ASCENDER - Position Management: Process Separations

The purpose of this document is to guide you through the necessary steps to remove an employee from all positions and calculate the employee's last paycheck. There are two types of separations:

- Separation due to termination (for contract, noncontract, or salaried employees). Contracted positions are determined by the pay rate code in the appropriate salary table (e.g., daily/hourly, midpoint, or annual).

- Separation due to contract payoff.

When a separation transaction is approved, the job codes are updated for the payoff amounts and information.

This document assumes you are familiar with the basic features of the ASCENDER Business system and have reviewed the ASCENDER Business Overview guide.

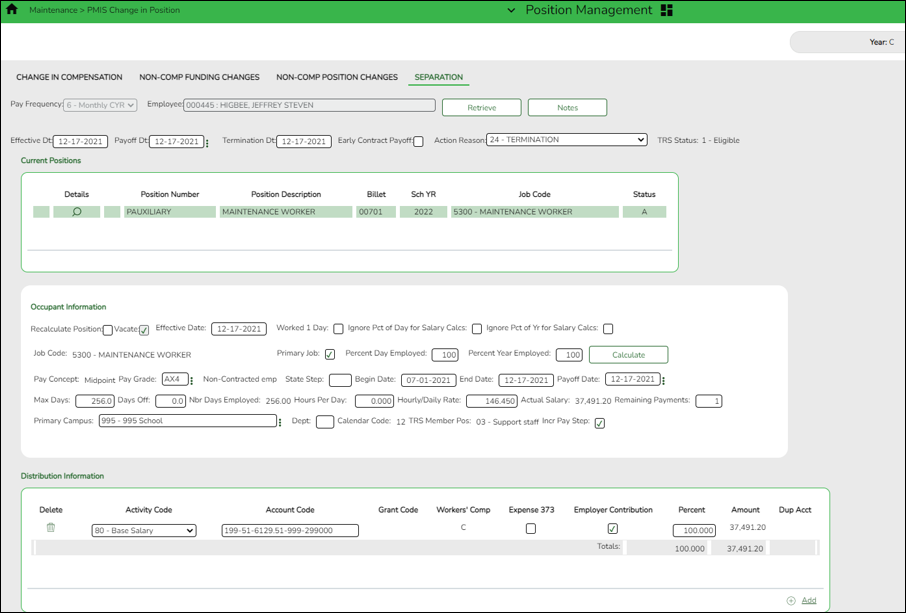

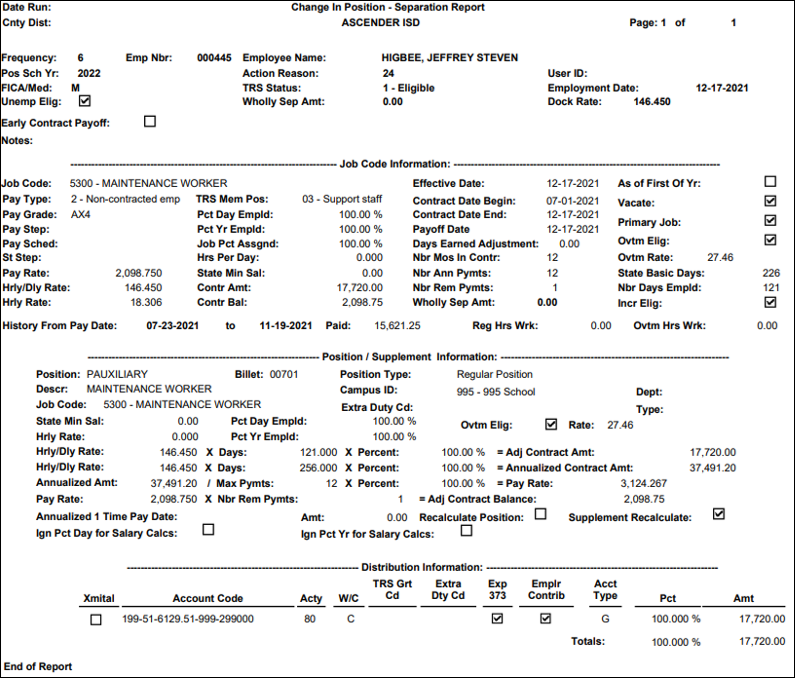

Process an Employee Payoff

Additional Verification & Updates

When completing a payoff, verify or manually update the following fields:

Payroll > Maintenance > Staff Job/Pay Data > Pay Info

Verify Bank/EFT information. If issuing the payoff in the form of a check, delete the bank information. Or, if the check is generated in a separate pay run from your regular payroll, select Checks Issue from the Payment Method drop-down field on the Payroll > Payroll Processing > Run Payroll page.

Payroll > Maintenance > Staff Job/Pay Data > Job Info

Do not change or delete the Accrual Code, Accrual Rate, or the Workers' Comp payments during a contract payoff.

Payroll > Maintenance > Staff Job/Pay Data > Deductions

Verify the Net Amount and Remaining Payments for each voluntary deduction. If the number of remaining payments is 99 or 1, the system only deducts one deduction; otherwise, it takes the number of remaining payments times the net amount.

If multiple Employer Contributions need to be expensed, type the number of times the LEA's contribution should be applied in the Emplr Contrib Factor field.

Note: It may be necessary to take multiple deductions for an employee who is being paid off early or who will not receive summer paychecks. Multiple deductions for the employee and/or employer-paid contributions may be deducted from either the employee’s last paycheck or across multiple paychecks. The deductions are submitted in a timely manner to the vendors during the regular monthly billing statements. This process eliminates the task of collecting personal checks from employees to cover insurance premiums during the summer months. The Payroll > Maintenance > Hours/Pay Transmittals > Addl Ded tab can be used to enter multiple deductions for both employee and employer contributions.

Payroll > Maintenance > Staff Job/Pay Data > Leave Balance

If all earned leave is posted at the beginning of the school year instead of being incremented monthly, it may be necessary to adjust the Earned column to reflect only the leave earned with your LEA for the number of days worked during the school year. State leave detail is displayed on service records.

Personnel > Maintenance > Employment Info

Update the Termination Date field on the tab as it is not automatically updated. Also, if applicable, enter the Retirement Date.

Payroll > Reports > Payroll Information Reports > HRS6050 - Contract Balance Variance Report

After the Staff Job/Pay Data page is updated, print the Contract Balance Variance Report to verify the totals. If the remaining payments were set to 2 to correctly calculate the income tax, the employee is displayed with an out-of-balance condition. In this scenario, the out-of-balance condition is acceptable as long as the payoff amount was verified and you are aware of the out-of-balance condition.

Payroll or Personnel > Tables > District HR Options

Verify that the Max Gross Amt for District field is greater than the employee’s payoff amount.

The following occurs for a contract payoff: The contract balance is paid, the employee is inactivated, the remaining number of deductions are deducted, and any accrual balances are reversed.

If the leave earned for the year is changed due to the number of days worked for the year, consider re-classifying posted leave days used. State leave detail is displayed on the employee’s service record.