Sidebar

Add this page to your book

Remove this page from your book

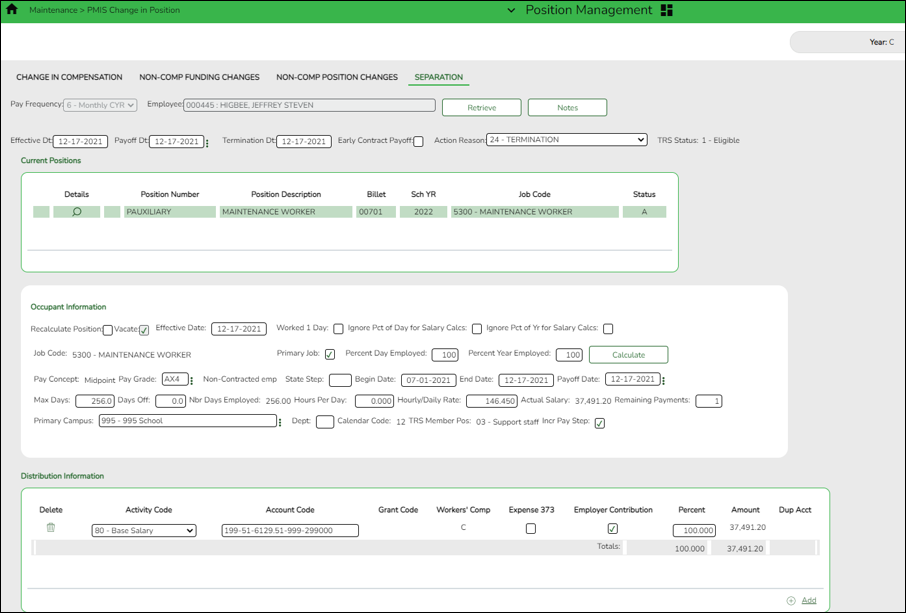

| Field | Description |

|---|---|

| Pay Frequency | Click  to select a pay frequency. to select a pay frequency. |

| Employee | Begin typing the employee name or number. As you type the data, a drop-down list of corresponding data is displayed. Select an employee and click Retrieve. Or, click Directory to perform a search in the Employees directory. |

| Effective Dt | Type the effective date for the change in compensation in MMDDYYYY format. For example, what is the last day that should be considered for payoff calculations? If this employee is terminating employment, use the termination date. |

❏ Be sure to click Retrieve to view and update the next few fields. If not retrieved, payoff dates are not available in the Payoff Dt drop-down field.

| Payoff Dt | Type the payoff date, which is typically the date of the final check. |

|---|---|

| Termination Date | Type the date on which the employee will terminate employment. Note: This field can be left blank if the employee is on a leave of absence and is being paid off for now, but will be returning to the LEA at a later date. Or, if the employee is being paid off for one contract to begin a new contract with the LEA. |

| Early Contract Payoff | Select to indicate that the change is for an early contract payoff. |

| Action Reason | Select the reason for separation from the position. The action reason codes are maintained on the District Administration > Tables > PMIS > Action Reason page. |

| TRS Status | This field displays the employee's TRS status. The field is populated based on the employee's payroll record. |

❏ Click Notes to enter any details related to the separation. The notes can be used as a form of communication between the personnel and payroll departments. The notes are displayed on the Payroll > Maintenance > Approve CIP Transaction page under CIP Notes.

❏ Click Retrieve. The Remaining Payments and Payoff Date under Occupant Information are updated. If the payoff amount is equivalent to the standard gross of two or three regular pay periods, manually update the number in the Remaining Payments field to 2 or 3 in order to correctly calculate the income tax and State Min 373 amounts.

❏ Click Next. The Supplements page is displayed.

Americans with Disabilities Act (ADA) and Web Accessibility

The Texas Computer Cooperative (TCC) is committed to making its websites accessible to all users. It is TCC policy to ensure that new and updated content complies with Web Content Accessibility Guidelines (WCAG) 2.0 Level AA. We welcome comments and suggestions to improve the accessibility of our websites. If the format of any material on our website interferes with your ability to access the information, use this form to leave a comment about the accessibility of our website.