1095-Bs, you only have to indicate the from and to calendar year and click Execute.

❏ In the From Calendar Year (YYYY) field, type the calendar year from which you want to copy records.

❏ In the To Calendar Year (YYYY), type the calendar year to which you want to copy records.

❏ If copying 1095-C records, in the Plan Start Month field, type 09 (September).

❏ In the Employee Share of Lowest Cost Monthly Premium, enter the amount equal to the lowest premium for employee only coverage – your LEA & state contribution. For example, if the LEA/state contributes $225.00 and TRS ActiveCare Primary had the lowest premium for employee only coverage, the amount will be $192.00. ASCENDER will automatically use the ‘old’ rate of $161.00 in Jan – Aug, then switch to the ‘new’ rate of $192.00 beginning with the Plan Start Month of September.

❏ Click Execute. If there are any errors, make corrections as needed.

Once the 1095 records are created or copied over from the prior year, you can make manual changes as needed using the Personnel > Maintenance > ACA 1095 YTD Data tabs.The following are a few examples of possible edits that may be required after creating the 1095 records:

- Adding or deleting coverage for employees or dependents

- Deleting employees who left during the calendar year or who were not paid during the reporting year

- Adding new employees to your LEA

When making changes, be sure to retrieve the appropriate employee for the current calendar year, make the necessary changes, and then click Save. - Verify 1095 data.

Verify 1095 data

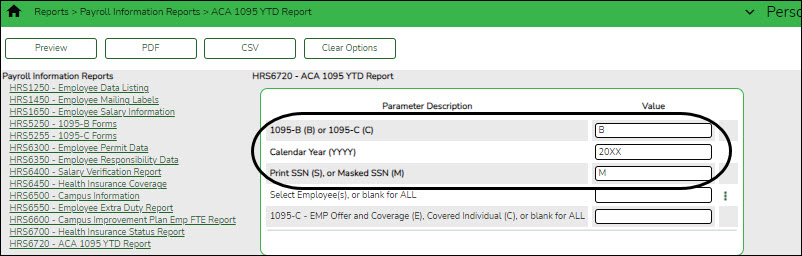

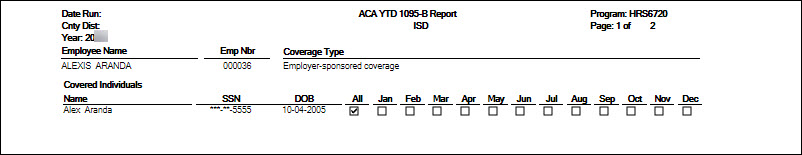

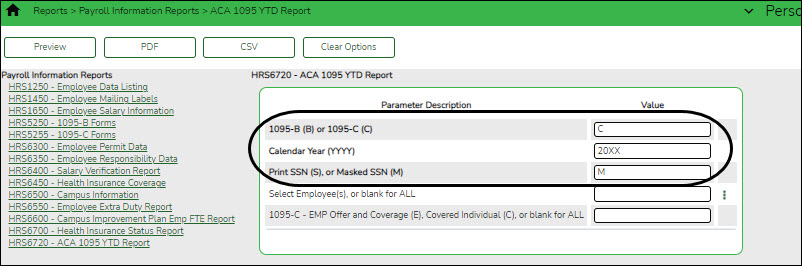

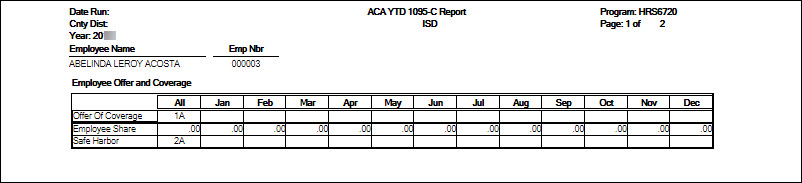

Generate the Personnel > Reports > Payroll Information Reports > HRS6720 - ACA 1095 YTD Report to verify 1095 data for each employee.

1095-B:

1095-C:

- Perform 1095 maintenance as needed.

Perform 1095 maintenance as needed

Use the following tabs to perform maintenance:

Personnel > Maintenance > ACA 1095 YTD Data > 1095-B

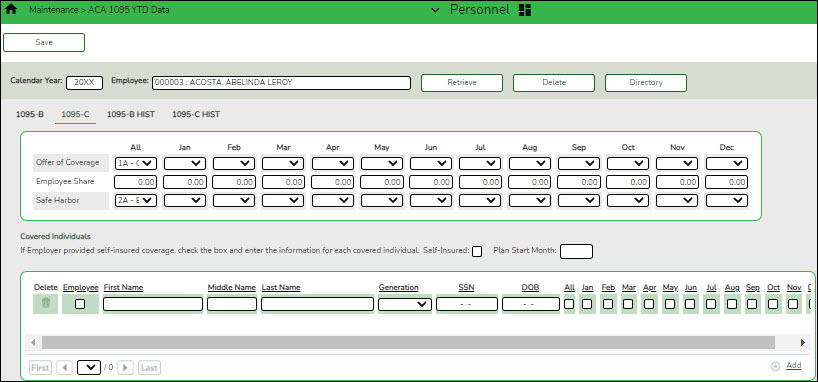

Personnel > Maintenance > ACA 1095 YTD Data > 1095-C

The 1095-C maintenance page consists of two grids:

❏ Complete the top grid for:

- Full-time and part-time employees who are enrolled in coverage including HMO enrollees and COBRA participants

- Full-time employees who declined coverage

❏ Complete the bottom grid for:- Full-time and part-time employees along with their dependents who are enrolled in a Self-Insured plan (e.g., TRS ActiveCare plans)

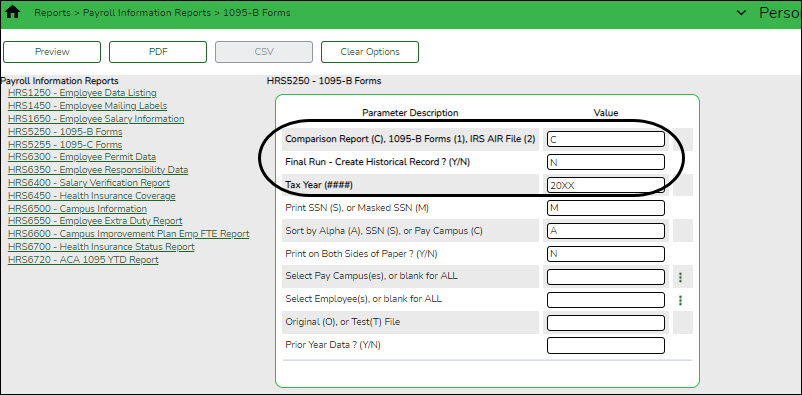

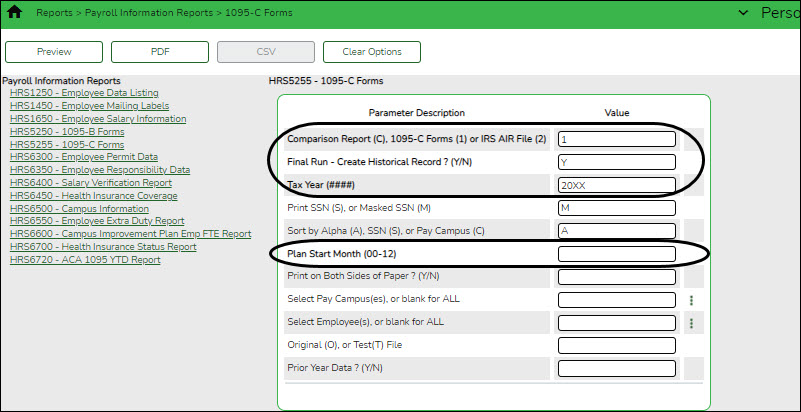

- Generate the comparison report.

Generate the comparison report

Personnel > Reports > Payroll Information Reports > HRS5250 - 1095-B Forms or HRS5255 - 1095-C Forms

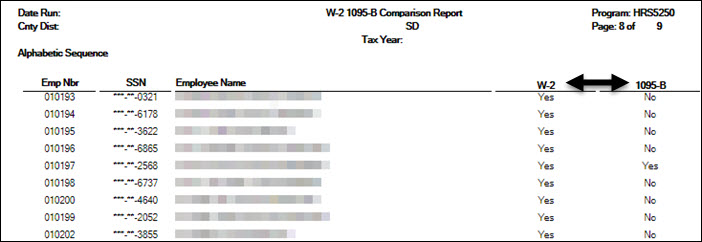

Generate the W2/1095 comparison report to verify that each employee with a W-2 for the specified reporting tax year has a 1095 form.

LEAs with less than 50 full‐time equivalents are required to provide form 1095‐B for ALL covered employees and ONLY covered employees, not necessarily everyone who received a W‐2. If the employee was not enrolled in the LEA's health insurance, do not complete form 1095‐B for the employee.

LEAs with 50 or more full‐time equivalents are required to provide form 1095‐C for ALL covered employees and for any employee that was full‐time for any month of the calendar year, not necessarily everyone who received a W‐2. The LEA is not required to provide a 1095 C to part‐time employees who are not enrolled in the LEA's insurance plan.

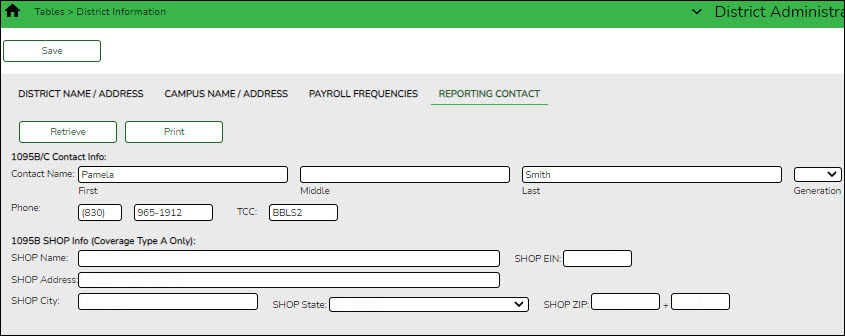

- Update reporting contact information.

Verify reporting contact information

District Administration > Tables > District Information > Reporting Contact

Before creating the ACA electronic file, verify the LEA's reporting contact information (Contact Name, Phone, and TCC fields) and update as needed. The SHOP fields can be left blank as it should only be used if reporting a Form 1095-A for employees who obtained coverage in the marketplace.

Note: The TCC is no longer validated during the creation of ACA files

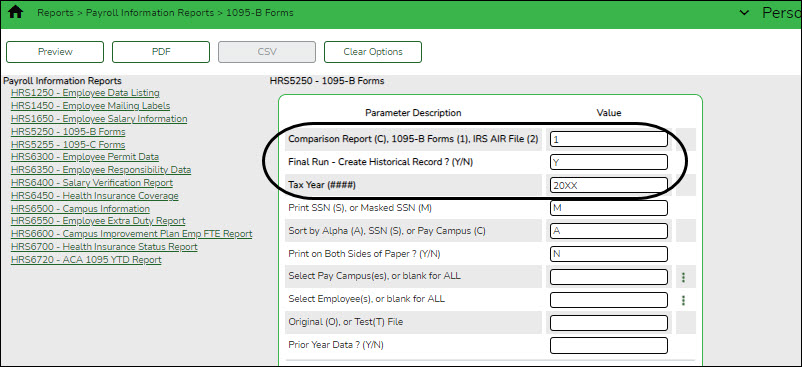

- Finalize the 1095 data and print forms.

Finalize the 1095 data and print forms

After all of the 1095 data is accurate, generate the Personnel > Reports > Payroll Information Reports > HRS5250 - 1095-B Forms or HRS5255 - 1095-C Forms report to finalize and print 1095 forms.

1095-B:

1095-C:

Keep in mind that the Plan Start Month (01-12) parameter is now required.

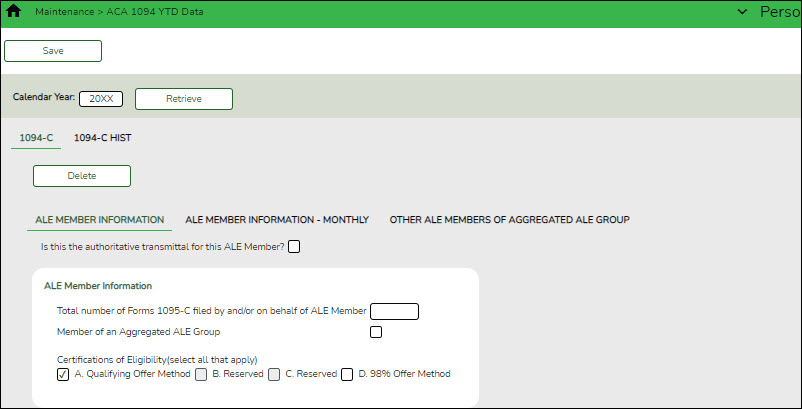

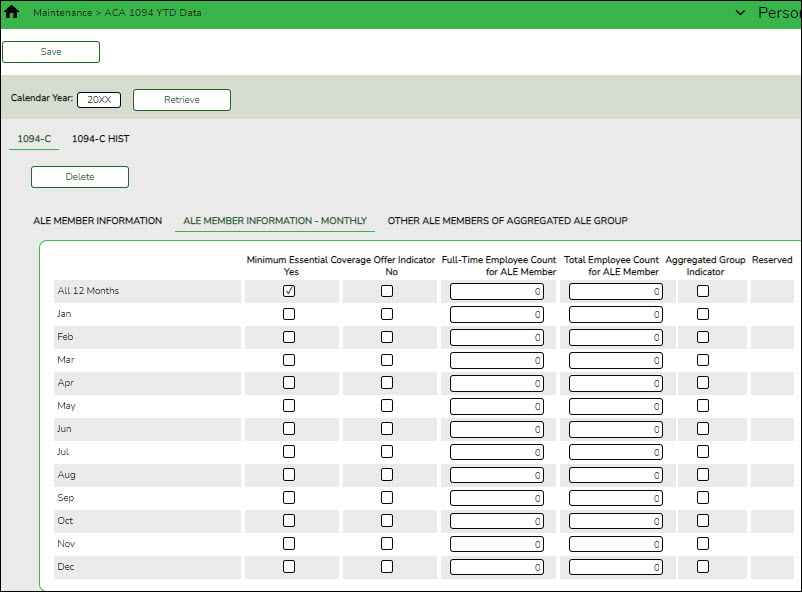

- Complete the 1094-C (Authoritative Transmission) data.

Complete 1094-C (Authoritative Transmission) data

Personnel > Maintenance > ACA 1094 YTD Data > 1094-C Complete and save data on the ALE Member Information and ALE Member Information - Monthly tabs.

Note: Only one authoritative transmittal should be filed for each employer.

Use the Personnel > Reports > Payroll Information Reports > HRS6720 - ACA 1095 YTD Report to verify the Total number of Forms 1095-C filed by and/or on behalf of ALE Member records.

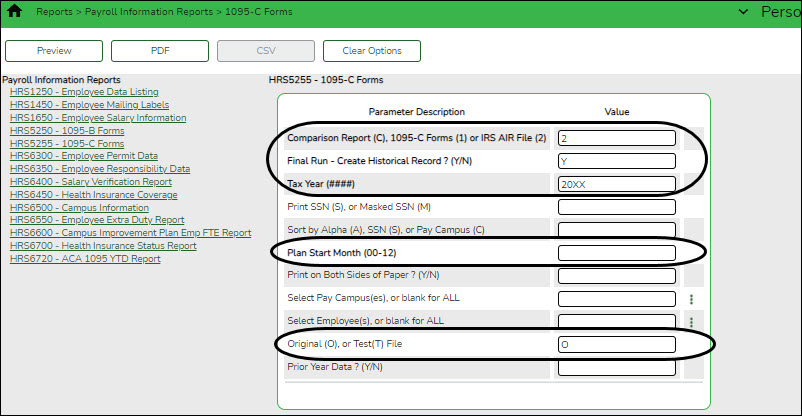

- Create the 1095 (B or C) AIR files.

Create 1095 (B or C) AIR file

Depending on the form type (1095-B or 1095-C), use the Personnel > Reports > Payroll Information Reports > HRS5250 - 1095-B Forms or HRS5255 - 1095-C Forms reports to create the Affordable Care Act Information Returns (AIR) files.

Below is an example of creating an AIR file using the 1095-C Forms report.

Note: The TCC is no longer validated during the creation of ACA files

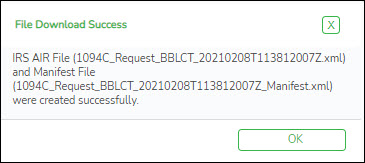

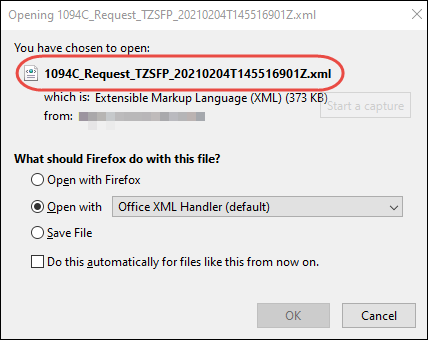

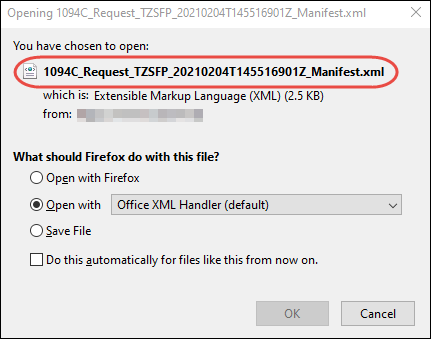

The ACA AIR Error Report is displayed along with a File Download Success message and two dialog boxes allowing you to download and save the two separate XML files.

Form file:

Manifest file:

- Submit the AIR files to the IRS.

Submit AIR file to the IRS

After you create the AIR files and populate the Personnel > Maintenance > ACA 1095 YTD Data > 1094-C tab (if submitting at least one 1095-C form), you must electronically submit the AIR files to the IRS using the Affordable Care Act Information Return (AIR) Program. The file must be submitted in XML format.

Be sure to review the Affordable Care Act Information Returns (AIR) webpage at https://www.irs.gov/e-file-providers/affordable-care-act-information-returns-air for updated information about filing electronic information returns.

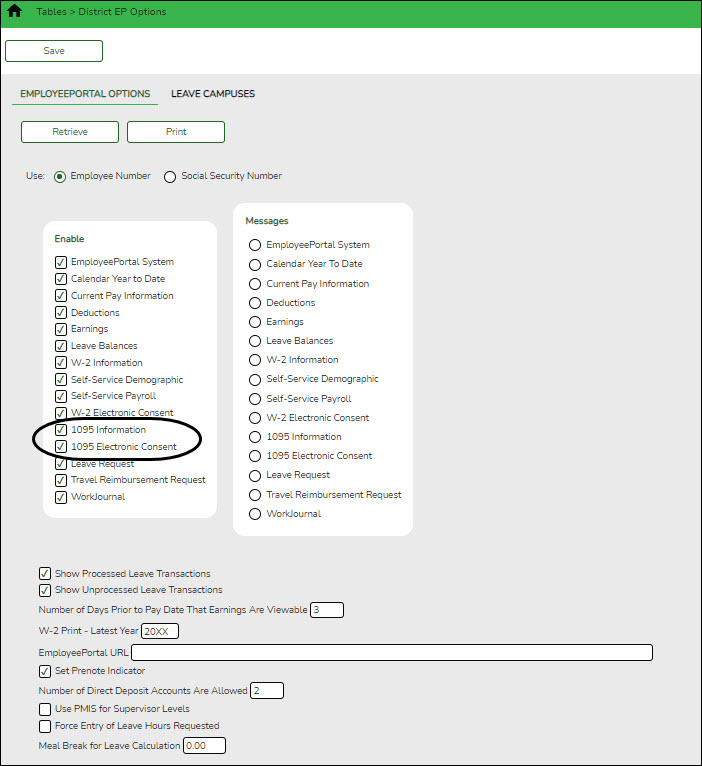

- Verify EmployeePortal options.

Payroll > Tables > District EP Options > EmployeePortal OptionsFor EmployeePortal users, verify that the 1095 Information and 1095 Electronic Consent options are set up accordingly. Keep in mind that if you want to allow your employees to print the actual 1095 form from EmployeePortal, the 1095 Electronic Consent option must be selected. If not selected, the employees can only view the form.

TIP: If your LEA wants to print copies of all 1095 forms, it is recommended to leave the 1095 Electronic Consent option unselected, and then select the option once you are ready to allow employees to consent to obtain and print their 1095 forms electronically.

Americans with Disabilities Act (ADA) and Web Accessibility

The Texas Computer Cooperative (TCC) is committed to making its websites accessible to all users. It is TCC policy to ensure that new and updated content complies with Web Content Accessibility Guidelines (WCAG) 2.0 Level AA. We welcome comments and suggestions to improve the accessibility of our websites. If the format of any material on our website interferes with your ability to access the information, use this form to leave a comment about the accessibility of our website.