User Tools

Sidebar

Add this page to your book

Remove this page from your book

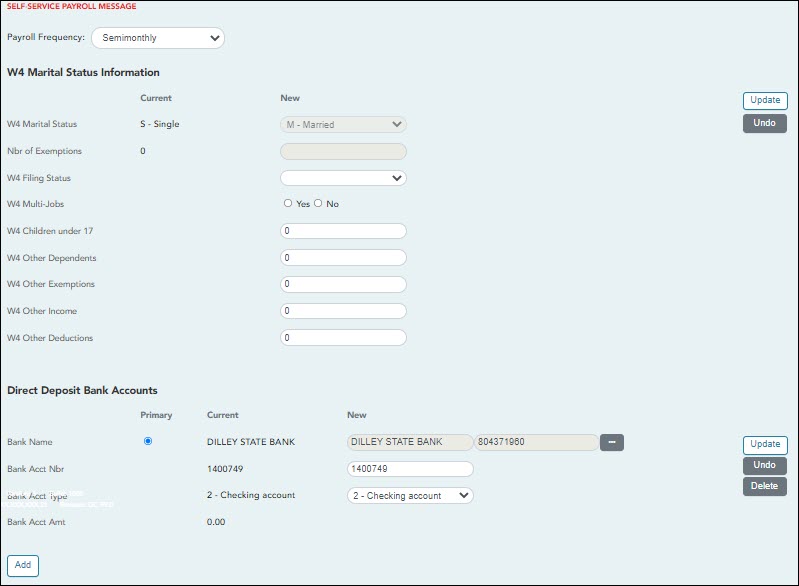

| Payroll Frequency | Click  to select the pay frequency for which you wish to view or change payroll information. to select the pay frequency for which you wish to view or change payroll information. |

|---|

❏ Under W4 Marital Status Information:

- To delete information, delete the data in the New column and click Update.

- Click Undo to return the data to its original state. A message is displayed confirming that you want to cancel your changes.

IMPORTANT: As of 2020, the Form W-4 was updated. Refer to the IRS W-4 Instructions for complete details about completing the W-4 fields. Also, be sure to review Publication 15-T Federal Income Tax Withholding, which contains the withholding tax calculations and the FAQs on the draft 2020 Form W-4 page, which contains helpful information.

Note: Due to IRS Withholding calculation changes, the W4 Marital Status and Nbr of Exemptions fields are no longer used after December 31, 2019.

Note: For W-4 Extra withholding, contact your Human Resources/Payroll department to set up any additional tax you want withheld each pay period.

The IRS Lock-in Letter field is only displayed if the IRS has determined that you do not have sufficient withholding and a Lock-in Letter has been issued and updated on your pay info record in ASCENDER. For more information about the IRS Lock-in Letter, visit the IRS website. If you have questions, contact your Human Resources/Payroll department.

❏ Under Direct Deposit Bank Accounts:

- Click Add to add a new financial institution to have your paycheck directly deposited.

- Click Delete to delete a financial institution from your record.

- To delete information, delete the data in the New column and click Update.

- Click Undo to return the data to its original state. A message is displayed confirming that you want to cancel your changes.

Note: The number of direct deposit accounts is determined by the LEA. If the LEA only allows one direct deposit bank and one already exists, you will not be allowed to enter and save a second one unless you delete the first one. If the LEA allows zero direct deposit banks and you have one or more, the banks will remain until you make a change. Once you attempt to make a change to the bank, the system will not allow you to save the change.

Americans with Disabilities Act (ADA) and Web Accessibility

The Texas Computer Cooperative (TCC) is committed to making its websites accessible to all users. It is TCC policy to ensure that new and updated content complies with Web Content Accessibility Guidelines (WCAG) 2.0 Level AA. We welcome comments and suggestions to improve the accessibility of our websites. If the format of any material on our website interferes with your ability to access the information, use this form to leave a comment about the accessibility of our website.