User Tools

Sidebar

Add this page to your book

Remove this page from your book

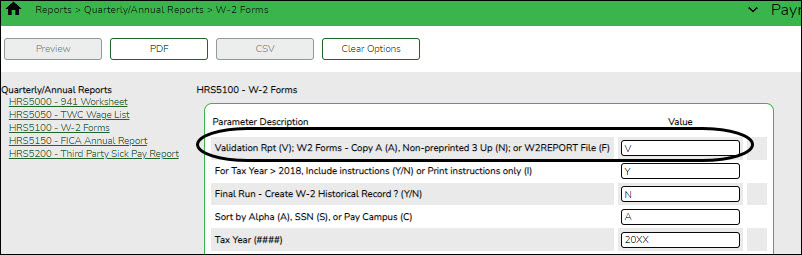

Payroll > Reports > HR Reports > Quarterly/Annual Reports > HRS5100 - W-2 Forms

❏ Generate the W-2 Validation report to review your W-2 totals. Also, verify the totals against the Payroll > Reports > Year To Date Reports > HRS3000 - Calendar Year To Date Report and Payroll > Reports > Quarterly/Annual Reports > HRS5200 - Third Party Sick Pay Report.

- The combined totals for the Calendar YTD and Third Party Sick Pay reports should balance to the Validation report. Although the third-party sick pay withholding tax displays as a separate amount on the Validation report, it is included in the employee’s withholding tax amount.

- Refer to the How W-2 Box Amounts are Populated page for clarification about how third-party sick pay amounts and 457 deferred compensation contributions and/or withdrawal amounts are handled.

Notes:

The Roth annuity is not displayed on the Validation report, but it is displayed in Box 12 - BB on the W-2. DO NOT continue until all reports are balanced.

If any manual processes are performed (e.g., check issues, check voids, or deduction refunds) that change the employee’s calendar year-to-date information, generate the reports again to verify the amounts.

All parameters below the Tax Year (####) parameter are used only when generating the W-2 submission file (W2REPORT).

Print the last page and use the Grand Totals in the balancing process.

Note: The Calendar YTD, Quarterly 941 Worksheet, and W-2 total amounts should match. Identify and correct any discrepancies if necessary.

Americans with Disabilities Act (ADA) and Web Accessibility

The Texas Computer Cooperative (TCC) is committed to making its websites accessible to all users. It is TCC policy to ensure that new and updated content complies with Web Content Accessibility Guidelines (WCAG) 2.0 Level AA. We welcome comments and suggestions to improve the accessibility of our websites. If the format of any material on our website interferes with your ability to access the information, use this form to leave a comment about the accessibility of our website.