User Tools

Sidebar

Add this page to your book

Remove this page from your book

Update employment info data

Personnel

Add or update employee information on the following tabs:

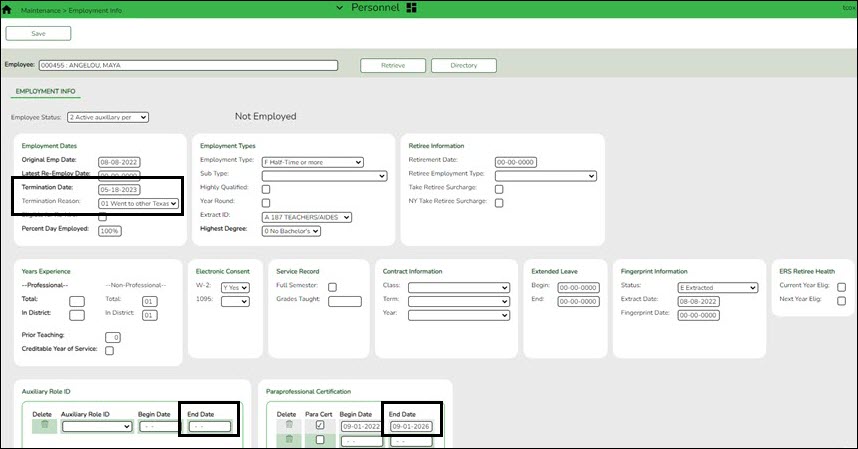

- Personnel > Maintenance > Employment Info - This tab is shared between the current year and next year records; therefore, changes to the current year records are effective in the next year records and vice versa.

❏ Select the NY Take Retiree Surcharge field to include the retiree surcharge when the Extract Payroll to Budget process is performed.

Note: If service records have not been created, do not update data such as the Percent Day Employed, Years Experience and Grade(s) Taught fields for existing employees.

Terminated Employees

It is best practice to not only update the Termination Date and Reason but, if applicable, update the Auxiliary Role ID and Paraprofessional Certification End Date.

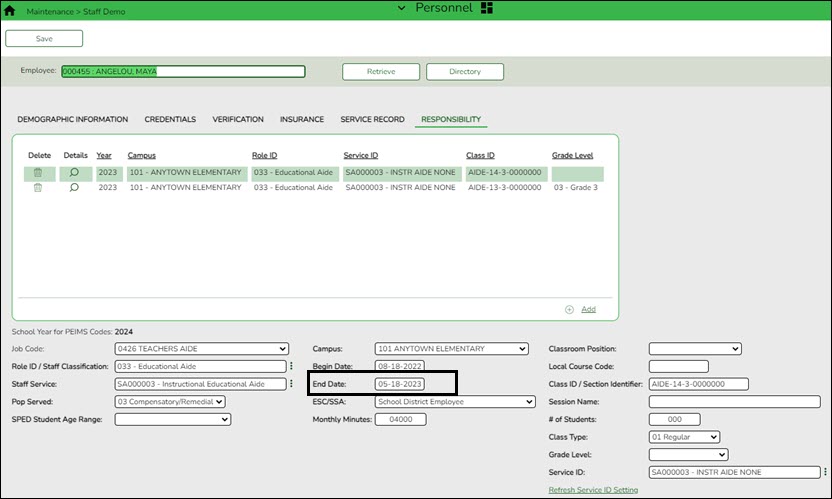

Personnel > Maintenance > Staff Demo > Responsibility

In addition, update the End Date on the employee's responsibility record.

Payroll

- Pay Info - This tab is not shared between the current year and next year records.

❏ Make the necessary changes to the extra duty supplements and verify the changes using the Payroll > Reports > Payroll Information Reports > HRS6400 - Salary Verification Report.

❏ Updates to the extra duty table do not automatically update the extra duty data on the Pay Info tab.

• Click Yes to update both the current year and next year records.

• Click No to update only the next year records.

This also occurs when changes are made in the current year records and next year records exist.

- Job Info - This tab is not shared between the current year and next year records.

❏ For new employees, a generic job is displayed on the Job Info tab and this job can be modified as needed. The following fields must be completed prior to saving:- Primary Campus

- % Assigned

- # of Days Empld

- TRS Member Position

- Begin Date

- End Date

Notes:

- The following data should be entered before performing automatic salary calculations:

- Pay Grade

- Step

- Sched (if applicable)

- Max Days

- State Step

- State Min Days

- TRS Year - This field should be selected if the employee has a nonstandard contract.

- Accrual Codes

- W/C Code

- State Minimum Salary % Assigned - Verify this field for employees whose # of Days Employed field does not match the State Min Days field on the Job Info tab for the primary job and adjust accordingly.

- Distribution information

- Distributions - This tab is not shared between the current year and next year records.

❏ If a contract amount is not entered on the Job Info tab, no amount or percentage is required before saving the record. If the account code does not exist in Budget, it cannot be selected from the account code drop-down list.

❏ A distribution code must exist for each job to be updated with salary calculations. When calculations are performed, amounts are updated based on the existing distribution percentages.

❏ Verify Expense 373 designations for applicable employees who are subject to Stat Min calculations.

- Deductions - This tab is not shared between the current year and next year records.

Exception: When changes to an existing employee's deduction information is saved, a message is displayed asking if the current year records should be updated.

If the Remain Pymts field is set to 99, it will not decrement each time a payroll is processed.

Be sure to add an Emplr Contrib (Employer Contribution) amount for vacancies/new employees to avoid an understated budget.

Update the garnishment amounts as there may be changes to the salary amounts for the upcoming year and the garnishment amounts are based on salary percentages.

Click Yes to update both the current year and next year records.

Click No to update only the next year records.

This also occurs when changes are made in the current year records and next year records exist.

• Click Yes to update both the current year and next year records.

• Click No to update only the current year records.

Americans with Disabilities Act (ADA) and Web Accessibility

The Texas Computer Cooperative (TCC) is committed to making its websites accessible to all users. It is TCC policy to ensure that new and updated content complies with Web Content Accessibility Guidelines (WCAG) 2.0 Level AA. We welcome comments and suggestions to improve the accessibility of our websites. If the format of any material on our website interferes with your ability to access the information, use this form to leave a comment about the accessibility of our website.