User Tools

Sidebar

Add this page to your book

Remove this page from your book

ASCENDER - Process 1099 Forms

Created: 12/07/2018

Reviewed: 01/23/2026

Revised: 01/23/2026

The purpose of this document is to guide you through the process of verifying and producing 1099-MISC (Miscellaneous Income) and 1099-NEC (Nonemployee Compensation) forms in Finance.

Beginning with the 2020 tax year, non-employee compensation (i.e., payments to a non-employee, such as an independent contractor) totaling $600 or more must be reported on the new Form 1099-NEC. Previously, non-employee compensation was reported in box 7 on Form 1099-MISC.

This document assumes you are familiar with the basic features of the ASCENDER Business system and have reviewed the ASCENDER Business Overview guide.

Some of the images and/or examples provided in this document are for informational purposes only and may not completely represent your LEA’s process.

Before You Begin

Review the following information and/or complete the tasks listed before you begin the 1099 forms processing steps:

Terms

| Term | Description |

|---|---|

| FIRE | Filing Information Returns Electronically |

| Form 1099-MISC |

Reference the following page on the IRS website for specific instructions about Form 1099-MISC: |

| Form 1099-NEC |

Reference the following page on the IRS website for specific instructions about Form 1099-NEC: |

| IRIS | Information Returns Intake System |

| IRS | Internal Revenue Service |

| SSA | Social Security Administration |

| SSN | Social Security Number |

Helpful Links

| About Form 1099-MISC, Miscellaneous Information | https://www.irs.gov/forms-pubs/about-form-1099-misc |

|---|---|

| About Form 1099-NEC, Nonemployee Compensation | https://www.irs.gov/forms-pubs/about-form-1099-nec |

| Filing Information Returns Electronically (FIRE) | https://www.irs.gov/e-file-providers/filing-information-returns-electronically-fire |

| Form 1099-MISC | https://www.irs.gov/pub/irs-pdf/f1099msc.pdf |

| Form 1099-NEC | https://www.irs.gov/pub/irs-pdf/f1099nec.pdf |

| E-file information returns with IRIS | https://www.irs.gov/filing/e-file-information-returns-with-iris |

| Information Returns Intake System (IRIS) IRIS 101 | https://www.irs.gov/pub/irs-efile/iris-101-07292025.pdf |

| IRS Homepage | https://www.irs.gov |

| Publication 1220, Specifications for Electronic Filing of Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G | https://www.irs.gov/pub/irs-pdf/p1220.pdf |

| Publication 15 (2023), (Circular E), Employer's Tax Guide | https://www.irs.gov/publications/p15 |

❏ Complete 1099-NEC filing to the IRS by the due date indicated in the 1099-NEC instructions.

❏ Complete the 1099-MISC filing to the IRS by the due date indicated in the 1099-MISC instructions.

❏ If your LEA has more than 10 applicable information returns of any type covered by TD 9972, you MUST file electronically. Refer to the appropriate IRS page: Filing Information Returns Electronically (FIRE) or Information Returns Intake System (IRIS) for additional information and a list of applicable information returns covered by TD 9972.

- The existing FIRE format is still available for 2025 processing; however, according the IRS website, the targeted date for the retirement of the FIRE system is tax year 2026/filing season 2027.

- The Information Returns Intake System (IRIS) will be the only intake system for information returns for tax year 2026/filing season 2027.

Process 1099 Forms

- Verify District Finance Options.

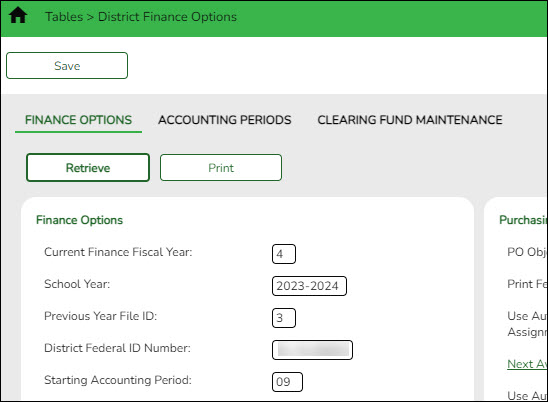

Finance > Tables > District Finance Options > Finance Options❏ Verify that the following fields contain accurate information:

- Current Finance Fiscal Year

- School Year

- Previous Year File ID - Verify that the Previous Year File ID field is not blank. If the field is blank, check transactions cannot be located for the current calendar year in the previous fiscal year. When creating the 1099 work table, only unique transactions are selected from both file IDs

- Starting Accounting Period

- Delete the 1099 work table.

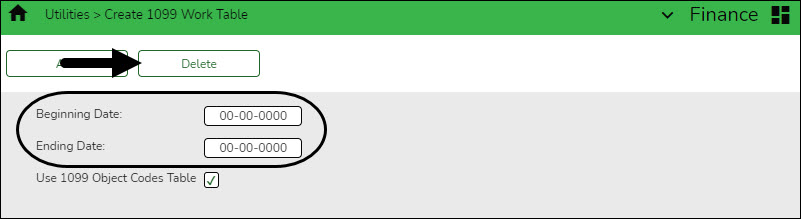

Log on to file ID C.Finance > Utilities > Create 1099 Work Table

Delete 1099 historical data from the tables before creating the new year 1099 work table.

Note: The Finance transactions are not affected when the 1099 work table transactions are deleted.

❏ Leave the Beginning Date and Ending Date fields blank to delete all existing 1099 table data.

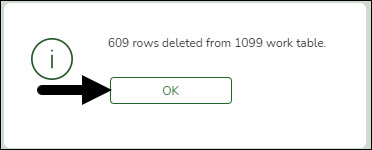

❏ Click Delete. A message is displayed with the number of rows being deleted from the 1099 work table.

❏ Click OK to close the message box.

- Create the 1099 object codes table.

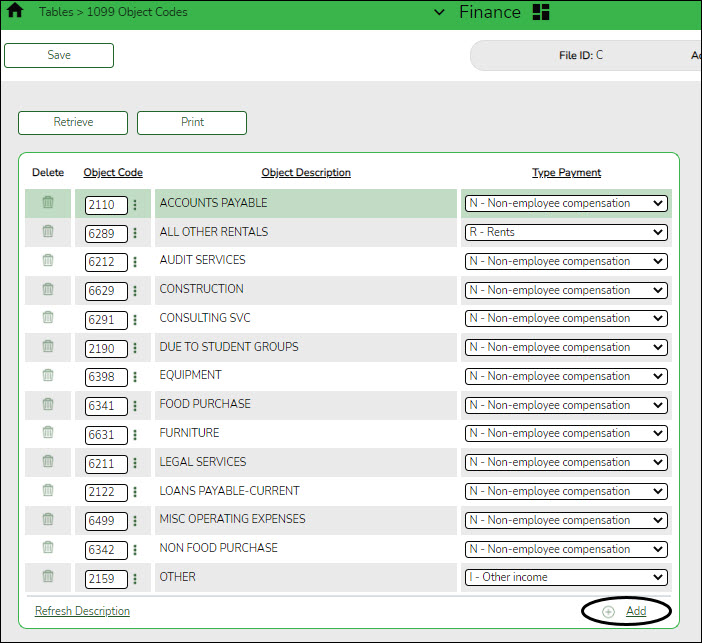

Finance > Tables > 1099 Object CodesIn file ID C, review all of the object codes that were used when paying 1099-eligible vendors. You can add and/or delete object codes as needed. Generally, 62XX accounts are included.

Ensure that you are appropriately capturing any end-of-year payable transactions from the current or prior year.

Note: If the table is not populated with object codes and type payments, all transactions (regardless of object code) for each 1099-eligible vendor are extracted when the Create 1099 Work Table utility is processed. The table must be completed prior to printing the 1099 forms.

Log on to the prior year file ID.

Ensure that the prior and current year file ID object code tables have the same object codes since the amounts spent from January 1 - August 31 exist in the prior year file ID.

- Create the 1099 work table.

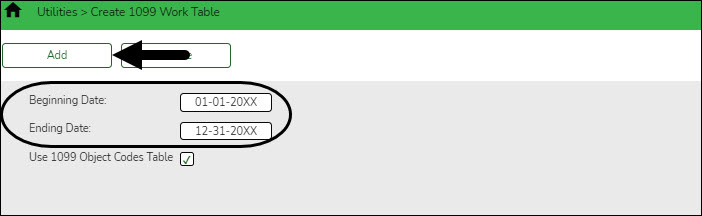

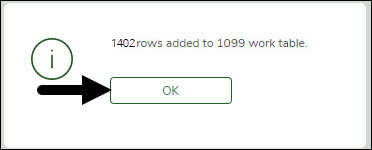

Log on to file ID C.Finance > Utilities > Create 1099 Work Table

Process this utility to populate the work table from the check transactions. The table populates the Finance > Maintenance > 1099 Record Maintenance page and allows you to modify entries.

The create 1099 work table process uses file ID C and the file ID in the Previous Year File ID field on the Finance > Tables > District Finance Options > Finance Options tab for file ID C to determine which file IDs to use. After this utility is processed, if check transactions are identified for a file ID other than C and the Previous Year File ID field is blank on the Finance Options tab in file ID C, a warning message asking for confirmation to continue is displayed. Click Yes to continue (only file ID C is processed).

❏ Type a Beginning and Ending Date range.

❏ Click Add to create a 1099 work table. A message is displayed with the number of rows being added to the 1099 work table.

❏ Click OK to close the message box.

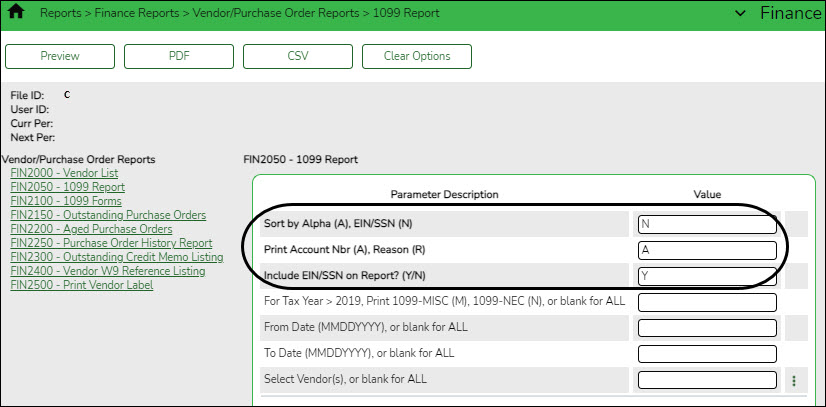

- Generate the 1099 report.

Finance > Finance Reports > Vendor/Purchase Order Reports > FIN2050 - 1099 ReportGenerate this report to review the vendors and transactions for accuracy. It is recommended to sort the report by the Employer Identification Number (EIN)/Social Security Number (SSN). This sorting option allows those vendors without an EIN/SSN to be displayed at the beginning of the report. A 1099 form is not generated for vendors without an EIN/SSN.

Notes:

The 1099-MISC (M) form prints the sum of all transactions (if at least $600) in the 1099 work file except those tied to an object code with a Type Payment of N - Non-employee compensation on the Finance > Tables > 1099 Object Codes page.

The 1099-NEC (N) form prints the sum of all transactions (if at least $600, excluding credit card transactions) in the 1099 work file that are tied to an object code with a Type Payment of N - Non-employee compensation on the Finance > Tables > 1099 Object Codes page.

If a vendor is not displayed on the report and should be, verify the following:

- The EIN or SSN is populated and the 1099 Eligible field is selected on the Finance > Maintenance > Vendor Information > Vendor Name/Address tab.

- The object code used to pay the vendor exists in the object codes table in both the current and prior year file IDs.

If 1099 transactions exist for objects that you do not want to be included in the 1099s, update the 1099 object code table. If you remove a code from the Finance > Tables > 1099 Object Codes page, it is not included on the 1099 form or the 1099 file, but it is displayed on the 1099 Report without a payment type description.Transactions can be deleted and added by running the Create 1099 Work Table utility again or manually deleting and adding transactions on the Finance > Maintenance > 1099 Record Maintenance page. If you delete a transaction from a vendor and the Create 1099 Work Table utility is processed again, delete the transaction on the Finance > Maintenance > 1099 Record Maintenance tab.

If the student activity check transactions are not maintained in ASCENDER, you must manually enter the information on the Finance > Maintenance > 1099 Record Maintenance page.

In addition to using the FIN2050 - 1099 Report, run the Finance > Inquiry > Vendor Inquiry > Vendor YTD Amounts Inquiry to verify that all 1099 eligible vendors are being reported.

- Generate the report in the prior file ID.

- In the From Date field, type 01-01-20XX.

- In the To Date field, type 12-31-20XX. This retrieves data from both file IDs.

- In the Greater Than Amount field, type 599.00.

- Click Retrieve.

This report displays all vendors that were paid 600.00 or more in the calendar year. These vendors are not necessarily 1099 eligible but the LEA can verify from which accounts the vendors are being paid to ensure that the 1099 object code table is accurate in both file IDs, and then compare this information to the FIN2050 - 1099 Report. - Perform 1099 record maintenance.

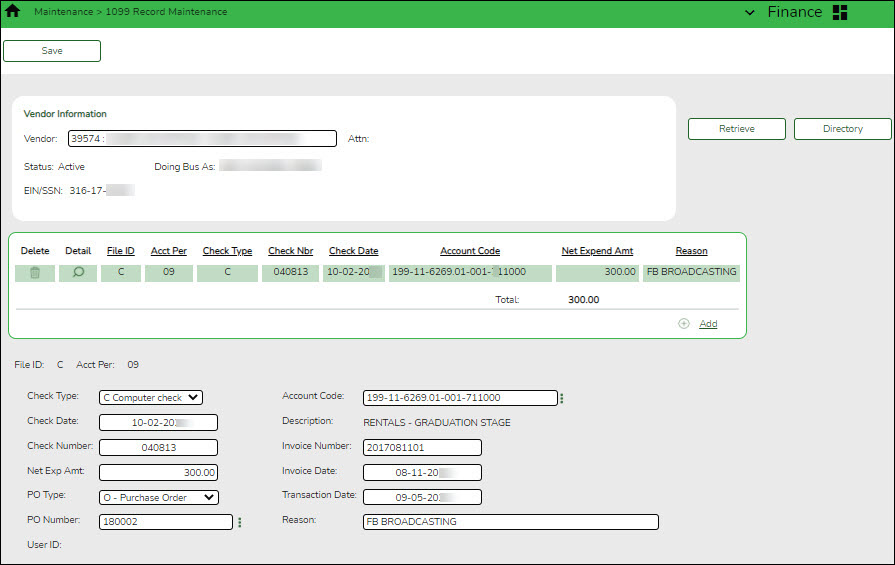

Finance > Maintenance > 1099 Record MaintenancePerform any necessary updates to the payment information in the 1099 work file. You can verify, add, delete, or update check transactions for each vendor to ensure the accuracy of the vendor 1099 records.

Only transactions that occurred in the prior year with object codes from the 1099 object codes table are displayed.

Be sure to delete any transactions that should not be reported (e.g., reimbursements).

Reminder: Any items added or deleted will revert back to the original state if any extract is performed.

- Verify the 1099 report.

Finance > Finance Reports > Vendor/Purchase Order Reports > FIN2050 - 1099 ReportGenerate this report again and continue reviewing vendors and transactions for accuracy.

If any vendors and/or transactions are missing, you can manually enter any exceptions on the Finance > Maintenance > 1099 Record Maintenance page, or make the corrections on the Finance > Maintenance > Vendor Name/Address tab and the Finance > Tables > 1099 Object Codes page (if extracting transactions again).

- Print the 1099 forms.

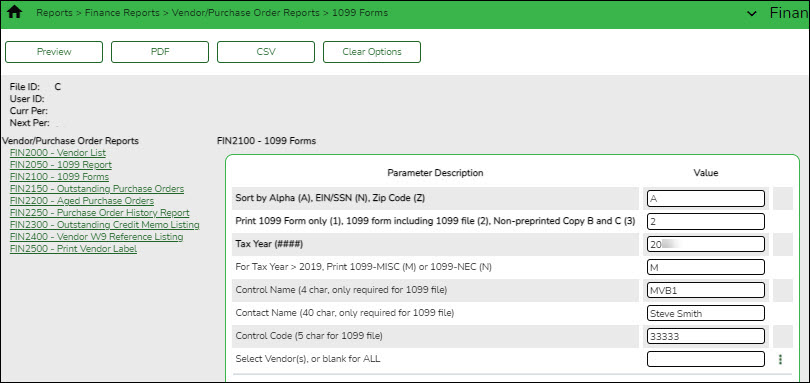

Finance > Reports > Finance Reports > Vendor/Purchase Order Reports > FIN2100 - 1099 FormsGenerate this report after all of the necessary information is verified.

If more than 10 information returns will be filed, you are required to create a 1099 file for electronic submission to the IRS.

All LEAs should run this report using options 2 and 3 in the Print 1099 Form only (1), 1099 form including 1099 file (2), Non-preprinted Copy B (3) parameter. Note that when generating the report with option 3 (Copy B), each page displays two Copy B forms, with each form representing a separate vendor.

The following parameters are required when generating the report with option 2 (1099 form including 1099 file):

- Control Name (4 char, only required for 1099 file)

- Contact Name (40 char, only required for 1099 file)

- Control Code (5 char for 1099 file)

- File 1099 forms.

Use the appropriate IRS electronic filing system (Filing Information Returns Electronically (FIRE)/Information Returns Intake System (IRIS) system) to file 1099s.- The existing FIRE format is still available for 2025 processing; however, according the IRS website, the targeted date for the retirement of the FIRE system is tax year 2026/filing season 2027. Review the IRS website for additional information about FIRE: https://www.irs.gov/e-file-providers/filing-information-returns-electronically-fire.

- The Information Returns Intake System (IRIS) will be the only intake system for information returns for tax year 2026/filing season 2027. Review the IRS website for additional information about IRIS: Click https://www.irs.gov/filing/e-file-information-returns-with-iris

Note: Users must use a separate Transmitter Control Code (TCC) for IRIS processing.

If filing by paper, mail all Copy A forms along with a 1096 Form. The submission must be postmarked and mailed to the IRS generally by January 31st. Refer to the IRS website for the exact reporting deadline dates. - If using IRIS, enter connection information in ASCENDER.

ASCENDER now interfaces with the IRS Information Returns Intake System (IRIS) to allow authorized users to transmit information returns directly to the IRS via the Application-to-Application (A2A) transmission method. Through the A2A transmission method, users can perform the following:- Electronic filing of information returns

- Submit transmissions directly from their application to the IRIS application

- XML Format

- Bulk filing

- Corrections and Automatic Extensions

Before beginning the IRIS process, review the IRIS introductory presentation provided by the IRS:Information Returns Intake System (IRIS) IRIS 101 and review IRS webpage: E-file information returns with IRIS.

If using Information Returns Intake System (IRIS) to file 1099s, complete the following connection information.Finance > Utilities > IRIS > Connection

This utility is used to enter the assigned IRS credentials to create a connection from ASCENDER to the Information Returns Intake System (IRIS) via the Application to Application (A2A) method when processing 1099-NEC and 1099-MISC information returns.

The IRIS transmittal process requires multiple steps through the IRS to obtain the proper credentials to connect and transmit 1099 filings from ASCENDER to IRIS. For additional information, refer to the E-file information returns with IRIS webpage: https://www.irs.gov/filing/e-file-information-returns-with-iris.

Set up connection information:

❏ The Calendar Year field populates the from year (e.g., 2025-2026 = 2025) listed in the School Year field on the Finance > Tables > District Finance Options > Finance Options tab and must exist in District Administration > Tables > District Information. The year must be greater than or equal to 2025.

❏ Under IRIS Settings:

Field Description Transmitter Control Code Type the five-character alphanumeric Transmitter Control Code (TCC) that identifies the business transmitting the electronic information return. This field is required.

Note: An IRIS TCC is required before you can electronically file through IRIS. The IRIS TCC is not the same as the FIRE TCC. For additional information about applying for a TCC, refer to the IRIS Application for TCC webpage: https://www.irs.gov/tax-professionals/iris-application-for-tcc.

A2A Client ID Type the IRIS Application to Application (A2A) Client ID. This field is required.

The IRIS A2A Channel uses the Application Program Interface (API) Client ID to authenticate and authorize access to IRIS A2A services. You can retrieve your IRIS Client ID from the IRS API Client ID Application on the IRS Application Summary page.User ID Type a complete IRIS User ID. This field is required.

A full IRIS user ID must be entered to generate access tokens. You can retrieve your complete user ID from the IRS A2A Setup Complete page.Key Identifier Type the key the client used to sign the JSON WEB TOKENS (JWT). This field is required.

Transmitters will use JSON WEB TOKENS (JWTs) for authentication and authorization.❏ Under Contact Information, enter contact information for an individual who will be available for inquiries from the IRS on a daily basis. Per IRS, the contact listed on the application does not have to be the individual listed as the contact on the information return.

First Name Type the contact's first name. This is a required field. Middle Name Type the contact's middle name. Last Name Type the contact's last name. This is a required field. Phone Area Code Type the contact's three-digit phone area code. This is a required field. Phone Nbr Type the contact's seven-digit phone number. This is a required field. E-mail Type the contact's e-mail address. This is a required field. ❏ Click Save.

Other functions and features:

Retrieve The Retrieve button is also used to retrieve information from the last save. If you click Retrieve, any unsaved changes are lost.

- If using IRIS, process 1099 transmission from ASCENDER to IRIS.

If using Information Returns Intake System (IRIS) to file 1099s, complete the following to process and transmit 1099 information returns.Before using this utility, the Connection tab must be completed with the proper IRS credentials.

This utility is used to select vendors to be included in the 1099 information file, create the selected 1099 .xml submission file, and transmit and process 1099-NEC and 1099-MISC information returns through the Information Returns Intake System (IRIS) via the Application to Application (A2A) method.

For additional information, refer to the E-file information returns with IRIS webpage: https://www.irs.gov/filing/e-file-information-returns-with-iris

Process IRIS return:

❏ The Calendar Year field populates the from year (e.g., 2025-2026 = 2025) listed in the School Year field on the Finance > Tables > District Finance Options > Finance Options tab and must exist in District Administration > Tables > District Information. The year must be greater than or equal to 2025.

❏ Under Submission Type, select the form type to be submitted:

- 1099-NEC

- 1099-MISC

❏ Click Retrieve. A list of vendors meeting the criteria is displayed in the grid on the left side of the page.

Field Description Status Displays the vendor status from the Finance > Maintenance > Vendor Information > Vendor Name/Address page. Vendor Nbr Displays the vendor number from the Finance > Maintenance > Vendor Information > Vendor Name/Address page. Vendor Sort Key Displays the vendor sort key from the Finance > Maintenance > Vendor Information > Vendor Name/Address page. Vendor Name Displays the vendor name from the Finance > Maintenance > Vendor Information > Vendor Name/Address page. ❏ Select the vendors to be included in the file submission to IRIS.

❏ Use the following buttons to move the selected vendors to the right side of the page.

- Click to move selected entries from the left side to the right side of the page.

- Click to move selected entries from the left side to the right side of the page.

- Click to move all entries from the left side to the right side of the page.

- Click to move all entries from the left side to the right side of the page.

- Click to move selected entries from the right side to the left side of the page.

- Click to move selected entries from the right side to the left side of the page.

- Click to move all entries from the right side to the left side of the page.

- Click to move all entries from the right side to the left side of the page.

❏ Click Execute.

- The .xml file is generated and submitted through IRIS in the background as part of the program’s internal process. The IRIS submission file cannot exceed the 100 MB size limit. If it does, reduce the number of vendors selected for processing to meet the submission requirements.

- If the file is Accepted, the IRIS Submission Successful message is displayed at the bottom of the page.

- If the file is Rejected, the Error button is displayed at the top of the page and an Error pop-up message is displayed indicating an error occurred. In addition, two files are automatically downloaded to the browser:

- The .xml file that was created to send to IRIS. (Example file: IRSTAX_NEC_20260113094015.xml)

- The .xml response file that contains the errors that occurred during submission to IRIS. The response file includes the line numbers that correspond to the line number in the submission .xml file. (Example file: IRSTAX_NEC_RESPONSE_20260113094015_2025-68318816669-2ab9e6747.xml)

Other functions and features:

Retrieve The Retrieve button is also used to retrieve information from the last save. If you click Retrieve, any unsaved changes are lost.

Americans with Disabilities Act (ADA) and Web Accessibility

The Texas Computer Cooperative (TCC) is committed to making its websites accessible to all users. It is TCC policy to ensure that new and updated content complies with Web Content Accessibility Guidelines (WCAG) 2.0 Level AA. We welcome comments and suggestions to improve the accessibility of our websites. If the format of any material on our website interferes with your ability to access the information, use this form to leave a comment about the accessibility of our website.