Sidebar

Add this page to your book

Remove this page from your book

This is an old revision of the document!

ASCENDER - PMIS: Retro Pay

The purpose of this document is to guide you through the Position Management Retro Pay Process. The following steps should be performed after the 11-month and/or 12-month employees have been rolled to the current year payroll and PMIS.

This process calculates the difference between the current salary reflected in Payroll and the new salary reflected in NY PMIS, and then pays the employee the difference via extra duty pay.

This checklist assumes you are familiar with the basic features of the ASCENDER Business system and have reviewed the ASCENDER Business Overview guide.

Some of the images and/or examples provided in this document are for informational purposes only and may not completely represent your LEA’s process.

Before You Begin

Review the TRS Rules for Retro Pay.

- Reference Item 16. Retroactive Pay Increases Excluded by the Plan’s Terms under Compensation Not Eligible for TRS on the TRS Creditable Compensation page at https://www.trs.texas.gov/Pages/re_creditable_compensation.aspx.

Retro Pay Process

- Create a simulation.

Create a simulation

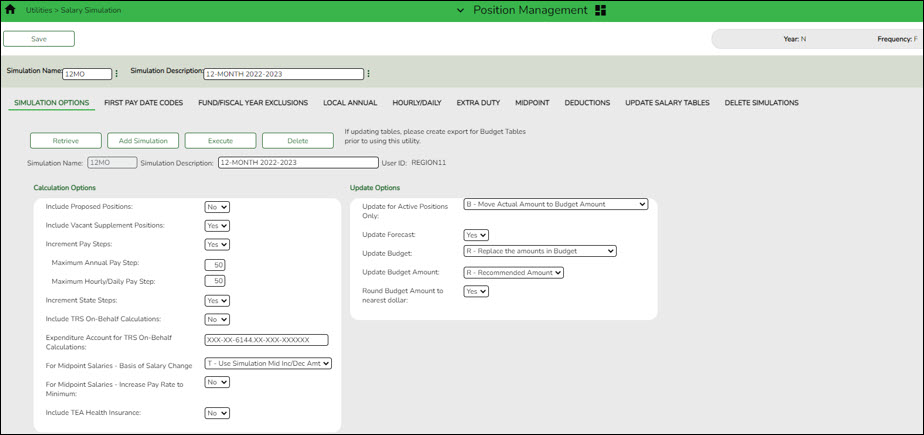

Position Management > Utilities > Salary Simulation > Simulation Options

Create a salary simulation for the group of employees who are owed retro pay that includes a raise.

❏ Under Update Options, in the Update Forecast field, select Yes.

❏ Click Execute to begin the simulation process.

❏ Under Calculation Reports:

- Select the report(s) from the list. Click Select All or Unselect All to select all of the reports or unselect all reports.

- Click Generate Reports. The reports are displayed in the order selected.

❏ Click Process to save the data to budget and/or PMIS records based on the Update Options selected. And, then process the simulation. The simulation updates the forecast and clears the Accept Changes checkbox.

Americans with Disabilities Act (ADA) and Web Accessibility

The Texas Computer Cooperative (TCC) is committed to making its websites accessible to all users. It is TCC policy to ensure that new and updated content complies with Web Content Accessibility Guidelines (WCAG) 2.0 Level AA. We welcome comments and suggestions to improve the accessibility of our websites. If the format of any material on our website interferes with your ability to access the information, use this form to leave a comment about the accessibility of our website.