User Tools

Sidebar

Add this page to your book

Remove this page from your book

This is an old revision of the document!

End-of-Month Closing Checklist

After all transactions for an accounting period have been completed, it is necessary to close the accounting period. Following the procedures outlined in this checklist ensures that you have accurately closed the accounting period.

| ❏ |

1. Prepare for end-of-month closing:

Prior to starting end-of-month closing, verify the following processes are complete:

• All entries for the month have been posted.

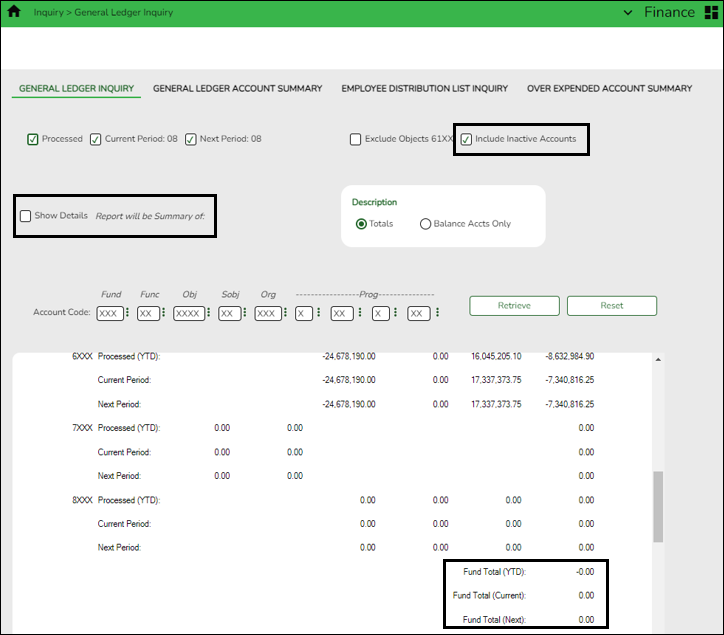

To avoid month-to-month balance discrepancies, it is recommended to confirm that all fund totals are zero on a monthly basis. Log on to file ID C. Finance > Inquiry > General Ledger Inquiry Verify the bank account group fund fiscal year. Run an inquiry to verify that Fund Total (YTD), Fund Total (Current), and Fund Total (Next) amounts are zero. Note: If amounts are not zero, contact your regional ESC consultant for further assistance. ❏ Select Include Inactive Accounts. Selecting this option may prevent out-of-balance accounts. ❏ Unselect the Show Details checkbox. ❏ Leave all account code components masked (X). ❏ Click Retrieve to generate a summary for all accounts. |

|---|---|

| ❏ |

2. Finance > Tables > District Finance Options > Accounting Periods

• The current accounting period may be locked to keep other users from posting to the month about to be closed. Select Lock Current Accounting Period.

|

| ❏ |

3. Review the following Finance reports to ensure accuracy of current accounting period data.

• FIN1000 - Cash Receipts Journal

|

| ❏ |

4. Finance > Utilities > Export Finance Tables

Export the database. |

| ❏ |

5. Finance > Utilities > End of Month Closing

Perform EOM closing. |

| ❏ |

6. Finance > Tables > District Finance Options > Accounting Periods

Verify that the current accounting period is correct. |

| ❏ |

7. Finance > Utilities > Export Finance Tables

Export the database. |

Americans with Disabilities Act (ADA) and Web Accessibility

The Texas Computer Cooperative (TCC) is committed to making its websites accessible to all users. It is TCC policy to ensure that new and updated content complies with Web Content Accessibility Guidelines (WCAG) 2.0 Level AA. We welcome comments and suggestions to improve the accessibility of our websites. If the format of any material on our website interferes with your ability to access the information, use this form to leave a comment about the accessibility of our website.