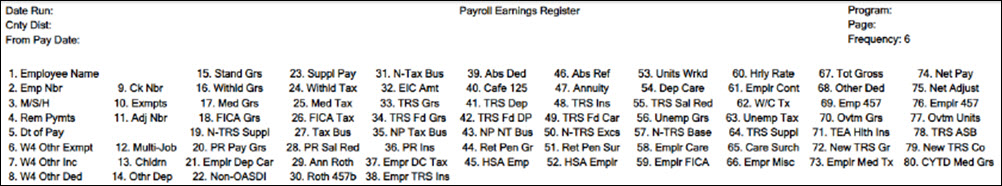

YTD Payroll Earnings Register Report Field Descriptions

The Payroll Earnings Register report provides a listing of all employees receiving payment for the pay period. The report includes a breakdown of the payroll calculations including the standard gross, absence deductions, supplemental pay, deductions, benefits, and calculated net pay by the employee.

This document provides a numerical listing with descriptions of all the components within the Payroll Earnings Register report.

| Field Name on Report | Field Description |

|---|---|

| 1. Employee Name | Displays the employee's full name. |

| 2. Emp Nbr | Displays the employee's six digit employee number as listed in ASCENDER. |

| 3. M/S/H | Displays 1:Filing Status data from the Payroll > Maintenance > Staff Job/Pay Data > Pay Info tab under W-4 Withholding Certificate. • H Head of household • M Married filing jointly • S Single or Married filing separately |

| 4. Rem Pymts | Displays the number of payments remaining to the employee. For example, this count will be 0 on the employee's payoff date. |

| 5. Dt of Pay | Displays the pay date associated with the data. |

| 6. W4 Othr Exmpt | Displays 3: Other Exemptions data from the Payroll > Maintenance > Staff Job/Pay Data > Pay Info tab under W-4 Withholding Certificate. |

| 7. W4 Othr Inc | Displays 4a: Other Income data from the Payroll > Maintenance > Staff Job/Pay Data > Pay Info tab under W-4 Withholding Certificate. |

| 8. W4 Othr Ded | Displays 4b: Other Deductions data from the Payroll > Maintenance > Staff Job/Pay Data > Pay Info tab under W-4 Withholding Certificate. |

| 9. Ck Nbr | Displays the employee’s check number. The system distributes check numbers beginning with the Beginning Check Nbr as indicated on the Payroll > Payroll Processing > Run Payroll page. |

| 10. Exmpts | Displays the number of exemptions claimed by the employee for federal income tax withholding. |

| 11. Adj Nbr | Displays 0 when a regular payroll is created. This number increases upon the first payroll adjustment (void/reissue/supplement), the number then becomes 1. |

| 12. Multi-Job | Displays whether or not the Multi-Jobs (Multiple Jobs) checkbox is selected on the employee's Withholding Certificate (Form W-4). This data is displayed on the Payroll > Maintenance > Staff Job/Pay Data > Pay Info tab under W-4 Withholding Certificate. |

| 13. Chldrn | Displays the number of Children under 17. This data is displayed on the Payroll > Maintenance > Staff Job/Pay Data > Pay Info tab under W-4 Withholding Certificate. This field is used to determine the amount of child tax credit an employee may be able to claim for qualifying dependent children under the age of 17 when filing their tax return. The amount is calculated by multiplying the number entered in this field by the designated amount in Step 3 on the W-4 form for the applicable reporting tax year. |

| 14. Other Dep | Displays the number of Other Dependents. This data is displayed on the Payroll > Maintenance > Staff Job/Pay Data > Pay Info tab under W-4 Withholding Certificate. This field is used to determine the amount of tax credit an employee may be able to claim for other qualifying dependents when filing their tax return. The amount is calculated by multiplying the number entered in this field by the designated amount in Step 3 on the W-4 form for the applicable reporting tax year. |

| 15. Stand Grs | Displays the Standard Gross amount of pay due to the employee per pay period. The calculation for the pay rate is as follows: Contract Total / # of Annual Pymts = Standard Gross amount. This data is displayed in the Pay Rate field on the on the Payroll > Maintenance > Staff Job/Pay Data > Job Info tab. |

| 16. Withld Grs | Displays the employee’s Withholding Gross amount. This amount is to be used for withholding tax calculations. Total Gross - TRS Sal Red - Cafeteria = Withld Grs. |

| 17. Med Grs | Displays the employee's Medicare Gross amount. This amount is to be used for Medicare Tax calculations. Stand Grs – Cafe 125 = Med Grs. |

| 18. FICA Grs | The FICA (Federal Insurance Contributions Act) is a payroll tax for employees who are not eligible for Medicare tax. This amount is the employee's Stand Grs or Suppl Pay. |

| 19. N-TRS Suppl | Displays the Non-TRS Supplement amount. This amount is retrieved from the Payroll > Maintenance > Hours/Pay Transmittals > Non TRS tab. This type of compensation is non-TRS supplemental pay amounts (payment type 3) such as travel and uniform allowances and TRS ActiveCare contributions taken as compensation. |

| 20. PR Pay Grs | Displays the Performance Pay Gross amount. |

| 21. Emplr Dep Car | Displays Employer contributions that are coded Dependent Child Care. The abbreviation code is DC on the Payroll > Tables > Tax/Deductions > Deduction Cd. |

| 22. Non-OASDI | Displays the employer's 2.0% contribution of TRS Gross (up to the state minimum salary). |

| 23. Suppl Pay | Displays supplemental compensation paid to the employee in addition to the regular Standard Gross and/or compensation for Pay Type 3 & 4 employees. |

| 24. Withld Tax | Displays the Withholding tax calculated for the employee based on their withholding gross amount and their W-4 Withholding Certificate selections for the pay period. Review the Calculating Withholding Tax for detailed examples. |

| 25. Med Tax | Displays the employee’s Medicare Tax that is calculated as 1.45% of the Medicare Gross amount. |

| 26. FICA Tax | Displays the employee’s 6.2% contribution of FICA Grs. |

| 27. Tax Bus | Displays the Business Tax Allowance. This is calculated if the employee has a business allowance tax amount (B type) on the Payroll > Maintenance > Staff Job/Pay Data > Pay Info tab or a Non-TRS entry with a payment type 2 and a taxable amount on the Payroll > Maintenance > Hours/Pay Transmittals > Non TRS tab. |

| 28. PR Sal Red | Displays the TRS employer contribution that is 8.25% of Performance Pay. |

| 29. Ann Roth | Displays the Net Amount (employee contributions) that are coded Roth Annuities. The abbreviation code is R1 on the Payroll > Tables > Tax/Deductions > Deduction Cd. |

| 30. Roth 457b | Displays the Net Amount (employee contributions) that are coded Roth 457b Annuities. The abbreviation code is R2 on the Payroll > Tables > Tax/Deductions > Deduction Cd. |

| 31. N-Tax Bus | Displays the Non-Tax Businesses Allowance. This is calculated if the employee has a business allowance tax amount (B type) on the Payroll > Maintenance > Staff Job/Pay Data > Pay Info tab or a Non-TRS entry with a payment type 2 and a taxable amount on the Payroll > Maintenance > Hours/Pay Transmittals > Non TRS tab. Available only if the employee has a business allowance nontax amount on the Pay Info tab (T type) or a Non-TRS entry on the Payroll > Maintenance > Hours/Pay Transmittals screen with a payment type 2 and a Non-Taxable amount. |

| 32. EIC Amt | Displays the Earned Income Credit Amount. Per IRS requirements, EIC is obsolete for calendar years greater than 2019. The EIC is a tax credit for certain workers who have a qualifying child who lives with them in the United States. The tax credit is based upon a percentage of their earned income. |

| 33. TRS Grs | Displays Gross Pay that is TRS eligible. |

| 34. TRS Fd Grs | Displays Gross Pay that is paid from federal funds. |

| 35. NP Tax Bus | Displays the Non-TRS nonpaid business allowance taxable amount. This is calculated if the employee has a Non-TRS entry with a payment code N, payment type 2, and a taxable amount on the Payroll > Maintenance > Hours/Pay Transmittals > Non TRS tab. |

| 36. PR Ins | Displays the TRS employee contribution that is .65% of Performance Pay. |

| 37. Empr DC Tax | Displays the Employer Dependent Care Taxable amount. Once the total dependent care (employee and employer) exceeds $5,000, the employer contribution amount is displayed. |

| 38. Empr TRS Ins | Displays the TRS employer contribution that is .65% of TRS Gross |

| 39. Abs Ded | Displays the amount to be deducted from an employee’s gross pay that reflects leave taken in excess of leave balance. |

| 40. Café 125 | Displays the Net Amount (employee contributions) of deductions marked as Café 125 (pre-tax) on the Payroll > Maintenance > Staff Job/Pay Data > Deductions tab. |

| 41. TRS Dep | Displays the TRS Deposit which is 8.25% + .65% of TRS Gross |

| 42. TRS Fd DP | Displays the TRS Grant Deposit calculated by multiplying TRS Federal Gross x 8.25%. |

| 43. NP NT Bus | Displays the Non-TRS nonpaid business allowance non-taxable amount. This is calculated if the employee has a Non-TRS entry with a payment code N, payment type 2, and a non-taxable amount on the Payroll > Maintenance > Hours/Pay Transmittals > Non TRS tab. |

| 44. Ret Pen Gr | Dipslays the Retiree Pension Gross amount. |

| 45. HSA Emp | Displays the Net Amount (employee contributions) that are coded Roth 457b Annuities. The abbreviation code is HSon the Payroll > Tables > Tax/Deductions > Deduction Cd tab. |

| 46. Abs Ref | Displays the Absence Refund amounts applied to an employee’s gross pay. |

| 47. Annuity | Displays the Net Amount (employee contributions) of annuity deductions. |

| 48. TRS Ins | Displays the TRS employee contribution that is .65% of TRS Gross. |

| 49. TRS Fd Cr | Displays the TRS Grant Care calculated by multiplying TRS Federal Gross x 1.25%. |

| 50. N-TRS Excs | Displays the Non-TRS reimbursement in excess of the base amount. |

| 51. Ret Pen Sur | Displays the TRS Retiree Pension Surcharge. This is calculated by multiplying the Pension Surcharge rate (TRS Rate + District Rate) by the Ret Emplr Pension Gross. |

| 52. HSA Emplr | Displays employer contributions that are coded Health Savings Account. The abbreviation code is HS on the Payroll > Tables > Tax/Deductions > Deduction Cd tab. |

| 53. Units Wrkd | Displays the number of units worked by the employee. This should match the amount entered for regular hours on the Payroll > Maintenance > Hours/Pay Transmittals > Reg Hours tab. |

| 54. Dep Care | Displays the Net Amount (employee contributions) that are coded Dependent Child Care. The abbreviation code is DC on the Payroll > Tables > Tax/Deductions > Deduction Cd tab. |

| 55. TRS Sal Red | Displays the TRS employee contribution that is 8.25% of TRS Gross. |

| 56. Unemp Grs | Displays the employee’s Unemployment Gross amount. |

| 57. N-TRS Base | Displays the Non-TRS reimbursable base amount. This is calculated if the employee has a Non-TRS entry with payment type 1 and a non-taxable amount on the Payroll > Maintenance > Hours/Pay Transmittals > Non TRS tab. |

| 58. Emplr Care | Displays the employer's .75% contribution of TRS Gross. |

| 59. Emplr FICA | Displays the employer's 6.2% contribution of FICA Grs. |

| 60. Hrly Rate | Displays the employee’s Hourly Pay Rate. |

| 61. Emplr Cont | Displays the Employer Contribution, which is the amount of the contribution, per pay period, by the LEA to the employee. This is designated by the Emplr Contrib field on the Payroll > Maintenance > Staff Job/Pay Data > Deductions tab. |

| 62. W/C Tx | Displays the Worker’s Compensation Tax based on the rate assigned by the LEA's insurance carrier for each code. Review the Calculating Workers' Compensation for examples. |

| 63. Unemp Tax | Displays the taxable rate of the employee's unemployment gross if the LEA is set up as taxable employer on the Payroll > Tables > Tax/Deductions > Unemployment tab. |

| 64. TRS Suppl | Obsolete? |

| 65. Care Surch | Displays the employer paid TRS Care Surcharge (RI deduction code). This is calculated if Take Retiree Surcharge is selected on the Personnel > Maintenance > Employment Info page. |

| 66. Emplr Misc | Displays the employer contribution that is coded Miscellaneous. The abbreviation code is M1, M2, and/or M3 on the Payroll > Tables > Tax/Deductions > Deduction Cd tab. |

| 67. Tot Gross | Stand Grs + Suppl Pay + Tax Bus = Total Gross |

| 68. Other Ded | Displays the Net Amount (employee contributions) not to include additional withholding. |

| 69. Emp 457 | Displays the Net Amount (employee contributions) that are coded 457 deferred comp. The abbreviation code is D1 or D2 on the Payroll > Tables > Tax/Deductions > Deduction Cd tab. |

| 70. Ovtm Grs | Displays the Total Gross Pay that is equal to Ovtm Hrs x Ovtm Rate. |

| 71. TEA Hlth Ins | Displays the TEA Health Insurance amount. |

| 72. New TRS Gr | Displays the New Member TRS Eligible Gross Pay. |

| 73. Emplr Med Tx | Displays the Employer’s Medicare tax that is calculated as 1.45% of the Medicare Gross amount. |

| 74. Net Pay | Displays the net pay, which is the amount of money employees take home after all deductions are subtracted. The below examples represent how net pay is calculated on the Earnings Register. Employee with a business allowance: Standard Gross + Suppl Pay + Taxable Bus Allowance - W/H tax - Med tax - Annuity - TRS Insurance - TRS Sal Red - Cafe 125 = Net Pay Employee without a business allowance: Standard Gross + Suppl Pay - W/H tax - Med tax - Annuity - TRS Insurance - TRS Sal Red - Deductions Employee paid NOT Cafe 125 = Net Pay |

| 75. Net Adjust | Displays the amount subtracted from Standard Gross, Suppl Pay, & Taxable Bus Allowance to calculate Net Pay. Equal to W/H tax + Med tax + Annuity + TRS Insurance + TRS Sal Red + Cafe 125. |

| 76. Emplr 457 | Displays the Employer contributions that are coded 457 deferred comp. The abbreviation code is D1 or D2 on the Payroll > Tables > Tax/Deductions > Deduction Cd. |

| 77. Ovtm Units | Displays the number of overtime units worked by the employee. This should match the amount entered for overtime on the Payroll > Maintenance > Hours/Pay Transmittals > Ovtm Hours tab. |

| 78. TRS ASB | Displays the TRS ASB (Above State Base), which is the Statutory Minimum Contribution. Typically (Pay Rate – Adj Stat Min) x 8.25% |

| 79. New TRS Co | Displays the Employer New Member Surcharge (8.25% of TRS Eligible Gross Pay) that is calculated on the employees first 90 days of TRS membership. |

| 80. CYTD Med Grs | Displays the employee’s Calendar Year To Date (as of January) Medicare Gross amount. |