User Tools

Sidebar

Add this page to your book

Remove this page from your book

This is an old revision of the document!

TSDS PEIMS Mid-Year Submission Data for Business

Created: 10/1/2024

Reviewed: In Progress

Revised: In Progress

This document outlines key Business data that is submitted during the Public Education Information Management System (PEIMS) Mid-Year Submission and used by the Texas Education Agency (TEA). The midyear submission (Collection 2) is a report of actual financial data for the prior school year. As the year progresses, this document may be updated to include additional fields of data.

For a complete list of submission rules and edits, see https://tealprod.tea.state.tx.us/TWEDSAPI/23/398/404/DataComponents/Entity/List

This document assumes you are familiar with the basic features of the ASCENDER Business system and have reviewed the ASCENDER Business Overview guide.

Some of the images and/or examples provided in this document are for informational purposes only and may not completely represent your LEA’s process.

Prerequisites

Review the following and take action as needed:

❏ Ensure applicable employees have the correct roles and permissions in ASCENDER Security Administration to access pages needed for TSDS reporting.

* The underlined text indicates the domain's submission level as it appears on the District Administration > Options > TSDS > Domains & Entities page.

I. Education Organization Domain

First Level Submission

The Education Organization domain includes information about public, charter, education service center, organization, or agency.

Information from AskTED is imported into the Operational Data Store (ODS). As you send data, TEA matches the School ID (county district number) to existing district and campus information to ensure that the reported data is credited to the correct Local Education Agency (LEA).

- Verify district information for current/prior school year.

Verify district information for current/prior school year

District Administration > Tables > District Information > District Name/Address

❏ In the Year field, type the four-digit school year for which you want to add or retrieve data and click Retrieve.

❏ Verify the ESC Region Number and ESC County District Number are accurate. The ESC County District Number is the six-digit ESC county district number assigned by Texas Education Agency (TEA).

ESC County District Numbers

❏ Click Save for each year; each year is a separate record. - Verify campus information/exclude non-instructional campuses from reporting.

Verify campus information/exclude non-instructional campuses from reporting

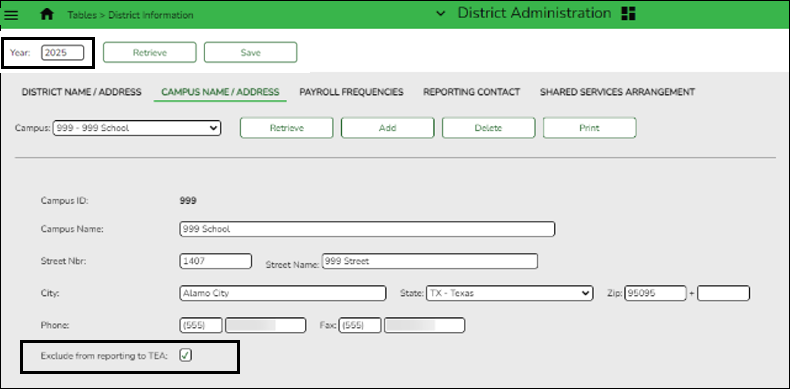

District Administration > Tables > District Information > Campus Name/Address

Ensure the Exclude from reporting to TEA checkbox is selected for all non-instructional campuses/departments to exclude them from being reported to TEA.

❏ In the Year field, type the four-digit school year for which you want to add or retrieve data and click Retrieve. The Year is automatically updated when the Fiscal Year Close process is completed in Finance.

❏ Retrieve each campus record and confirm that the address and phone numbers are accurate.

❏ Review the following guidelines as consideration for selecting the Exclude from reporting to TEA checkbox:- Instructional campuses listed in AskTed (001, 041, 101, etc.) should not have the Exclude from reporting to TEA checkbox selected.

- Non-instructional campuses (701, 750, 999, and other campuses or departments needed for purchasing) should have Exclude from reporting to TEA selected.

- Education Service Centers (ESCs): Exclude all campuses from TEA reporting.

- Business-only LEAs: Exclude all campuses from TEA reporting.

❏ Click Save for each campus; each campus is a separate record. - Verify Shared Services Arrangements, as needed.

Verify Shared Services Arrangements, as needed

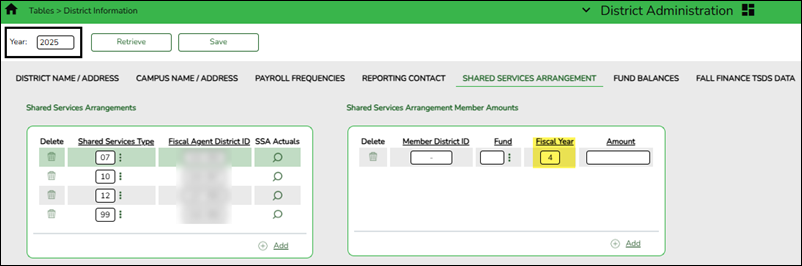

District Administration > Tables > District Information > Shared Services Arrangement

❏ In the Year field, type the four-digit reporting year for which you want to add or retrieve data and click Retrieve. For example, the reporting year for the 2025-2026 school year is 2026.

❏ Under Shared Services Arrangements, enter all Shared Services Arrangements for which the LEA is a member or the fiscal agent. Indicate the Shared Services Type and Fiscal Agent District ID.

Note: Since each year is entered on this tab, there are not separate tabs for the current and prior years as in previous years.

❏ Click Save.

- (Fiscal Agents Only) Enter Shared Services Arrangement expenditures

(Fiscal Agents Only) Enter Prior Shared Services Arrangement Expenditures

District Administration > Tables > District Information > Prior Shared Services Arrangement

SSA fiscal agents will enter SSA actual expenditures for the prior fiscal year. These amounts should represent the amount spent on behalf of each member district, not the amount transferred by the member LEA. This data is reported during the PEIMS Mid-Year Submission. For additional guidance, review the PriorYearSSAOrgAssociationExt Entity in the C049A table on the TWEDS website.

❏ In the Year field, type the four-digit school year for which you want to add or retrieve data and click Retrieve. For example, the reporting year for the 2025-2026 school year is 2026.

❏ On the left side, click the spyglass for the appropriate SSA.

❏ Under Prior Services Arrangement Member Amounts (right side of page), click +Add to add a row. Complete the following fields:

- SSA Member District ID (E0981) – indicates the county district number (CCCDDD) of the school district (as registered with the TEA), which is a member district in the shared services arrangement.

- SSA Fund (E0316S) (Descriptor: C145S) – identifies the fund group and specific fund (when applicable) for eh shared service arrangement actual financial data.

- Fiscal Year (E0974) – Type the one-digit fiscal year for the SSA record. This is the last fiscal year's SSA data. For example, for reporting year 2026 (school year 2025-2026), use SSA data from the 2024-2025 financial fiscal year 5.

- Actual Amount (E0774)- This is the amount spent on the members’ behalf.

II. Finance Domain

Third Level Submission

The Finance domain includes financial information captured in accounts (both actuals and budgeted).

- Add fund balance data.

Add fund balance data

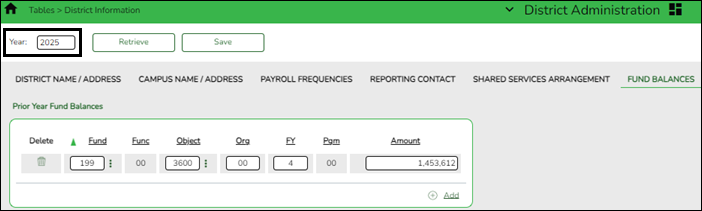

District Administration > Tables > District Information > Fund Balances

This tab is used to enter prior year ending fund balances (3XXX) as reflected on schedule C-1 of the audit. The purpose of these entries is to collect actual audited financial data for the prior school year as it is reported in the PEIMS Mid-Year Submission.

This data is included in the PriorYearActualExt Entity and represents the sum of the financial transactions to date relating to a specific account.

If the fund balance reported on the Annual Financial & Compliance Report (AFR) is a positive amount, it should be entered as a negative amount in ASCENDER.

Year Verify that the correct year is displayed. If not, type the correct four-digit year for which you want to add or retrieve data and click Retrieve.

TIP: Keep in mind that you are reporting prior year actual amounts. This means the year you enter should be one year ahead of the fiscal year associated with the fund entries. For example, if reporting on the 2024-2025 year, use data from the 2023-2024 year, entering 2025 in the Year field and 4 in the FY field for the fund entries.

- Add crosswalks.

Add crosswalks

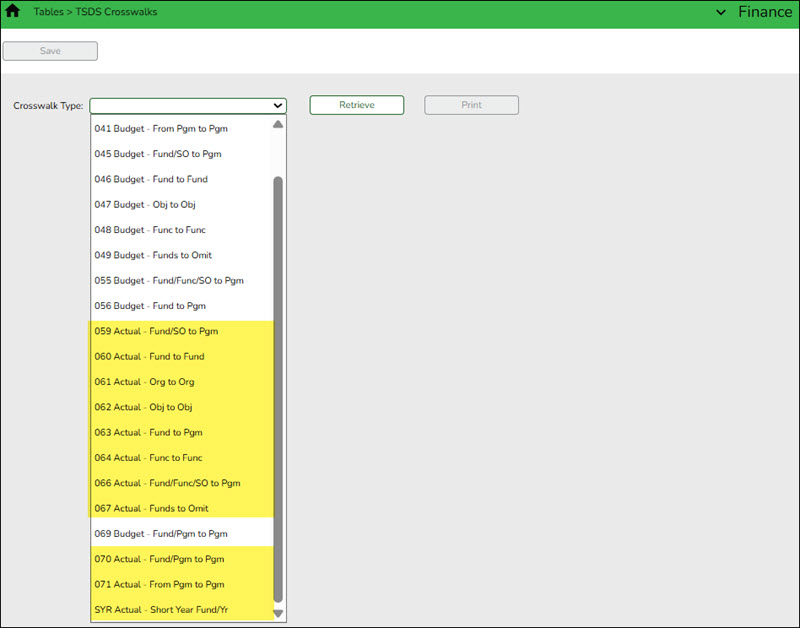

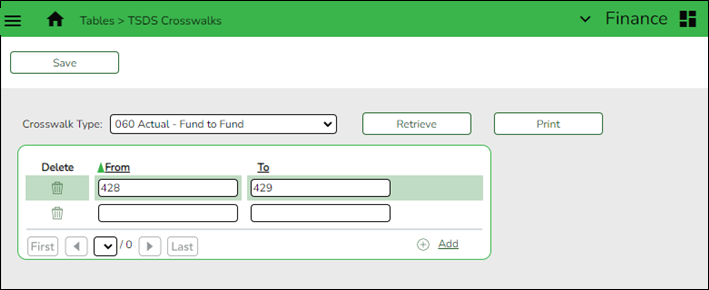

Finance > Tables > TSDS Crosswalks

Map financial data from the LEA's set of accounts to TEA's Chart of Accounts for both the current and previous file IDs.

- Verify the TSDS crosswalks are correct.

- Verify that there are not crosswalks for the automatic crosswalks processed by ASCENDER.

- Review the Actual Extract Automatic Crosswalks page.

- If a crosswalk is created on this page, it will be used and applied throughout the TSDS reporting process.

- Automatic crosswalks are applied AFTER crosswalks created on this page are applied.

- If you choose to use crosswalks, note that no updates are made to the Finance application. Any updates must be made manually in the Finance application.

For example:

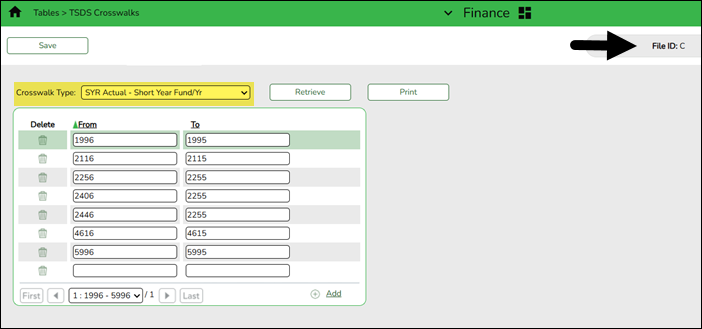

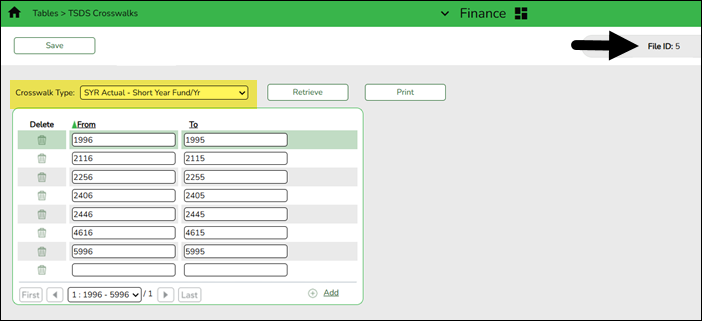

For LEA's changing from a September start fiscal year to July and this is the initial report of the change, select SYR Actual - Short Year Fund/Yr in the Crosswalk Type field, enter all funds in both the current and prior file IDs, and click Save.

For example:

File ID C

File ID 5 (prior file ID)

- Verify Finance data.

Verify Finance data

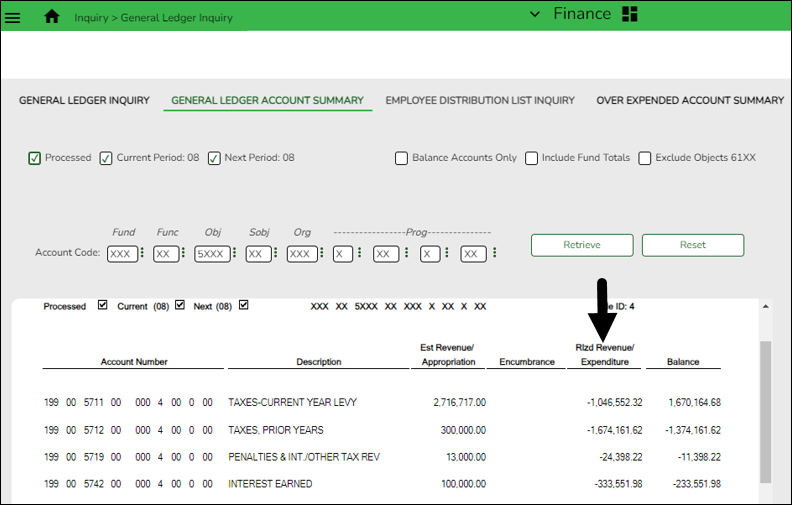

Finance > Inquiry > General Ledger Inquiry > General Ledger Account Summary

Prior year financial data is extracted from Finance for applicable funds. The totals include actual amounts entered into the system in the prior file ID.

The following data is reported:

- Fund (1XX-701)

- Function

- Object

- Report 5XXX-8XXX

- Unlike Fall data, which collapses 61XX into 6100, 62XX into 6200, 63XX into 6300, etc., each object code is reported (6112, 6118, 6119, etc.)

- Organization

- Fiscal Year

- Program Intent

- Amount (rounded to the nearest dollar)

III. Data Quality Tips

Finance Data (Prior Year)

| ASCENDER Breadcrumb | Step |

|---|---|

| Finance > Inquiry > General Ledger Inquiry | Click  to display all funds. Verify all funds are valid for the 2025 Actual. If not, create TSDS Crosswalks (Fund to Fund). to display all funds. Verify all funds are valid for the 2025 Actual. If not, create TSDS Crosswalks (Fund to Fund).ActualFund - Table ID C145A |

Click  to display all functions. Verify all functions are valid for the 2025 Actual. If not, create TSDS Crosswalks (Function to Function). to display all functions. Verify all functions are valid for the 2025 Actual. If not, create TSDS Crosswalks (Function to Function).TIP: Expense function codes should not be 00. ActualFunction - Table ID C146A |

|

Click  to display all objects. Verify all objects are valid for the 2025 Actual. If not, create TSDS Crosswalks (Object to Object). to display all objects. Verify all objects are valid for the 2025 Actual. If not, create TSDS Crosswalks (Object to Object).TIP: Expense object codes should not end with 0. ActualObject - Table ID C159A |

|

Click  to display all Program Intent Codes (PICs). Verify all PICs are valid for the 2025 Actual. If not, create TSDS Crosswalks (Program Intent to Program Intent). to display all Program Intent Codes (PICs). Verify all PICs are valid for the 2025 Actual. If not, create TSDS Crosswalks (Program Intent to Program Intent).TIP: Expense program intent code should not be 00. ActualProgramIntent - Table ID C147A |

|

Click  to display all organization codes. Verify all organization codes are valid for the 2025 Actual. If not, create TSDS Crosswalks (Org to Org). to display all organization codes. Verify all organization codes are valid for the 2025 Actual. If not, create TSDS Crosswalks (Org to Org). |

|

| Verify organizations 001-698 are tied to a campus ID in AskTED. If not, create TSDS crosswalks as needed (Org to Org). | |

Click  to verify accounts with PIC 91 are using function codes 36, 51 or 52. to verify accounts with PIC 91 are using function codes 36, 51 or 52. |

|

Click  to verify combinations: to verify combinations:• Org 701-750 should only be used in functions 41, 53, 99 • Function 71 should be used with object 65XX • Funds 205, 255, 270, 429 should be used with PIC 24 rather than 30 • Expense objects (6XXX) should not be used with Org 000 • Expense Objects (6XXX) should not be used with PIC 00 |

|

Click  to ensure fiscal years 3-6 are being reported. to ensure fiscal years 3-6 are being reported. |

|

| Verify expenditures exist for object code 6491 to record Statutorily Required Public Notices. | |

| Verify at least one account code exists for instructional staff development (function 13) with actual expenditures greater than zero. | |

| Verify at least one account code exists for general administration (function 41) with actual expenditures greater than zero. | |

| Verify at least one account code exists for instructional resources and media services (function 12 and object 6100-6600) with a budget and actual expenditures greater than zero. | |

| Verify at least one account code exists for guidance, counseling, evaluation services or social work services or health services in function 31-33, object 6100-6600 with amounts greater than zero. | |

| Verify at least one account code exists with object code 6212 for audit services. | |

| Verify actual expenditures are reported in Fund 199, object 6144. | |

| Verify expenditure accounts with function 91 or 92 (if applicable), organization code is 999. | |

| Verify one account code exists for Matching State Funds (object 5829) in funds 240 and 410. |

Americans with Disabilities Act (ADA) and Web Accessibility

The Texas Computer Cooperative (TCC) is committed to making its websites accessible to all users. It is TCC policy to ensure that new and updated content complies with Web Content Accessibility Guidelines (WCAG) 2.0 Level AA. We welcome comments and suggestions to improve the accessibility of our websites. If the format of any material on our website interferes with your ability to access the information, use this form to leave a comment about the accessibility of our website.